Weekly Market Report

For Week Ending August 13, 2022

For Week Ending August 13, 2022

After declining for three consecutive quarters, the share of homebuyers actively searching for a home grew to 49% nationally in the second quarter of 2022, up from 46% the previous quarter, according to the National Association of Home Builders (NAHB) recent Housing Trends Report. NAHB economists credit the rise in buyer activity to a less competitive housing market, which has motivated more prospective buyers to advance from the planning stage of the homebuying process to actively trying to purchase a home.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING AUGUST 13:

- New Listings decreased 16.0% to 1,480

- Pending Sales decreased 22.6% to 1,173

- Inventory increased 5.4% to 8,948

FOR THE MONTH OF JULY:

- Median Sales Price increased 7.1% to $375,000

- Days on Market increased 15.8% to 22

- Percent of Original List Price Received decreased 2.0% to 101.5%

- Months Supply of Homes For Sale increased 20.0% to 1.8

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Higher rates continue to cool demand, home prices still on the rise

- Median sales price was up 7.1 percent to $375,000, the slowest increase since June 2020

- Buyer activity was down, pending sales fell 23.3 percent

- Homes took 22 days to sell, 15.8 percent longer than the 19 days last July

(August 15, 2022) – According to new data from Minneapolis Area REALTORS® and the Saint Paul Area Association of REALTORS®, buyers in the Twin Cities have struggled to keep pace with the highs of 2021. Pending sales were down 23.3 percent in July compared to last year as buyers signed 4,807 purchase agreements. Buyers have been hampered by increased mortgage rates, still-low inventory, strong home prices and some economic uncertainty.

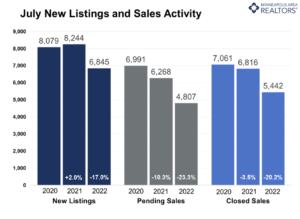

Sales & Listings

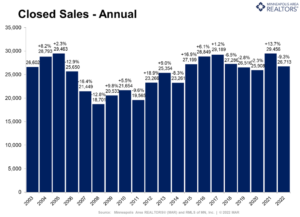

Buyer activity has been softening for 11 of the last 12 months as most acknowledge the frenzied demand of 2020 and 2021couldn’t last. July’s pending sales volume was 12.8 percent lower than July of 2019, reflecting affordability and supply challenges but also hinting at how demand was expedited from 2022/3 into 2020/1. “Many Twin Citizens eager to take advantage of historically low rates and purchase a home leapt at the chance,” said Denise Mazone, President of Minneapolis Area REALTORS®. “Combined with rising rates, that’s left a hole in our buyer pool this year, but there is still plenty of pent-up demand for homes. Plus there’s evidence rates are easing somewhat.” There has not been an influx of supply onto the market. Home sellers listed 6,845 homes last month, down 17.0 percent from last July. Selling activity has been fairly stable overall since 2020, but continuously lagging behind the supply needed to fuel the market demand, until the recent slowdown in sales.

Inventory & Home Prices

Homes in the metro sold for a median of $375,000 last month, 7.1 percent more than last July. That was the slowest growth rate in two years and amounts to $205 per square foot. The recent downshift in buyer activity has offered a small reprieve for persistent buyers thirsty for inventory and less competition. The metro ended July with 8,694 homes for sale, 4.5 percent more than last July. In a welcome development for buyers, inventory levels have grown for three consecutive months and months supply rose to 1.7. That suggests the supply squeeze is loosening but it’s important to recognize we’re still in a strong seller’s market. “Aspiring home buyers still face competition and multiple offers, just slightly less so than the last couple years, “according to Mark Mason, President of the Saint Paul Area Association of REALTORS®. “So while the market has rebalanced slightly, it still favors sellers.”

Location & Property Type

Market activity varies by area, price point and property type. New home sales fell 18.8 percent while existing home sales were down 16.4 percent. Single family sales fell 18.1 percent, condo sales declined 24.5 percent and townhome sales were down 20.8 percent. Sales in Minneapolis decreased 17.5 percent while Saint Paul sales fell 25.0 percent. Cities like Monticello, Golden Valley, and Orono saw the largest sales gains while Stillwater, Chanhassen, and Fridley had lower demand than last year.

July 2022 Housing Takeaways (compared to a year ago)

- Sellers listed 6,845 properties on the market, a 17.0 percent decrease from last July

- Sellers signed 4,807 purchase agreements, down 23.3 percent (5,442 closed sales, down 20.2 percent)

- Sellers levels grew 4.5 percent to 8,694 units

- Month’s Supply of Inventory rose 13.3 percent to 1.7 months (4-6 months is balanced)

- The Median Sales Price rose 7.1 percent to $375,000

- Days on Market rose 15.8 percent to 22 days, on average (median of 11 days, up 57.1 percent)

- Changes in Sales activity varied by market segment

- Single family sales decreased 18.1 percent; Condo sales were down 24.5 percent & townhouse sales fell 20.8 percent

- Traditional sales declined 18.9 percent; foreclosure sales fell 12.5 percent; short sales were down 14.3 percent

- Previously owned sales decreased 16.2 percent; new construction sales declined 18.8 percent

Weekly Market Report

For Week Ending August 6, 2022

For Week Ending August 6, 2022

The average 30-year fixed rate mortgage dropped to 4.99% the week ending 8/4, marking the first time since April rates have dipped below 5%, according to Freddie Mac. With rates down the past two weeks, the Mortgage Bankers Association reports mortgage applications rose slightly from the previous week, including an uptick in refinance applications, as buyers took advantage of the opportunity to lock in lower rates and save on their monthly mortgage payment.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING AUGUST 6:

- New Listings decreased 21.7% to 1,560

- Pending Sales decreased 23.1% to 1,118

- Inventory increased 7.8% to 8,818

FOR THE MONTH OF JULY:

- Median Sales Price increased 7.1% to $375,000

- Days on Market increased 15.8% to 22

- Percent of Original List Price Received decreased 2.0% to 101.5%

- Months Supply of Homes For Sale increased 20.0% to 1.8

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Weekly Market Report

For Week Ending July 30, 2022

For Week Ending July 30, 2022

As housing supply continues to increase across the country, prospective buyers’ housing expectations are on the rise as well, with the National Association of Home Builders (NAHB) reporting the share of prospective buyers expecting their home search to be easier in the coming months climbed to 22% in the second quarter, up from 17% in the first quarter. The NAHB attributes the improved outlook among buyers to increases in inventory and a decline in buyer competition.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING JULY 30:

- New Listings decreased 24.5% to 1,443

- Pending Sales decreased 22.4% to 1,171

- Inventory increased 10.3% to 8,830

FOR THE MONTH OF JUNE:

- Median Sales Price increased 8.6% to $380,000

- Days on Market increased 5.0% to 21

- Percent of Original List Price Received decreased 0.8% to 103.3%

- Months Supply of Homes For Sale increased 23.1% to 1.6

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Weekly Market Report

For Week Ending July 23, 2022

For Week Ending July 23, 2022

Mortgage applications declined for the fourth straight week, falling 1.8 percent from the previous week and marking the lowest level of activity since February 2000, according to the Mortgage Bankers Association. Increasing mortgage rates, escalating sales prices, and decades-high inflation continue to hinder affordability, putting homeownership on hold for many prospective buyers.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING JULY 23:

- New Listings decreased 13.5% to 1,607

- Pending Sales decreased 25.1% to 1,142

- Inventory increased 9.7% to 8,729

FOR THE MONTH OF JUNE:

- Median Sales Price increased 8.6% to $380,000

- Days on Market increased 5.0% to 21

- Percent of Original List Price Received decreased 0.8% to 103.3%

- Months Supply of Homes For Sale increased 23.1% to 1.6

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Weekly Market Report

For Week Ending July 16, 2022

For Week Ending July 16, 2022

Increasing homeownership costs have led many prospective homebuyers to continue renting, adding additional pressure to an already highly competitive rental market. Rental vacancy rates have remained below 6% since Q3 2021, a 3-decade low, the U.S. Census Bureau reports. As demand continues to outpace supply, rents on new leases have surged 14.1% this year through June, according to Apartment List, a huge leap from the typical 2% – 3% annual rent increases before the pandemic.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING JULY 16:

- New Listings decreased 11.5% to 1,750

- Pending Sales decreased 24.8% to 1,097

- Inventory increased 10.1% to 8,441

FOR THE MONTH OF JUNE:

- Median Sales Price increased 8.6% to $380,000

- Days on Market increased 5.0% to 21

- Percent of Original List Price Received decreased 0.8% to 103.3%

- Months Supply of Homes For Sale increased 23.1% to 1.6

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

June Monthly Skinny Video

As existing home sales continue to soften nationwide, housing supply is slowly improving, with inventory up for the second straight month.

Buyers grapple with affordability challenges amidst rising rates and home prices

- Median sales price reached a record $380,000 despite declining sales

- June inventory up 9.8 percent, a second consecutive year-over-year increase

- Softer demand led to longer days on market, up 5.0 percent to 21 days, on average

(July 18, 2022) – According to new data from Minneapolis Area REALTORS® and the Saint Paul Area Association of REALTORS®, Twin Cities home prices rose as sellers continued receiving strong offers despite slightly longer market times. Meanwhile, buyers signed 18.4 percent fewer purchase agreements than last year. While these signal a rebalancing marketplace, the persistent shortage of homes in the region should keep prices resilient.

Home Prices & Sales

The median home price hit a record $380,000 last month, an 8.6 percent increase from last June and a 23.4 percent increase since the beginning of the pandemic in June of 2020. For the last few years, historically low mortgage rates have offset the effect of rising prices on monthly payments. With rates recently moving from under 3.0 percent to 5.5 percent, the impact of rising prices has increased monthly payments. “While buyers should know that mortgage rates are still well below their long-term average, the increase in rates has had a real impact,” said Denise Mazone, President of Minneapolis Area REALTORS®. “Today’s buyers are more sensitive to that.” Indeed, the housing affordability index reached its lowest level since at least 2004. Buyers signed 5,544 purchase agreements last month, 18.4 percent fewer than last June. That’s the lowest June figure since 2014. But, the decline can be misleading because it’s compared to a uniquely strong market last year. Comparing to pre-pandemic levels, June closings were down just 3.6 percent from June 2019.

Inventory & Listings

A silver lining of moderating buyer activity is its effect on the inventory shortage throughout the region. The metro ended June with 8,020 homes for sale, 9.8 percent more than last June. Inventory gains have been rare, but with a mere 1.6 month’s of supply, buyers are thirsty for more choices. “It’s reassuring to see more homes on the market after a few years of under 2.0 months of supply,” according to Mark Mason, President of the Saint Paul Area Association of REALTORS®. “That said, the gain came mostly from fewer buyers and not more sellers, so we still need more supply and more building activity to balance out the market.” While the Twin Cities saw demand weaken, seller activity was more stable. New listings were down 6.7 percent from last year, with 7,901 homes coming on the market. But relative to June 2020, seller activity increased 4.4 percent.

Location & Property Type

Market activity varies by area, price point and property type. New home sales fell 12.1 percent while existing home sales were down 15.1 percent. Single family sales fell 13.8 percent, condo sales declined 24.5 percent and townhome sales were down 15.1 percent. Sales in Minneapolis decreased 21.7 percent while Saint Paul sales fell 15.8 percent. Cities like Rogers, Minnetrista, and Waconia saw the largest sales gains while New Richmond, Apple Valley, and Farmington had lower demand than last year.

June 2022 Housing Takeaways (compared to a year ago)

- Sellers listed 7,901 properties on the market, a 6.7 percent decrease from last June

- Buyers signed 5,544 purchase agreements, down 18.4 percent (6,422 closed sales, down 15.4 percent)

- Inventory levels grew 9.8 percent to 8,020 units

- Month’s Supply of Inventory rose 23.1 percent to 1.6 months (4-6 months is balanced)

- The Median Sales Price rose 8.6 percent to $380,000

- Days on Market rose 5.0 percent to 21 days, on average (median of 8 days, up 14.3 percent)

- Changes in Sales activity varied by market segment

- Single family sales decreased 13.8 percent; Condo sales were down 24.5 percent & townhouse sales fell 15.1 percent

- Traditional sales declined 15.2 percent; foreclosure sales rose 39.1 percent; short sales were up 100.0 percent (from 4 to 8)

- Previously owned sales decreased 15.1 percent; new construction sales decreased 12.1 percent

Weekly Market Report

For Week Ending July 9, 2022

For Week Ending July 9, 2022

Homebuyers felt a tinge of relief recently as mortgage rates softened somewhat, with the 30-year fixed-rate mortgage falling from 5.7% to 5.3% the week ending July 7, the biggest one week decline since 2008, according to Freddie Mac. Over the past two weeks mortgage rates have dropped by half a percent, making homebuying about 5% more affordable than last month and saving buyers approximately $100 in monthly mortgage payments, according to the National Association of REALTORS®.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING JULY 9:

- New Listings decreased 18.3% to 1,481

- Pending Sales decreased 19.0% to 931

- Inventory increased 12.0% to 8,123

FOR THE MONTH OF JUNE:

- Median Sales Price increased 8.6% to $380,000

- Days on Market increased 5.0% to 21

- Percent of Original List Price Received decreased 0.8% to 103.3%

- Months Supply of Homes For Sale increased 23.1% to 1.6

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

- « Previous Page

- 1

- …

- 23

- 24

- 25

- 26

- 27

- …

- 153

- Next Page »