Weekly Market Report

For Week Ending May 18, 2019

For Week Ending May 18, 2019

There is a stillness in the air during this spring’s housing market, and not the foreboding kind that precedes a scary moment in a horror film or a major weather event, but rather a sameness to the springs of the last few years. Prices are still edging upwards and providing affordability challenges for many buyers. The number of new listings and homes for sale are still not quite enough – though improving – to meet current demand. And competition for desirable homes is still fierce.

In the Twin Cities region, for the week ending May 18:

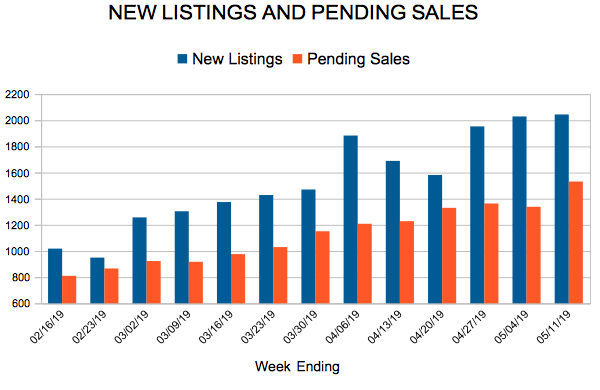

- New Listings decreased 5.9% to 2,147

- Pending Sales decreased 5.8% to 1,395

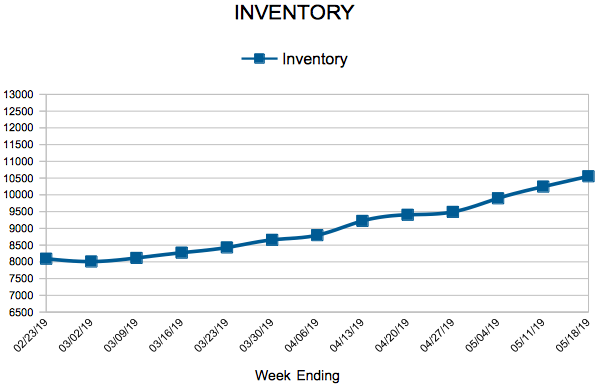

- Inventory increased 1.0% to 10,553

For the month of April:

- Median Sales Price increased 5.2% to $281,000

- Days on Market increased 5.7% to 56

- Percent of Original List Price Received decreased 0.5% to 99.4%

- Months Supply of Homes For Sale increased 5.0% to 2.1

All comparisons are to 2018

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

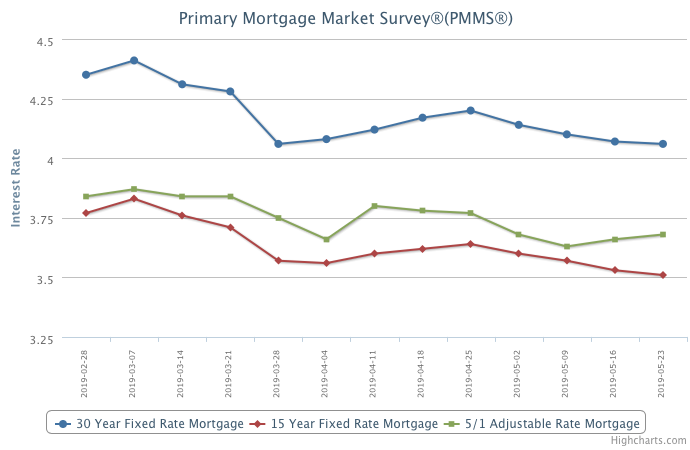

Low Mortgage Rates Lead to Rise in Purchase Demand

May 23, 2019

Mortgage rates fell for the fourth consecutive week and continued the medium-term trend of lower rates since late 2018. The drop in mortgage rates is causing purchase demand to rise and the mix of demand is skewing to the higher end as more affluent consumers are typically more responsive to declines in rates.

Information provided by Freddie Mac.

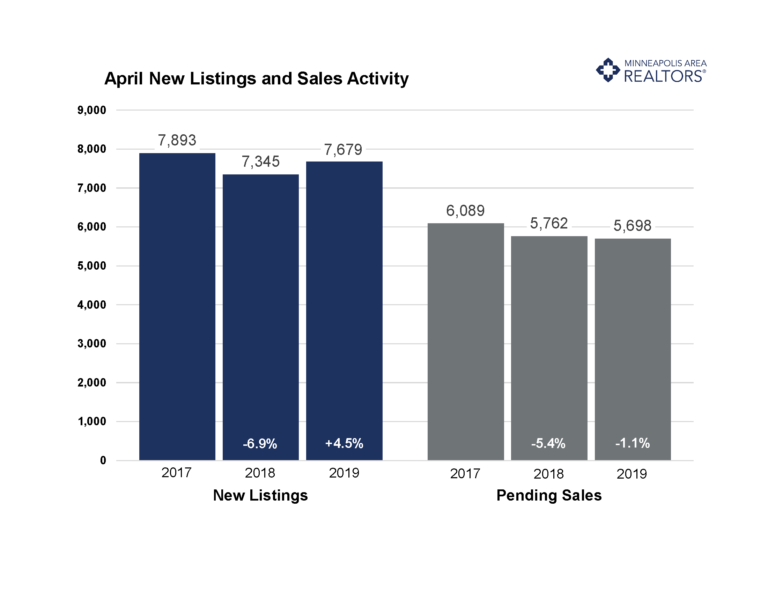

Prices rising, pending sales stable amidst market rebalancing

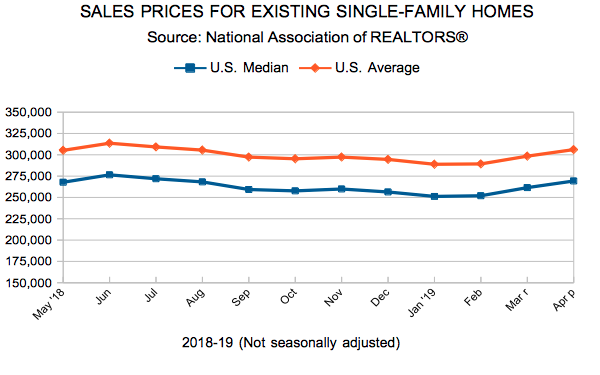

Gardeners aren’t the only ones struggling with spring weather this year. The season’s late start and temperature swings suppressed housing market activity early this year, but those effects are moderating. The latest numbers for Twin Cities residential real estate show some strength amidst ongoing signs of change. Prices reached a new record of $281,000. New listings reversed course and rose 4.5 percent. Closed sales were down about 7.0 percent though pending sales—a measure of future closings—fell just 1.1 percent. Market times rose 5.7 percent year-over-year, the second increase since March 2015. Another sign of a changing market is the ratio of sold to list price has fallen for five of the last six months. In conjunction with other indicators, this suggests the market is improving for buyers, even though sellers still have strong pricing power, favorable negotiating leverage and quick market times.

The number of active listings for sale decreased slightly compared to the prior year. Even so, buyers have seen inventory gains for seven of the last eight months. After seven months of gains, months supply was flat at 2.0 months, suggesting the market is still undersupplied. Well-priced, turnkey properties continue to be highly sought-after. Mortgage rates remain cooperative at around 4.1 percent, which is good news for buyers. The market is tightest at the entry-level prices, where multiple offers and homes selling for over list price are commonplace. The move-up and upper-bracket segments are less competitive and better supplied.

April 2019 by the Numbers (compared to a year ago)

Sellers listed 7,679 properties on the market, a 4.5 percent increase from last April

Buyers closed on 4,384 homes, a 6.9 percent decrease

Inventory levels for April declined 1.2 percent compared to 2018 to 9,667 units

Months Supply of Inventory was flat at 2.0 months

The Median Sales Price rose 5.2 percent to $281,000, a record high for any month

Cumulative Days on Market rose 5.7 percent to 56 days, on average (median of 21)

Changes in Sales activity varied by market segment

Single family sales declined 7.1 percent; condo sales rose 9.1 percent; townhome sales fell 9.1 percent

Traditional sales decreased 5.2 percent; foreclosure sales declined 30.3 percent; short sales fell 38.9 percent

Previously-owned sales were down 8.9 percent; new construction sales surged 20.3 percent

Quotables

“Things still seem to be rebalancing a bit,” said Todd Urbanski, President of Minneapolis Area REALTORS®. “Low and stable rates have definitely helped, and so has the ongoing economic expansion.”

“We’re doing better here than many other parts of the country,” said Linda Rogers, President-Elect of Minneapolis Area REALTORS®. “It’s important for buyers and sellers to understand local dynamics, not national headlines.”

All information is according to the Minneapolis Area REALTORS® based on data from NorthstarMLS. Minneapolis Area REALTORS® is the leading regional advocate and provider of information services and research on the real estate industry for brokers, real estate professionals and the public. We serve the Twin Cities 16-county metro area and western Wisconsin.

Existing Home Sales

April Monthly Skinny Video

“Buyers are beginning to return in force this Spring. For well-priced homes in desirable locations, competition is fierce.”

New Listings and Pending Sales

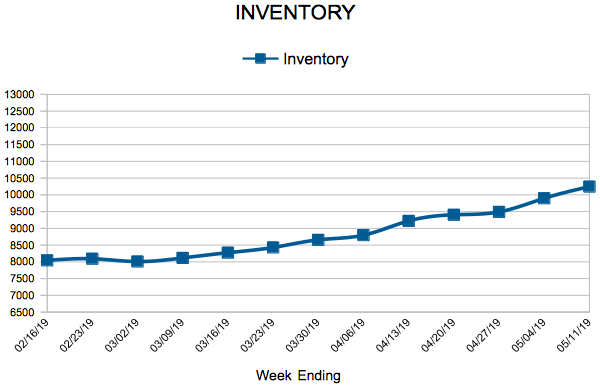

Inventory

Weekly Market Report

For Week Ending May 11, 2019

There is no such thing as a national real estate market. When the median sales price of homes for sale in San Francisco ($1.6 million) are compared to the median annual household income in Youngstown, Ohio ($26,295), it is especially evident. National news outlets will report on housing stories as though one size fits all, but this is particularly untrue in 2019 – not only in terms of home pricing compared to income, but with trends in new listings and pending sales.

In the Twin Cities region, for the week ending May 11:

- New Listings decreased 1.7% to 2,044

- Pending Sales decreased .1% to 1,531

- Inventory increased 1.5% to 10,245

For the month of April:

- Median Sales Price increased 5.2% to $281,000

- Days on Market increased 5.7% to 56

- Percent of Original List Price Received decreased 0.5% to 99.4%

- Months Supply of Homes For Sale increased 5.0% to 2.1

All comparisons are to 2018

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

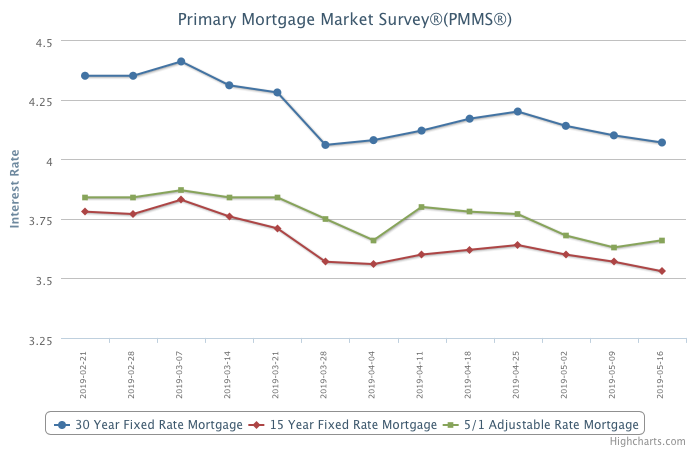

Mortgage Rates Hold Steady Amid Global Trade Disputes

May 16, 2019

Modestly weaker consumer spending and manufacturing data, along with continued jitters around trade policy, caused interest rates to decline throughout the yield curve. While signals from the financial markets are flashing caution signs, the real economy remains on solid ground with steady job growth and five-decade low unemployment rates, which will drive up home sales this summer.

Information provided by Freddie Mac.

- « Previous Page

- 1

- …

- 64

- 65

- 66

- 67

- 68

- …

- 153

- Next Page »