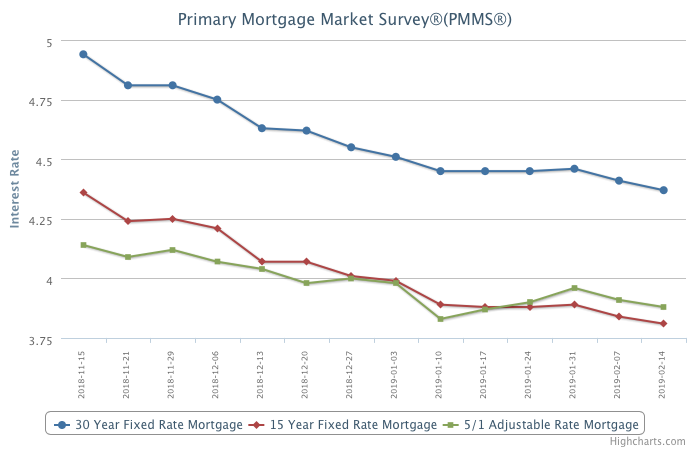

February 14, 2019

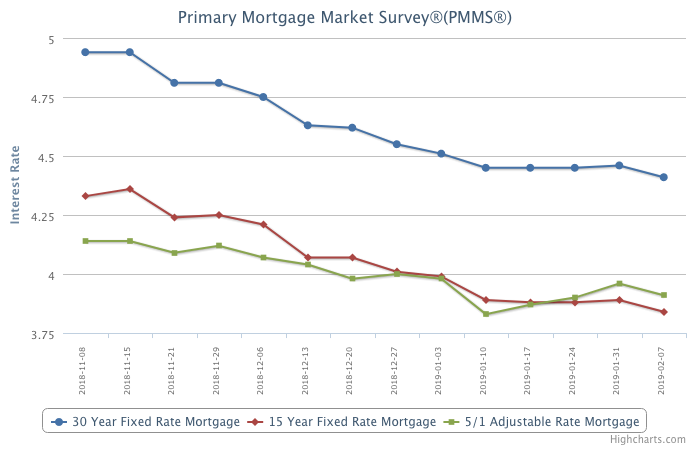

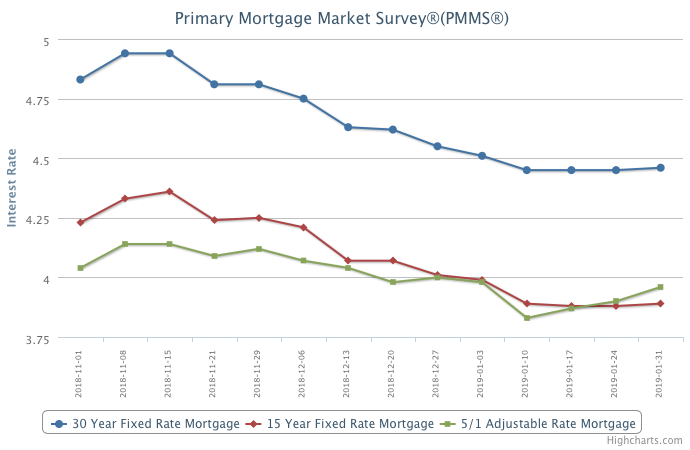

The combination of cooling inflation and slower global economic growth led mortgage rates to drift down to the lowest levels in a year. While housing activity has clearly softened over the last nine months and the lingering effects of higher rates from last year are still being felt, lower mortgage rates and a strong job market should rekindle demand for the spring homebuying season.

Information provided by Freddie Mac.