For Week Ending March 6, 2021

For Week Ending March 6, 2021

With the spring market well underway, buyer activity remains very robust and hot properties continue to frequently encounter bidding wars. While mortgage rates have ticked up over 3% for the first time since last July, the incremental increase is unlikely to have a substantial effect on buyer demand.

In the Twin Cities region, for the week ending March 6:

- New Listings decreased 21.8% to 1,433

- Pending Sales decreased 1.7% to 1,130

- Inventory decreased 44.6% to 4,818

For the month of February:

- Median Sales Price increased 11.5% to $314,000

- Days on Market decreased 31.3% to 46

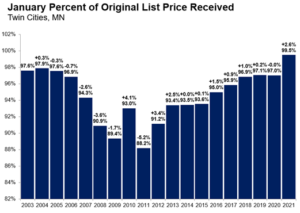

- Percent of Original List Price Received increased 2.1% to 100.1%

- Months Supply of Homes For Sale decreased 47.1% to 0.9

All comparisons are to 2020

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.