Weekly Market Report

For Week Ending November 25, 2017

From week to week, the tallies may vary slightly from the week prior in year-over-year comparisons, whether with a strong positive surge or a lingering negative streak. Tracking weekly figures is important for active real estate professionals, but the cooldown period of a meaningful real estate trend often takes weeks, if not months, to draw determined conclusions.

In the Twin Cities region, for the week ending November 25:

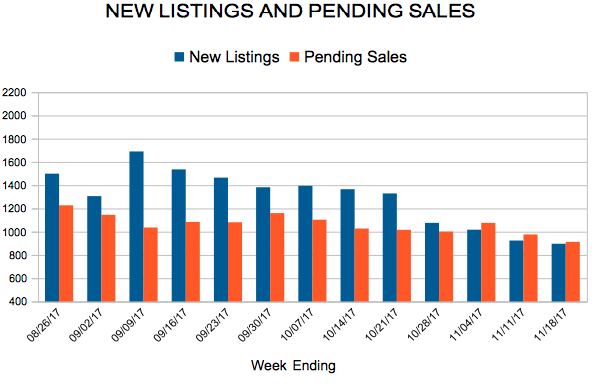

- New Listings decreased 11.9% to 450

- Pending Sales increased 12.7% to 702

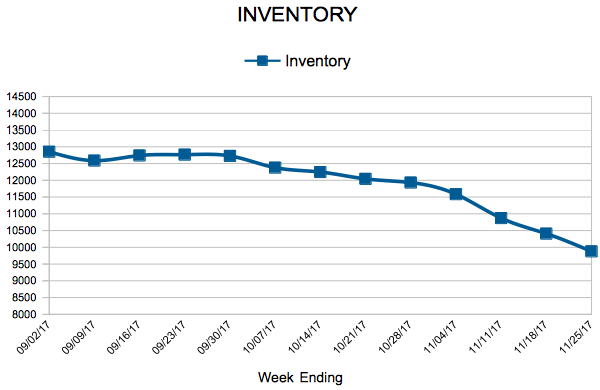

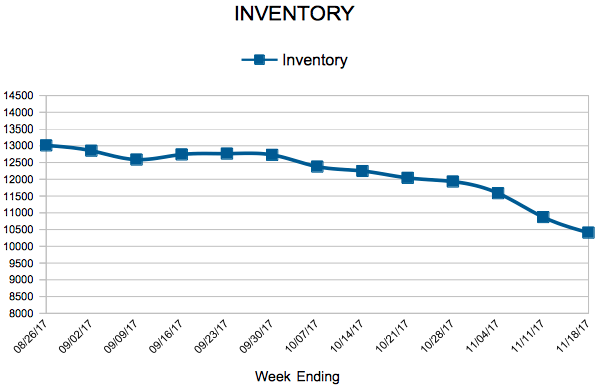

- Inventory decreased 21.7% to 9,878

For the month of October:

- Median Sales Price increased 6.1% to $244,000

- Days on Market decreased 14.8% to 52

- Percent of Original List Price Received increased 0.8% to 97.7%

- Months Supply of Inventory decreased 14.8% to 2.3

All comparisons are to 2016

Click here for the full Weekly Market Activity Report. From The Skinny Blog.

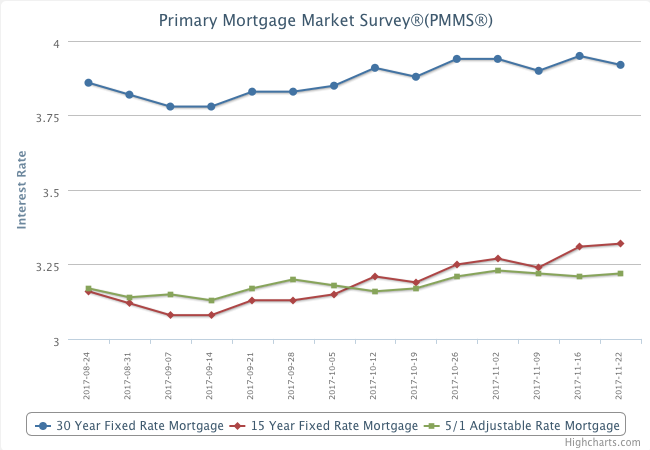

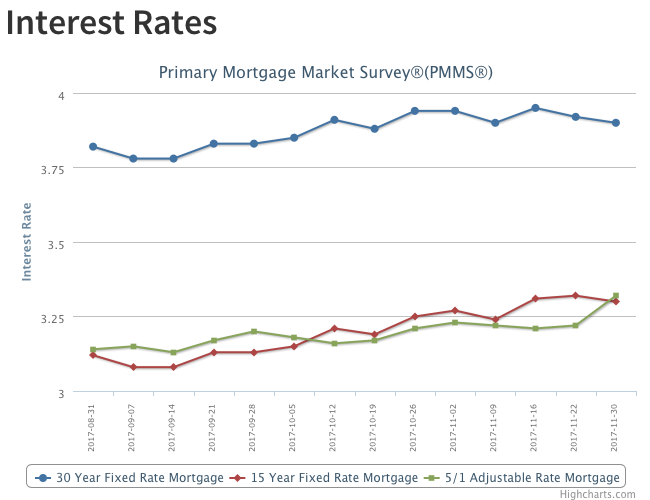

Mortgage Rates Inch Lower

The market implied probability of a Fed rate hike in December neared 100 percent, helping to drive short term interest rates higher. The 5/1 Hybrid ARM, which is more sensitive to short-term rates than the 30-year fixed mortgage, increased 10 basis points to 3.32 percent in this week’s survey. The spread between the 30-year fixed mortgage and 5/1 Hybrid ARM is just 58 basis points this week, the lowest spread since November of 2012.

New Listings and Pending Sales

Inventory

Weekly Market Report

For Week Ending November 18, 2017

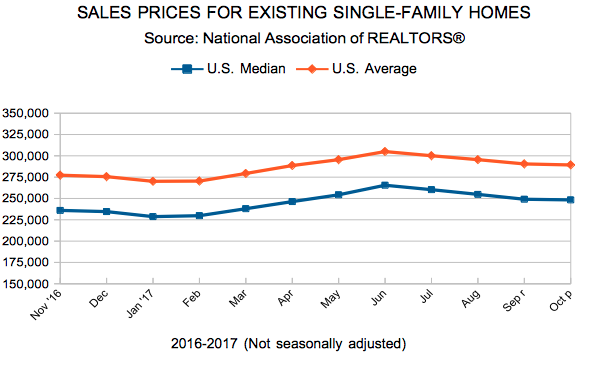

Home price appreciation is on the rise in most of the country, which is welcome news for any homeowner that experienced a time when it was not. Although trends vary by region and state, the overarching trend is increased prices, according to research performed by the National Association of REALTORS® on American Community Survey data from 2005 through 2016. Price growth is strongest in the South and less so in the Northeast, and only a few states show no growth or losses. Affordability is most favorable in the Midwest, and the West is least affordable, on average.

In the Twin Cities region, for the week ending November 18:

- New Listings decreased 6.6% to 896

- Pending Sales decreased 5.1% to 912

- Inventory decreased 20.1% to 10,407

For the month of October:

- Median Sales Price increased 6.1% to $244,000

- Days on Market decreased 14.8% to 52

- Percent of Original List Price Received increased 0.8% to 97.7%

- Months Supply of Inventory decreased 18.5% to 2.2

All comparisons are to 2016

Click here for the full Weekly Market Activity Report. From The Skinny Blog.

October Monthly Skinny Video

Mortgage Rates Hold Steady

Existing Home Sales

New Listings and Pending Sales

- « Previous Page

- 1

- …

- 100

- 101

- 102

- 103

- 104

- …

- 153

- Next Page »