For Week Ending August 17, 2019

For Week Ending August 17, 2019

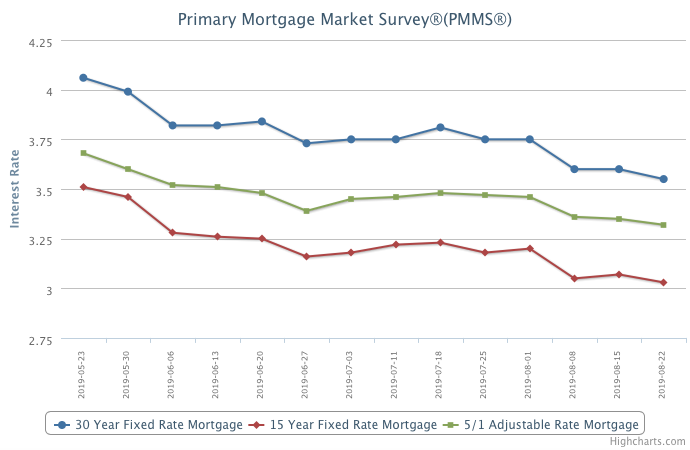

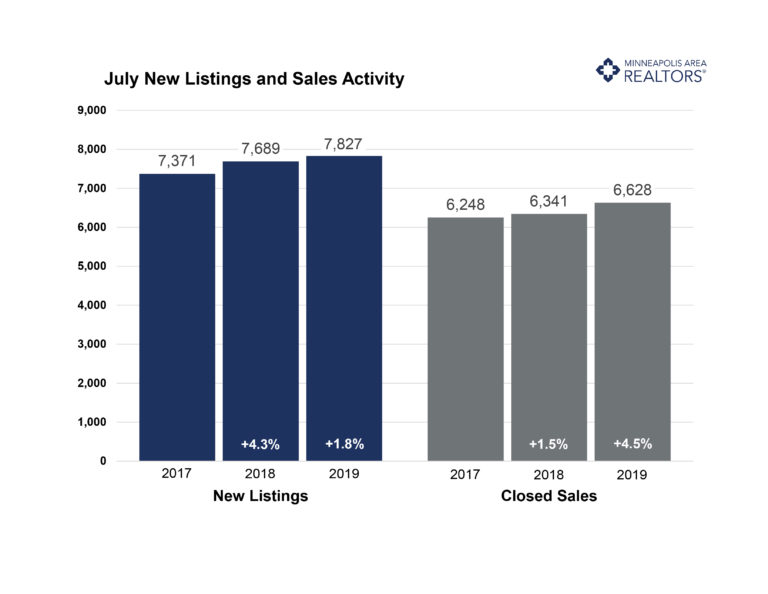

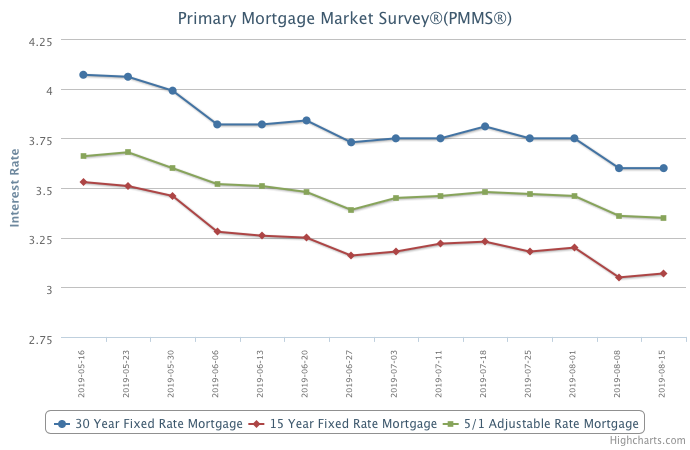

As families across the U.S. enjoy the last few weeks of summer before the start of the school year, it seems that the real estate market is seeing an infusion of new energy that is partially offsetting the expected seasonal slowdown. Further decreases in housing inventory and month’s supply at the national level point to a moderate influx of new buyers, perhaps due to the allure of lower mortgage rates. It remains to be seen whether these trends will be affected by events in the general economy.

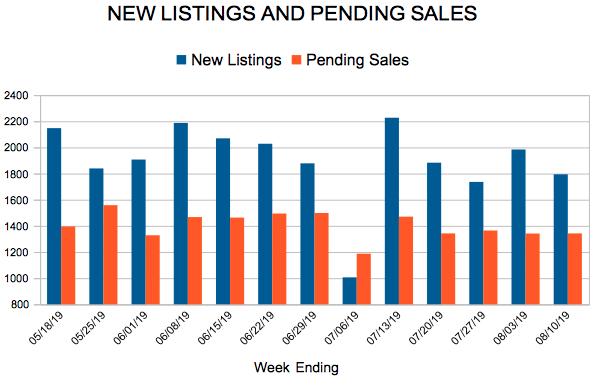

In the Twin Cities region, for the week ending August 17:

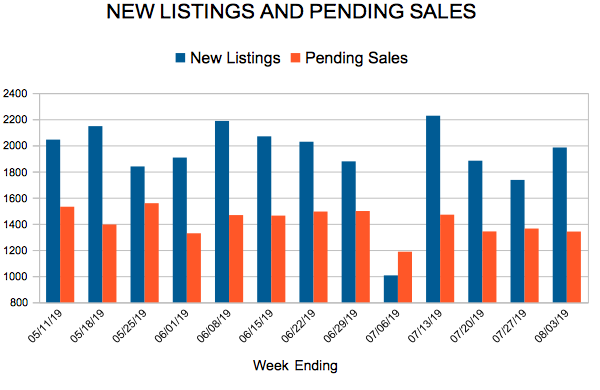

- New Listings decreased 2.9% to 1,712

- Pending Sales increased 3.9% to 1,316

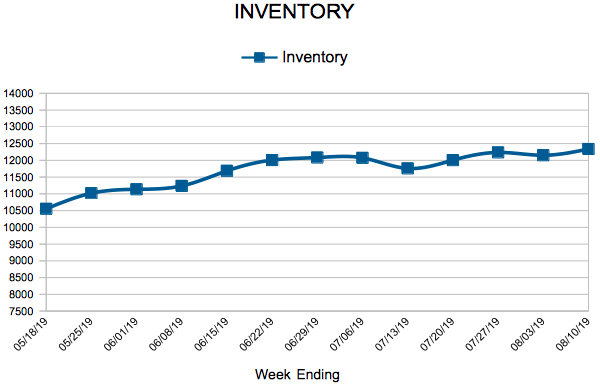

- Inventory decreased 3.5% to 12,392

For the month of July:

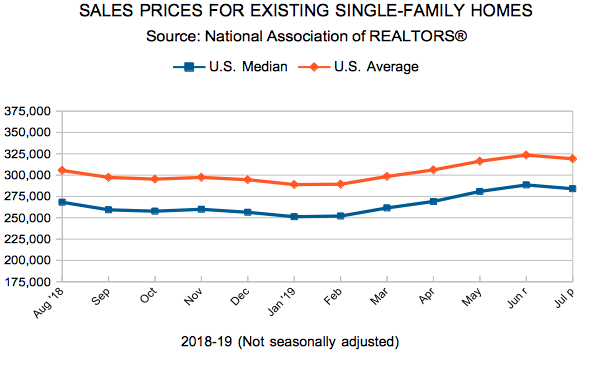

- Median Sales Price increased 5.9% to $283,900

- Days on Market remained flat at 38

- Percent of Original List Price Received decreased 0.1% to 99.7%

- Months Supply of Homes For Sale remained flat at 2.5

All comparisons are to 2018

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.