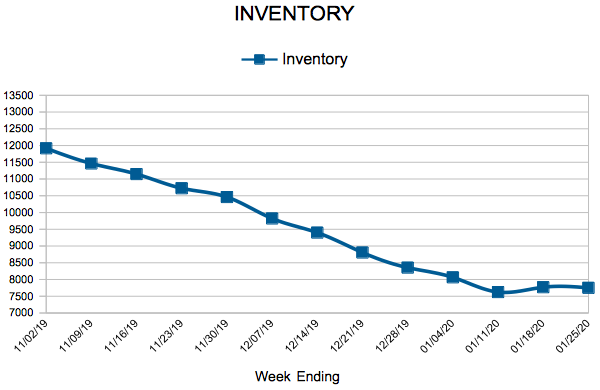

Inventory

Weekly Market Report

For Week Ending January 25, 2020

CoreLogic’s latest Single-Family Rent Index report saw the cost of renting single-family homes, including condos, up 3% in November 2019 compared to November 2018. According to the report, rent prices started climbing in 2010 and have stabilized around an annualized rate of 3% since early 2019. With the cost of rent continuing to trend upward, it makes sense that many are considering paying their own mortgage, instead of their landlord’s, by becoming first-time homeowners.

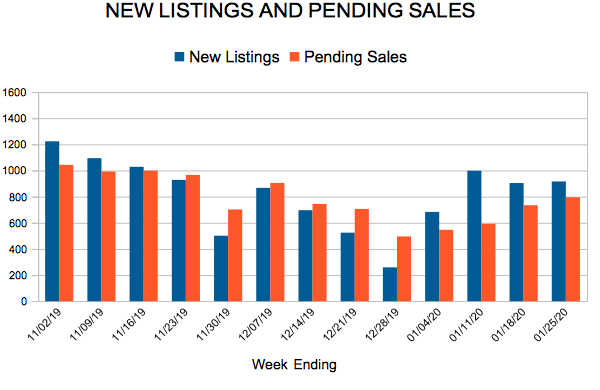

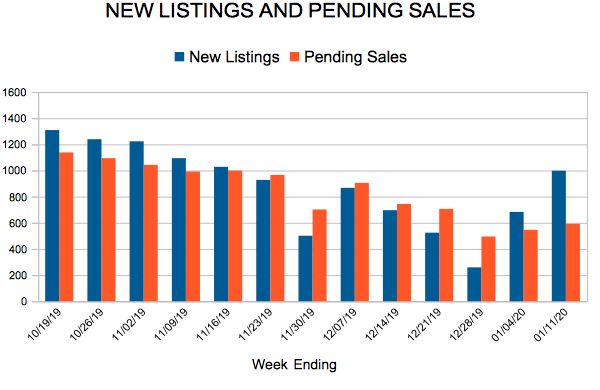

In the Twin Cities region, for the week ending January 25:

- New Listings decreased 5.2% to 916

- Pending Sales decreased 0.9% to 795

- Inventory decreased 14.9% to 7,751

For the month of December:

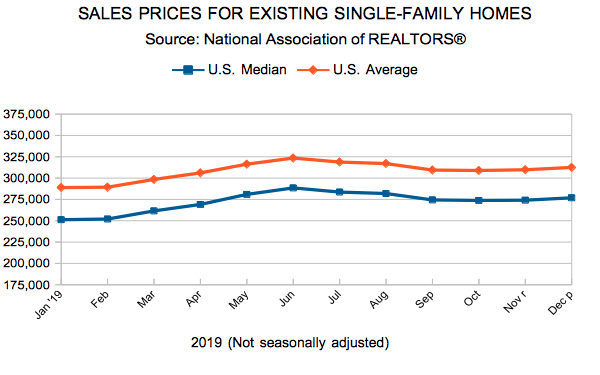

- Median Sales Price increased 8.2% to $279,000

- Days on Market decreased 1.8% to 56

- Percent of Original List Price Received increased 0.5% to 97.3%

- Months Supply of Homes For Sale decreased 15.8% to 1.6

All comparisons are to 2019

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

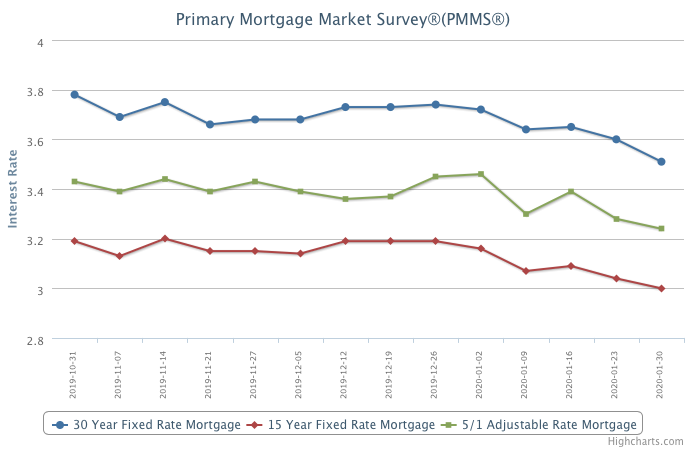

Mortgage Rates Continue to Drop

January 30, 2020

This week’s mortgage rates were the second lowest in three years, supporting homebuyer demand and leading to higher refinancing activity. Borrowers who take advantage of these low rates can improve their cash flow by lowering their monthly mortgage payments, giving them more money to spend or save.

Information provided by Freddie Mac.

New Listings and Pending Sales

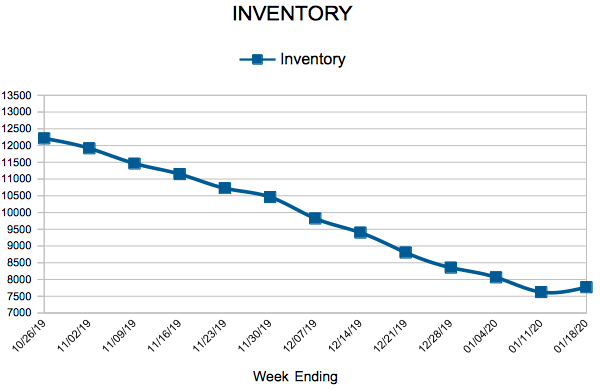

Inventory

Weekly Market Report

For Week Ending January 18, 2020

The Mortgage Bankers Association reported that applications for home purchases rose 16% last week, reaching its highest level since 2009. Applications to refinance also grew, increasing a stunning 43% last week and are 109% higher than a year ago, the MBA reports. The sharp increases in both purchase and refinance applications are spurred by lower rates providing incentives for both buyers and existing homeowners to act.

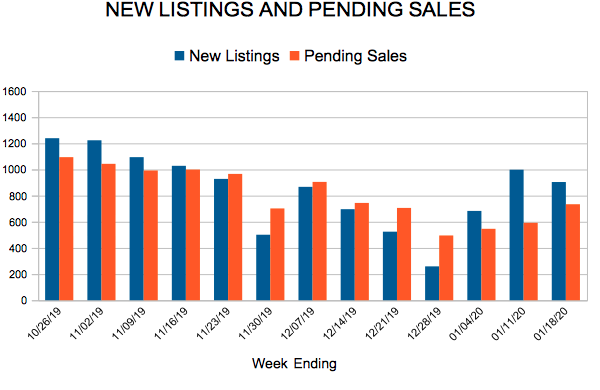

In the Twin Cities region, for the week ending January 18:

- New Listings decreased 14.3% to 904

- Pending Sales increased 2.5% to 734

- Inventory decreased 14.3% to 7,770

For the month of December:

- Median Sales Price increased 8.2% to $279,000

- Days on Market decreased 1.8% to 56

- Percent of Original List Price Received increased 0.5% to 97.3%

- Months Supply of Homes For Sale decreased 21.1% to 1.5

All comparisons are to 2019

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Mortgage Rates Drop to Lowest Level in Three Months

January 23, 2020

Rates fell to the lowest level in three months and are about a quarter point above all-time lows. The very low rate environment has clearly had an impact on the housing market as both new construction and home sales have surged in response to the decline in rates, the rebound in the economy and improving financial market sentiment.

Information provided by Freddie Mac.

Existing Home Sales

New Listings and Pending Sales

- « Previous Page

- 1

- …

- 47

- 48

- 49

- 50

- 51

- …

- 153

- Next Page »