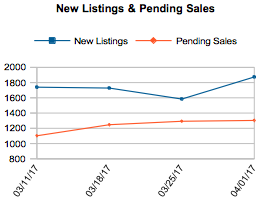

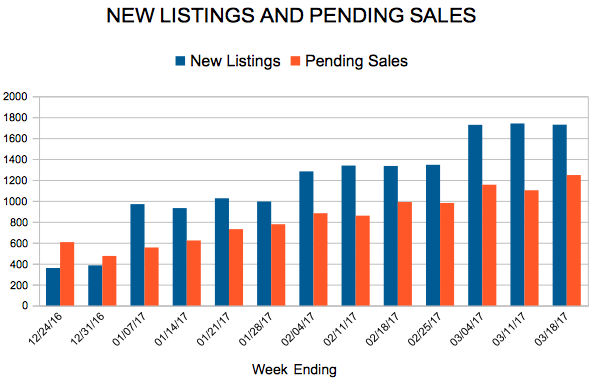

New Listings and Pending Sales

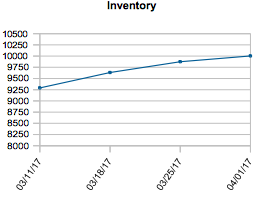

Inventory

Weekly Market Report

For Week Ending April 1, 2017

Confidence in buying a home has fallen according to the Fannie Mae Home Purchase Sentiment Index after hitting an all-time index high in February. Continuing price increases and low inventory are easy answers for why the index fell. The good news is that an improved employment outlook and higher wages are major factors toward purchasing a home, and demand is not expected to abate.

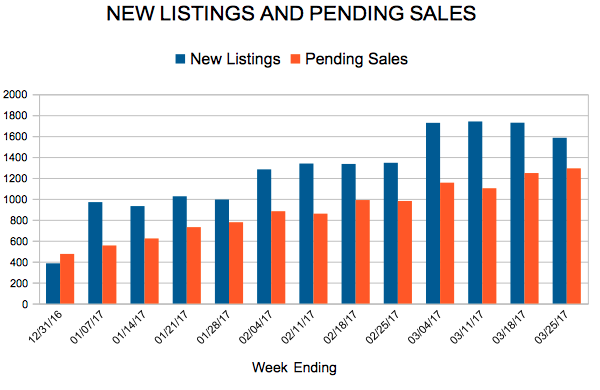

In the Twin Cities region, for the week ending April 1:

- New Listings decreased 3.9% to 1,874

- Pending Sales decreased 5.2% to 1,303

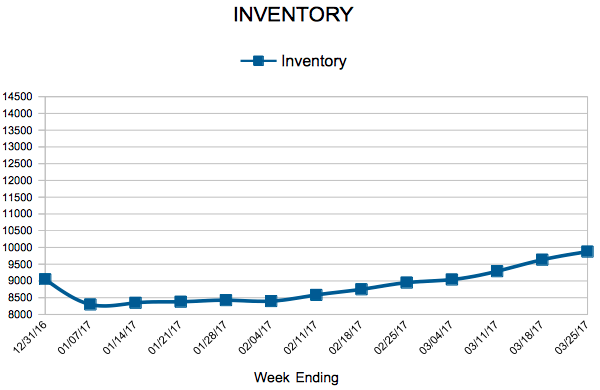

- Inventory decreased 21.7% to 10,003

For the month of February:

- Median Sales Price increased 7.7% to $223,250

- Days on Market decreased 14.6% to 82

- Percent of Original List Price Received increased 1.4% to 96.5%

- Months Supply of Inventory decreased 28.0% to 1.8

All comparisons are to 2016

Click here for the full Weekly Market Activity Report. From The Skinny Blog.

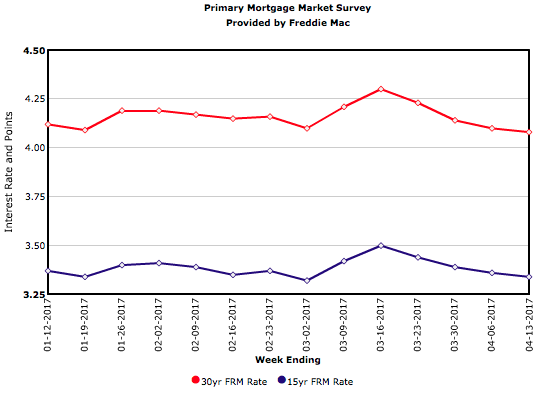

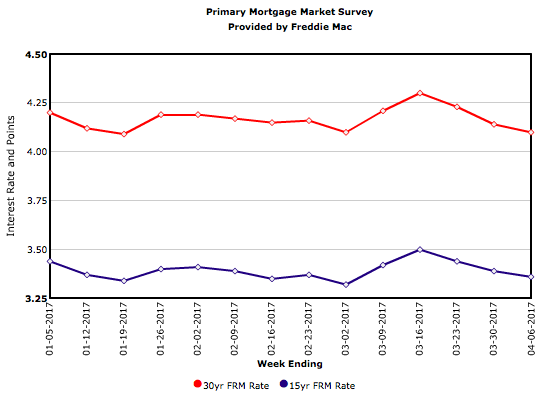

Mortgage Rates Move Lower

New Listings and Pending Sales

Inventory

Weekly Market Report

For Week Ending March 25, 2017

During the first quarter of 2017, housing affordability has clearly become an issue for some buyers, as prices continue to rise amidst strong demand. Even so, pending sales figures have generally remained positive across the nation. A better balance between high-price inventory and starter homes being sold would be the most beneficial situation for the marketplace.

In the Twin Cities region, for the week ending March 25:

- New Listings increased 6.3% to 1,584

- Pending Sales decreased 4.9% to 1,292

- Inventory decreased 23.0% to 9,874

For the month of February:

- Median Sales Price increased 7.6% to $223,000

- Days on Market decreased 14.6% to 82

- Percent of Original List Price Received increased 1.4% to 96.5%

- Months Supply of Inventory decreased 28.0% to 1.8

All comparisons are to 2016

Click here for the full Weekly Market Activity Report. From The Skinny Blog.

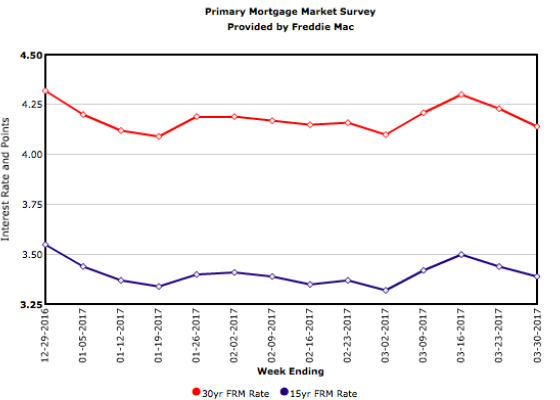

Mortgage Rates See Another Significant Decline

New Listings and Pending Sales

- « Previous Page

- 1

- …

- 116

- 117

- 118

- 119

- 120

- …

- 153

- Next Page »