For Week Ending April 17, 2021

For Week Ending April 17, 2021

A new analysis by housing giant Freddie Mac suggests that the U.S. housing market needs 3.8 million more single-family homes nationwide to meet demand. Sam Khater, Freddie Mac’s chief economist, noted “we should have almost four million more housing units if we had kept up with demand the last few years.” While new construction activity has increased in recent years, it has never fully recovered to its previous peak more than fifteen years ago.

In the Twin Cities region, for the week ending April 17:

- New Listings increased 19.0% to 1,582

- Pending Sales increased 45.3% to 1,481

- Inventory decreased 47.6% to 5,276

For the month of March:

- Median Sales Price increased 10.4% to $328,000

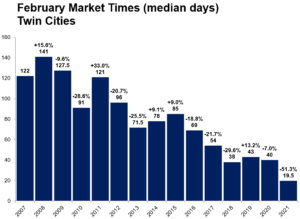

- Days on Market decreased 36.1% to 39

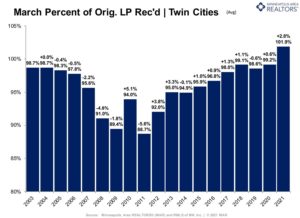

- Percent of Original List Price Received increased 2.7% to 101.9%

- Months Supply of Homes For Sale decreased 55.0% to 0.9

All comparisons are to 2020

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.