For Week Ending December 19, 2015

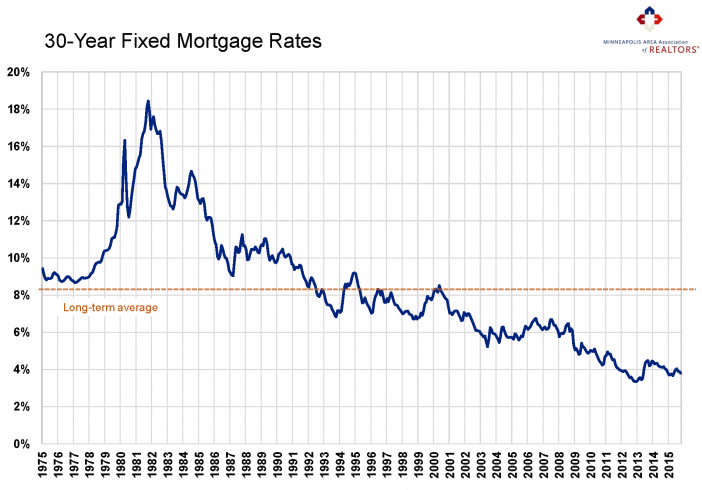

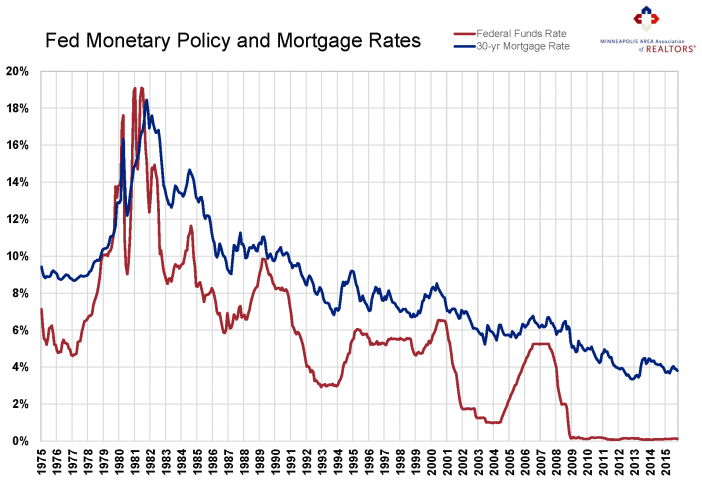

A week after the Federal Reserve raised short-term interest rates to .25 percent to .5 percent, the average on a 30-year fixed mortgage dropped .01 percent from the previous week to 3.96 percent, proving for now that the Fed’s effect on long-term rates is indirect when inflation is low, among other factors. Some even believe that rate hikes mean much more to Wall Street observers than home buyers. Not everyone agrees with this assessment, but residential real estate is still certainly spinning on an active axis as we work our way to a new year.

In the Twin Cities region, for the week ending December 19:

- New Listings increased 1.3% to 601

- Pending Sales increased 17.2% to 799

- Inventory decreased 18.4% to 12,105

For the month of November:

- Median Sales Price increased 6.8% to $219,040

- Days on Market decreased 7.6% to 73

- Percent of Original List Price Received increased 1.2% to 95.8%

- Months Supply of Inventory decreased 28.2% to 2.8

All comparisons are to 2014

Click here for the full Weekly Market Activity Report. From The Skinny Blog.