Hacked By Shade

Hacked By Shade

GreetZ : Prosox & Sxtz

Hacked By Shade <3

Weekly Market Report

For Week Ending February 4, 2017

According to a recent Gallup poll, it is the first time in more than 15 years that a majority of Americans are optimistic about finding a quality job. This is great news for the entry-level housing market, as job growth and improved wages fuel demand for home purchases. Rents have also been on the rise, another factor that has put the entry-level market in strong demand.

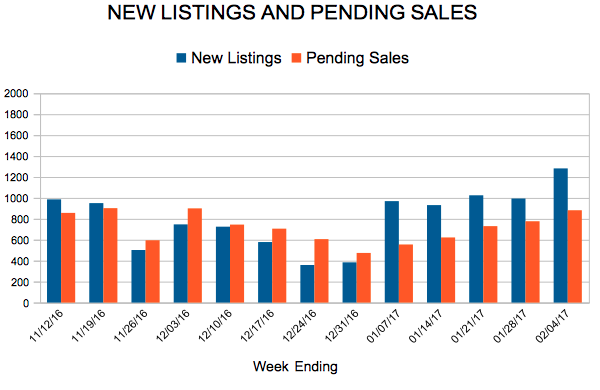

In the Twin Cities region, for the week ending February 4:

- New Listings increased 3.3% to 1,282

- Pending Sales remained flat at 882

- Inventory decreased 24.0% to 8,399

For the month of January:

- Median Sales Price increased 4.7% to $225,000

- Days on Market decreased 7.1% to 79

- Percent of Original List Price Received increased 0.9% to 95.9%

- Months Supply of Inventory decreased 26.1% to 1.7

All comparisons are to 2016

Click here for the full Weekly Market Activity Report. From The Skinny Blog.

Mortgage Rates in Holding Pattern

The 30-year fixed mortgage fell two basis points to 4.17 percent this week. Rates are at about the same level at which they started the year and have stayed within a two basis point range over the past three weeks. Mixed economic releases such as Friday’s jobs report and uncertainty about the Administration’s fiscal policies have contributed to the holding pattern in rates.

The Best Online Pharmacy. Buy Cialis Without Prescription – Orders-Cialis.info

Why buy cialis on the internet is really beneficial for you?

So you've decided to order cialis and do not know where to start? We can give you some advice. First, ask your doctor for advice in order to properly determine the dosage, when you do that, you need to decide for yourself exactly where you will be buying the drug. You can buy cialis online, or you can just buy it at the pharmacy. Buy cialis online has a number of advantages, one of which is price. The cost of the Internet will always be lower than in stores, and when combined with the free shipping, it will be the best choice. Besides the price there are a number of advantages over conventional pharmacies, one of which is anonymity. Also, you can always check the online store on reliability, read reviews about it and the opinion of other buyers. Read more.

Hacked By HolaKo

Hacked By HolaKo

Greetz : TiGER-M@TE - w4l3xzy3 - Mauritania Attacker - Mr.Domoz - Kuroi'SH - ShadowMan .. @nd all friends.

\!/Straight Outta Palestine\!/

#You Have Been Trolled !

Weekly Market Report

For Week Ending January 28, 2017

While the winter months that lead us through the holiday season and to the end of December are typically a slower time for the housing market, the beginning of each new year tends to bring a renewed interest in moving or buying. The annual January resolution effect is in full swing so far in 2017. Prices are increasing, purchase agreements are being signed, and despite record inventory lows, demand remains strong.

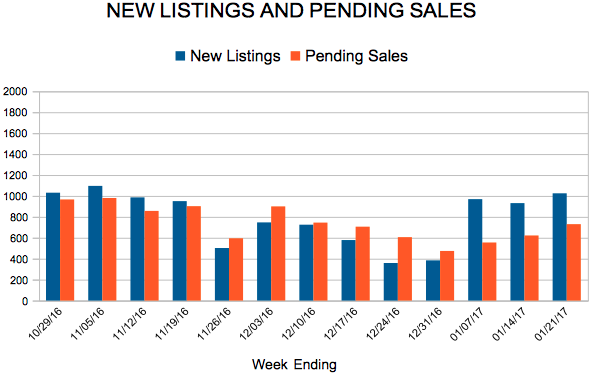

In the Twin Cities region, for the week ending January 28:

- New Listings decreased 3.0% to 994

- Pending Sales decreased 9.5% to 777

- Inventory decreased 24.2% to 8,427

For the month of December:

- Median Sales Price increased 3.9% to $228,000

- Days on Market decreased 10.1% to 71

- Percent of Original List Price Received increased 0.6% to 96.0%

- Months Supply of Inventory decreased 26.1% to 1.7

All comparisons are to 2016

Click here for the full Weekly Market Activity Report. From The Skinny Blog.

Weekly Market Report

For Week Ending January 28, 2017

While the winter months that lead us through the holiday season and to the end of December are typically a slower time for the housing market, the beginning of each new year tends to bring a renewed interest in moving or buying. The annual January resolution effect is in full swing so far in 2017. Prices are increasing, purchase agreements are being signed, and despite record inventory lows, demand remains strong.

In the Twin Cities region, for the week ending January 28:

- New Listings decreased 3.0% to 994

- Pending Sales decreased 9.5% to 777

- Inventory decreased 24.2% to 8,427

For the month of December:

- Median Sales Price increased 3.9% to $228,000

- Days on Market decreased 10.1% to 71

- Percent of Original List Price Received increased 0.6% to 96.0%

- Months Supply of Inventory decreased 26.1% to 1.7

All comparisons are to 2016

Click here for the full Weekly Market Activity Report. From The Skinny Blog.

Mortgage Rates Steady

Hello world!

New Listings and Pending Sales

- « Previous Page

- 1

- …

- 120

- 121

- 122

- 123

- 124

- …

- 153

- Next Page »