Weekly Market Report

For Week Ending January 11, 2020

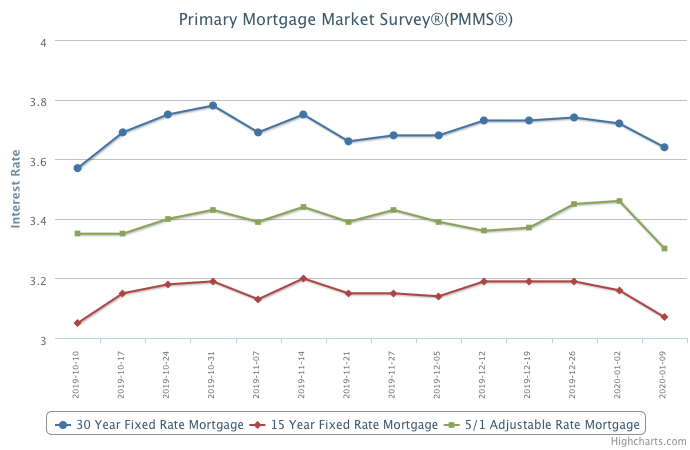

Freddie Mac reported that the average 30-year fixed-rate mortgage dropped to 3.64% this week, the lowest level in three months and down from 4.45% one year ago. Additionally, conforming and FHA loan limits have increased for 2020. Increased loan limits coupled with low rates, will give more buyers the ability to purchase a wider range of properties. These changes, along with the continued strong labor market, is likely to spur buyer demand even in the face of a constrained supply of homes for sale throughout much of the country.

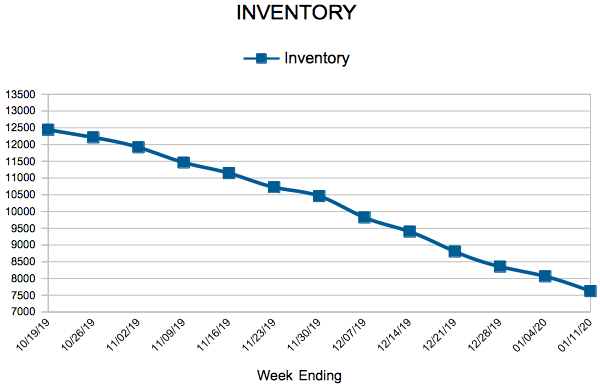

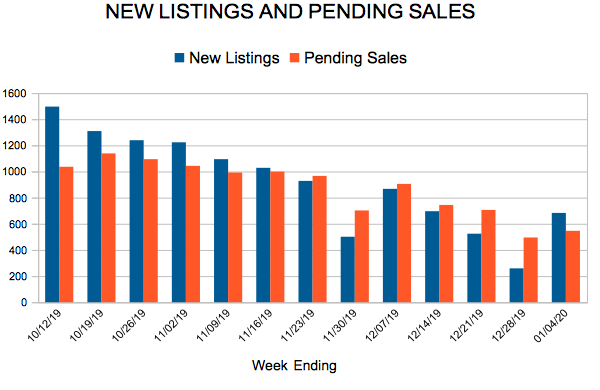

In the Twin Cities region, for the week ending January 11:

- New Listings decreased 4.9% to 998

- Pending Sales decreased 12.2% to 592

- Inventory decreased 15.2% to 7,624

For the month of December:

- Median Sales Price increased 8.0% to $278,600

- Days on Market decreased 1.8% to 56

- Percent of Original List Price Received increased 0.4% to 97.2%

- Months Supply of Homes For Sale decreased 21.1% to 1.5

All comparisons are to 2019

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

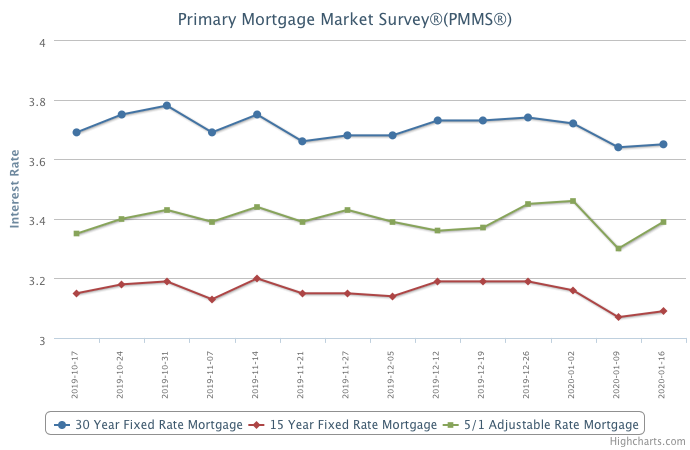

Mortgage Rates Generally Hold Steady

January 16, 2020

Mortgage rates inched up by one basis point this week with the 30-year fixed-rate mortgage averaging 3.65 percent. By all accounts, mortgage rates remain low and, along with a strong job market, are fueling the consumer-driven economy by boosting purchasing power, which will certainly support housing market activity in the coming months. While the outlook for the housing market is positive, worsening homeowner and rental affordability due to the lack of housing supply continue to be hurdles, and they are spreading to many interior markets that have traditionally been affordable.

Information provided by Freddie Mac.

New Listings and Pending Sales

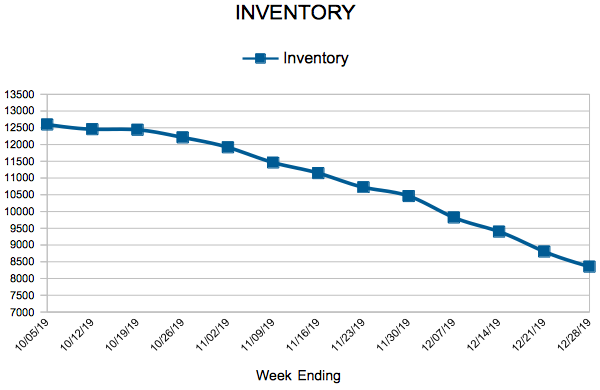

Inventory

Weekly Market Report

For Week Ending January 4, 2020

With the start of the New Year, the real estate market turns more active across mostof the country. Sellers connect with agents, resulting in a pop of new listings, followed by renewed interest by buyers, which leads to an increase in pending sales. This pattern is seen every year and 2020 should be no different. We’re starting off the year with continued low interest rates, low unemployment, and rising rents nationally. This sets us up for a strong start to 2020 and plenty of optimism for the coming spring market.

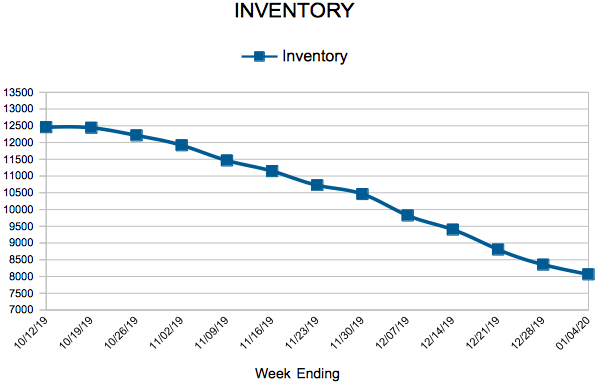

In the Twin Cities region, for the week ending January 4:

- New Listings decreased 17.9% to 683

- Pending Sales decreased 7.0% to 546

- Inventory decreased 12.8% to 8,064

For the month of November:

- Median Sales Price increased 5.6% to $279,900

- Days on Market decreased 1.9% to 51

- Percent of Original List Price Received increased 0.2% to 97.5%

- Months Supply of Homes For Sale decreased 4.5% to 2.1

All comparisons are to 2019

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Mortgage Rates Drop as 2020 Gets Underway

January 9, 2020

Mortgage rates fell to the lowest level in thirteen weeks, as investors sought the quality and safety of the U.S. Treasury fixed income markets. The drop in mortgage rates, combined with the strong labor market, should propel a continued rise in homebuyer demand.

Information provided by Freddie Mac.

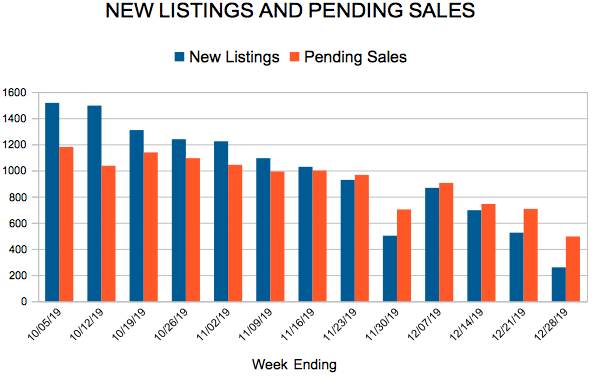

New Listings and Pending Sales

Inventory

Weekly Market Report

For Week Ending December 28, 2019

Data from the Census Bureau’s Survey of Construction (SOC) and the National Association of Home Builders shows that 62.5 percent of all new construction homes started in 2018 were built as part of a community or homeowner’s association, up from 47.6% in 2009. These associations are typically created when the developments are built to maintain common areas of the developments and to enforce private deed restrictions, which often detail requirements for the exterior appearance and upkeep of properties.

In the Twin Cities region, for the week ending December 28:

- New Listings decreased 15.6% to 259

- Pending Sales decreased 3.7% to 495

- Inventory decreased 14.0% to 8,354

For the month of November:

- Median Sales Price increased 5.6% to $279,900

- Days on Market decreased 1.9% to 51

- Percent of Original List Price Received increased 0.2% to 97.5%

- Months Supply of Homes For Sale decreased 4.5% to 2.1

All comparisons are to 2018

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

- « Previous Page

- 1

- …

- 48

- 49

- 50

- 51

- 52

- …

- 153

- Next Page »