For Week Ending July 6, 2019

For Week Ending July 6, 2019

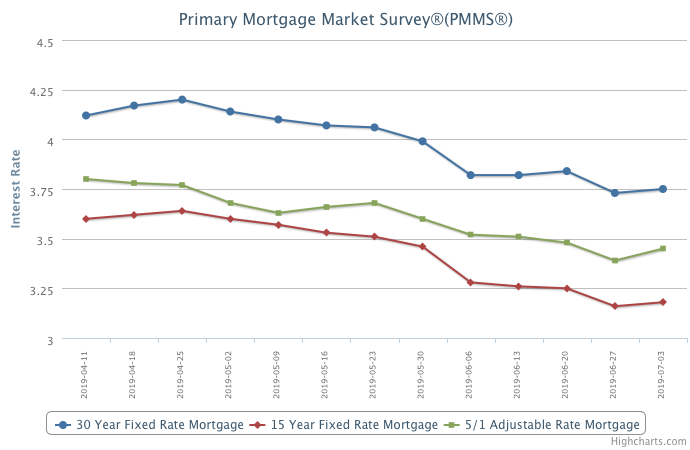

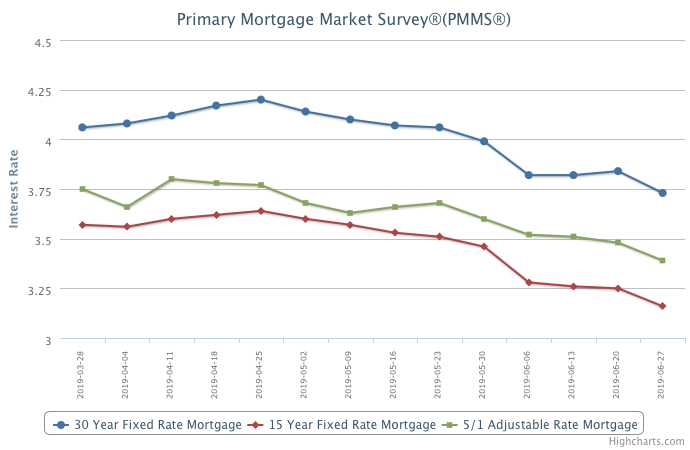

The order of the day is market balance between buyer and seller interests. While true that there may not be as many homes for sale to choose from and that prices are on the high end for the average first-time home buyer, there are considerations for sellers as well. Such as, more markets are swinging toward the back side of balance with fewer sales leading to some amount of downward price pressure from a beleaguered buyer core that is becoming less willing to overreach.

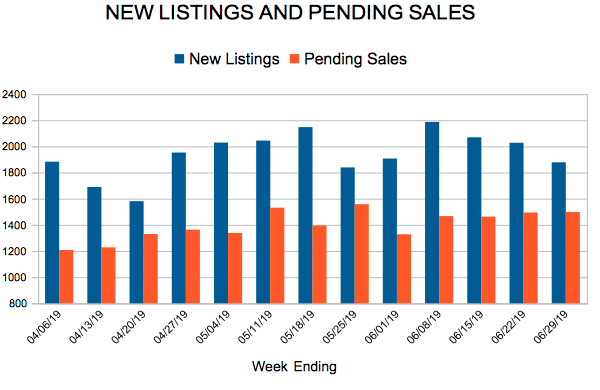

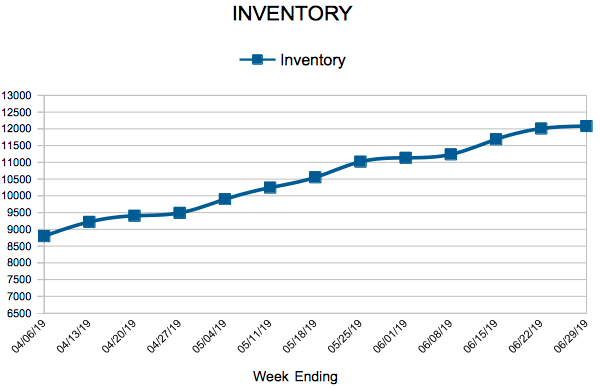

In the Twin Cities region, for the week ending July 6:

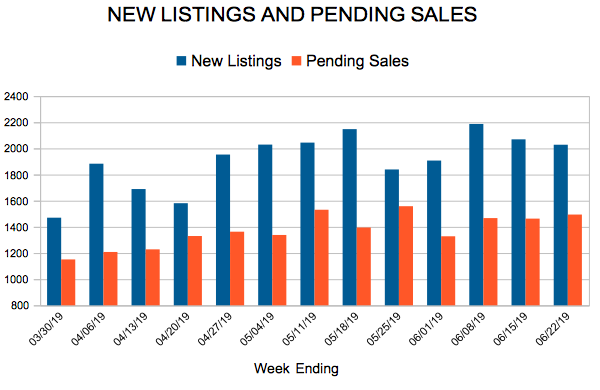

- New Listings decreased 16.0% to 1,006

- Pending Sales increased 11.5% to 1,187

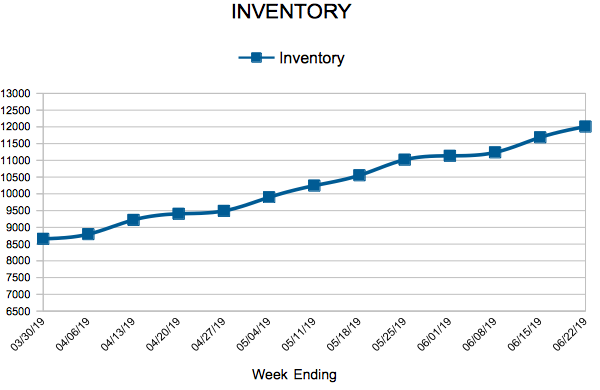

- Inventory increased to 12,074

For the month of June:

- Median Sales Price increased 7.2% to $290,000

- Days on Market increased 2.5% to 41

- Percent of Original List Price Received decreased 0.3% to 100.0%

- Months Supply of Homes For Sale remained flat at 2.5

All comparisons are to 2018

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.