For Week Ending July 11, 2020

Mortgage rates continue to hit new lows. This week, mortgage giant Freddie Mac reported that rates on a 30-year fixed-rate mortgage fell to a new record low of 3.03% with an average of .8 points. That is down from 3.07% last week and 3.75% from the same week a year ago. Record-low rates are continuing to boost already strong buyer demand throughout most of the country and economists expect rates to continue to remain low in the near future.

In the Twin Cities region, for the week ending July 11:

- New Listings decreased 18.8% to 1,834

- Pending Sales decreased 0.5% to 1,507

- Inventory decreased 25.9% to 9,287

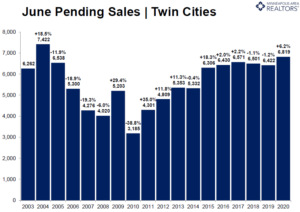

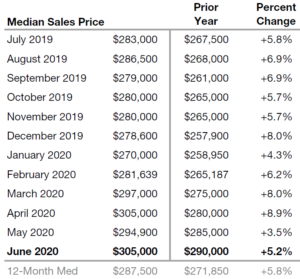

For the month of June:

- Median Sales Price increased 5.2% to $305,000

- Days on Market increased 2.4% to 42

- Percent of Original List Price Received decreased 0.4% to 99.6%

- Months Supply of Homes For Sale decreased 29.6% to 1.9

All comparisons are to 2019

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.