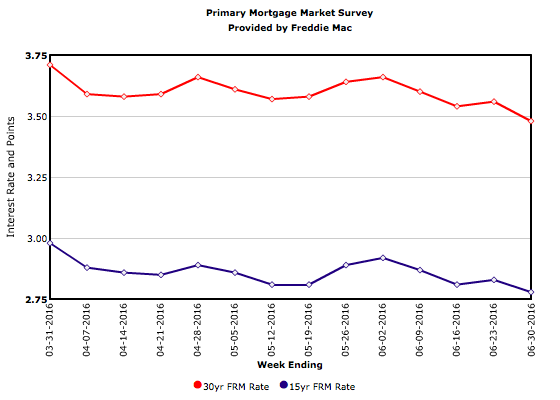

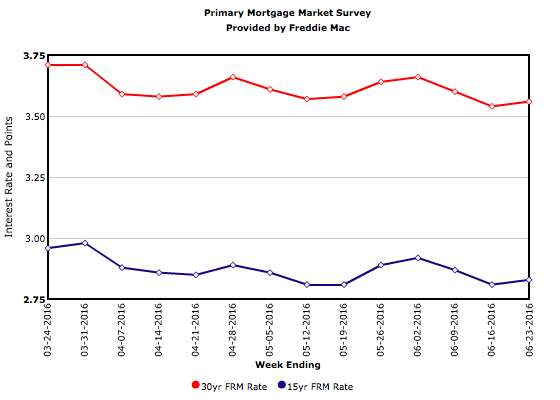

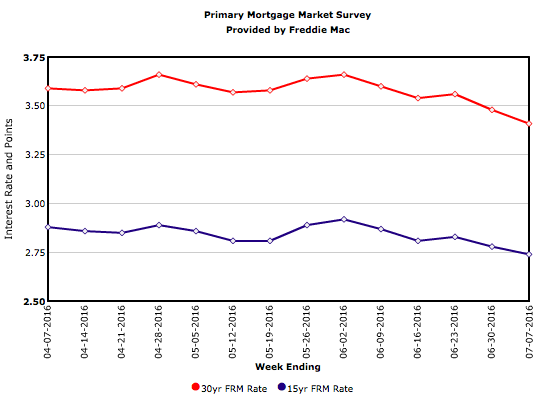

Continuing fallout from the Brexit vote drove Treasury yields lower again this week. The 30-year fixed-rate mortgage followed Treasury yields, falling 7 basis points to 3.41 percent in this week’s survey. Mortgage rates have now dropped 15 basis points over the past two weeks, leaving them only 10 basis points above the all-time low.