November 21, 2019

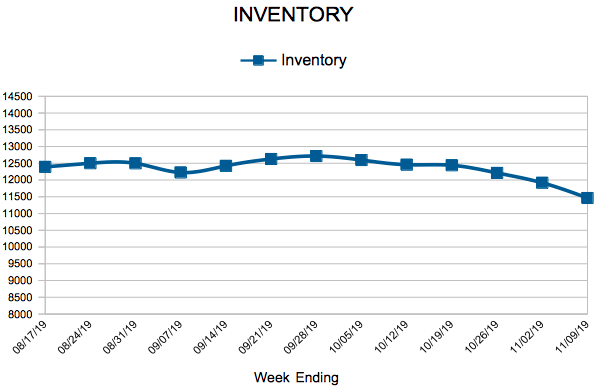

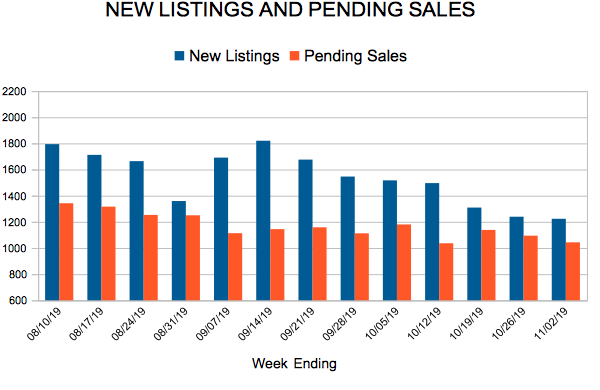

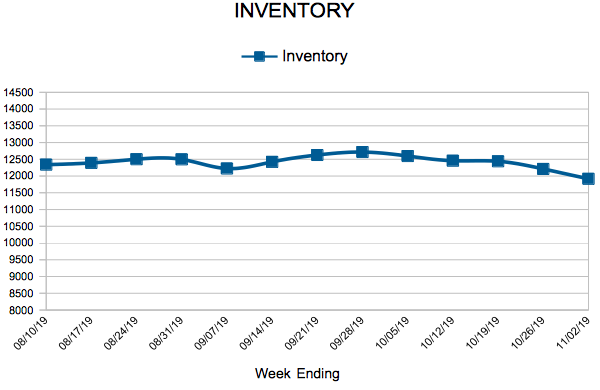

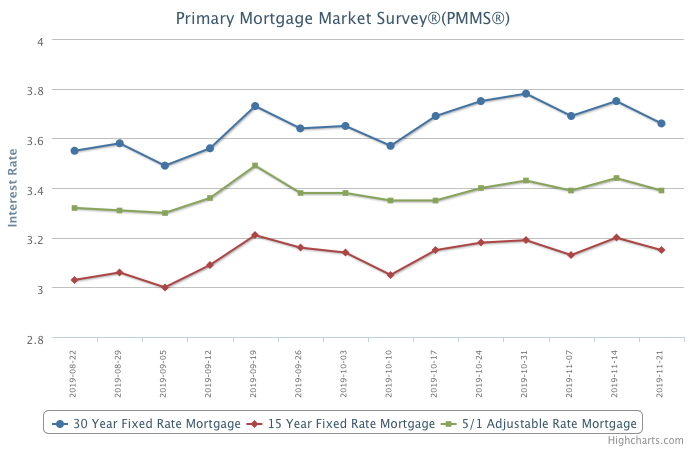

The housing market continues to steadily gain momentum with rising homebuyer demand and increased construction due to the strong job market, ebullient market sentiment and low mortgage rates. Residential real estate accounts for one-sixth of the economy, and the improving real estate market will support economic growth heading into next year.

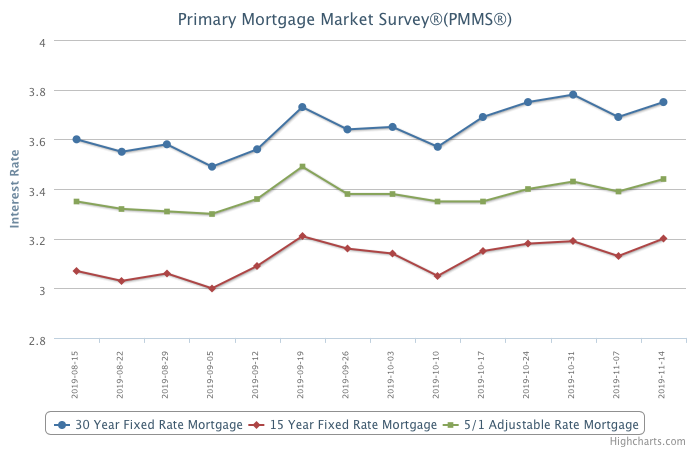

Information provided by Freddie Mac.