December 19, 2019

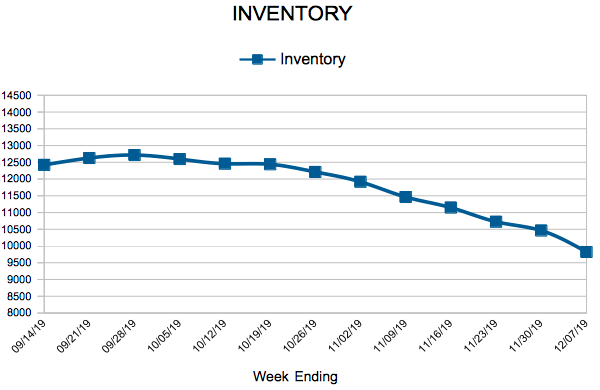

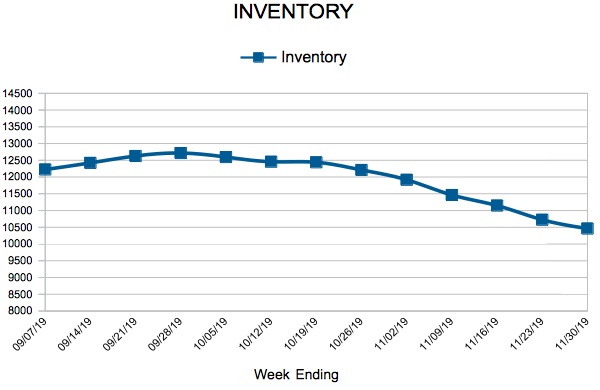

The economy continued to pick up momentum with a solid increase in residential construction, improvement in industrial output in our nation’s factories and a rise in job openings. While the economy is in a sweet spot, improvements in housing market sales volumes will be modest heading into next year simply due to the lack of available inventory. The demand is clearly not being met for entry-level Millennials and trade-up Generation X home buyers. If there was more inventory of unsold homes for buyers to choose from, home sales would be rising at a faster rate.

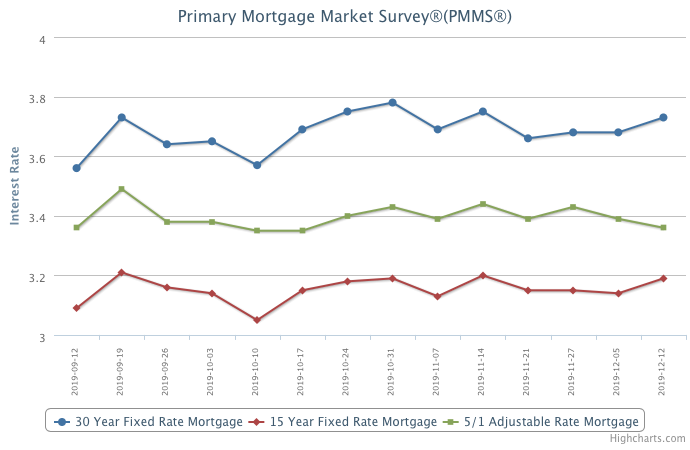

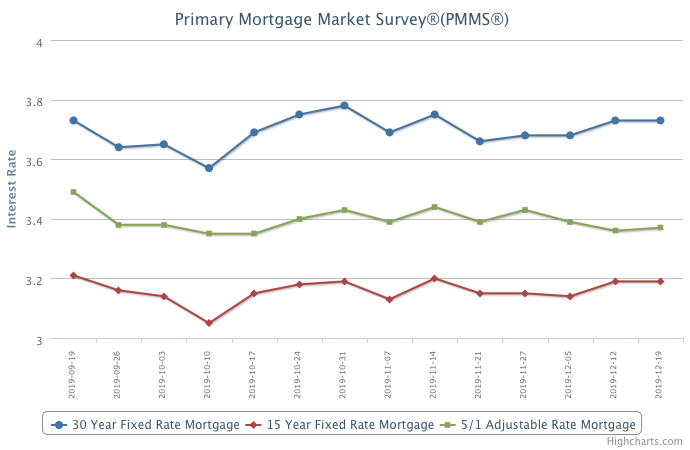

Information provided by Freddie Mac.