For Week Ending August 29, 2020

Mortgage rates continue to remain near all-time lows. This week, mortgage giant Freddie Mac reported that average rates on a 30-year fixed-rate mortgage were 2.91% with an average of .8 points, just slightly above the record-low rate of 2.88% recorded earlier in the month. The Federal Reserve has announced that they will be adopting a more flexible monetary policy in an effort to achieve inflation that averages 2% over time, which is likely to keep mortgage rates low and provide further support to economic activity for an extended period of time.

In the Twin Cities region, for the week ending August 29:

- New Listings increased 24.2% to 1,730

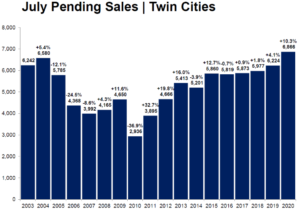

- Pending Sales increased 18.0% to 1,540

- Inventory decreased 30.7% to 9,094

For the month of July:

- Median Sales Price increased 10.6% to $313,000

- Days on Market increased 7.9% to 41

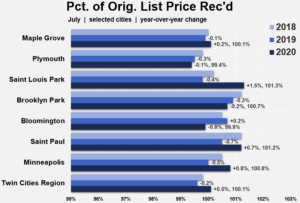

- Percent of Original List Price Received increased 0.5% to 100.1%

- Months Supply of Homes For Sale decreased 29.6% to 1.9

All comparisons are to 2019

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.