For Week Ending November 30, 2019

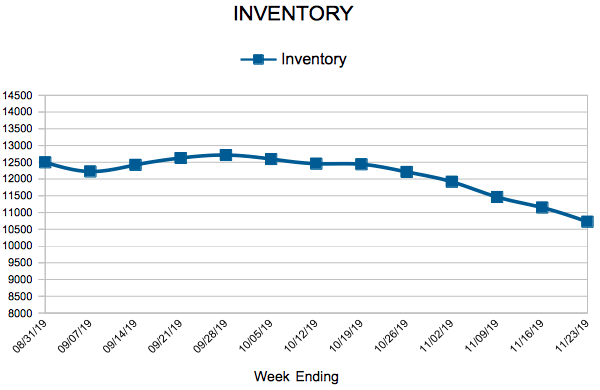

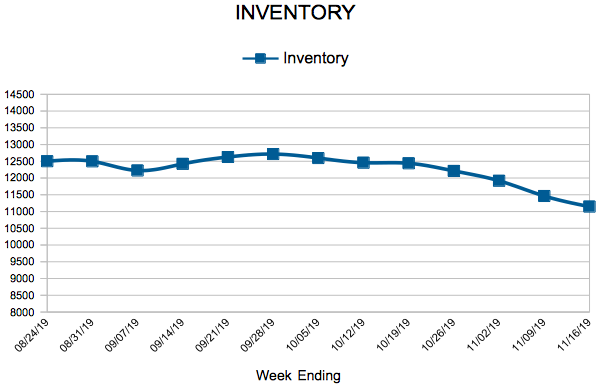

Americans across the country sat down to Thanksgiving with friends and family this week. Real estate activity took a backseat to the preparation of meals and the hosting of guests, where securing second helpings were more important than securing second homes. As we enter the final weeks of 2019, there is strength and optimism in the housing market, but at a pace that is muted due to the holiday season. The relatively low levels of inventory coupled with continued strong buyer activity are the common refrains across much of the country.

In the Twin Cities region, for the week ending November 30:

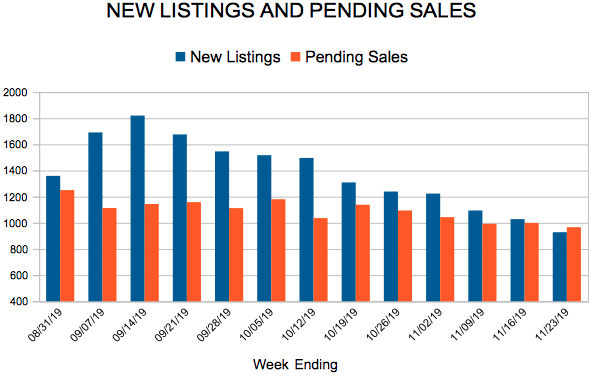

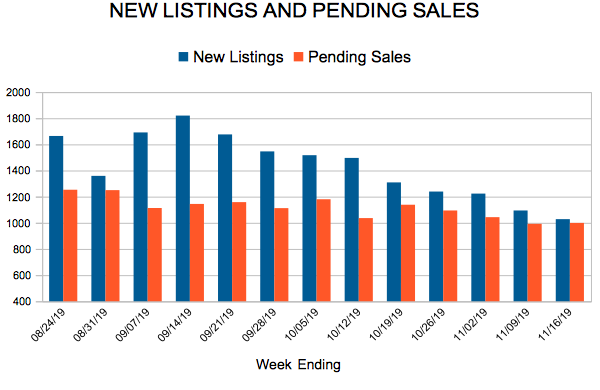

- New Listings decreased 43.6% to 501

- Pending Sales decreased 26.3% to 702

- Inventory decreased 6.6% to 10,461

For the month of October:

- Median Sales Price increased 5.7% to $280,000

- Days on Market decreased 4.2% to 46

- Percent of Original List Price Received increased 0.2% to 98.1%

- Months Supply of Homes For Sale decreased 4.0% to 2.4

All comparisons are to 2018

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.