Inventory

Weekly Market Report

For Week Ending January 5, 2019

The turn of a calendar year often creates a desire to resolve to do something different. Weight loss through a combination of regular exercise and healthy eating is often at the top of the list, followed by learning a new skill, quitting smoking, reading more, spending more time with loved ones, getting more organized, traveling and saving money. Annual evidence indicates that a bump in listing and buying activity also occurs each January, which appears to be the case again in 2019 for much of the country.

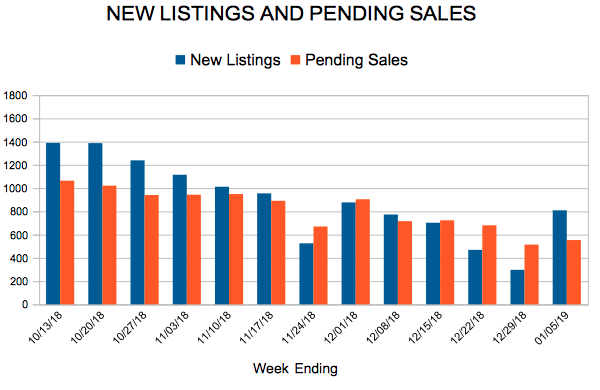

In the Twin Cities region, for the week ending January 5:

- New Listings decreased 4.9% to 809

- Pending Sales increased 0.7% to 553

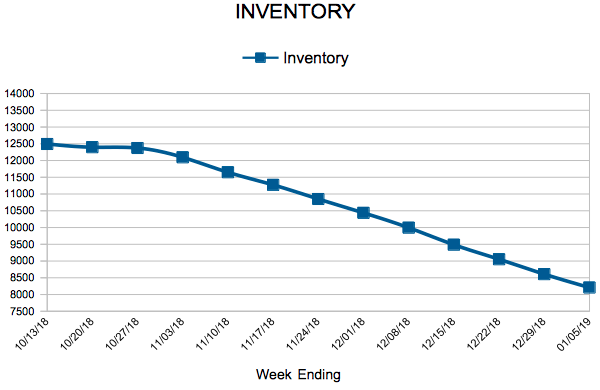

- Inventory increased 6.0% to 8,209

For the month of November:

- Median Sales Price increased 8.2% to $265,000

- Days on Market decreased 7.1% to 52

- Percent of Original List Price Received decreased 0.1% to 97.3%

- Months Supply of Inventory increased 10.5% to 2.1

All comparisons are to 2018

Click here for the full Weekly Market Activity Report. From The Skinny Blog.

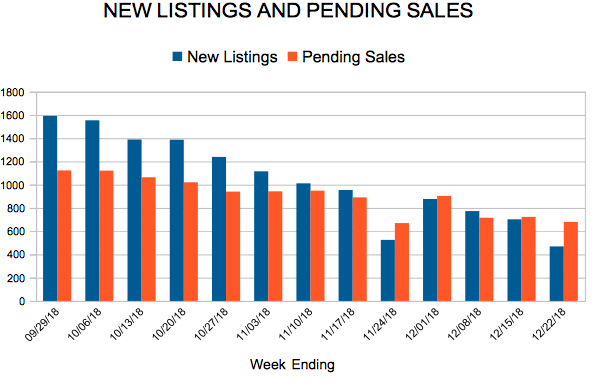

New Listings and Pending Sales

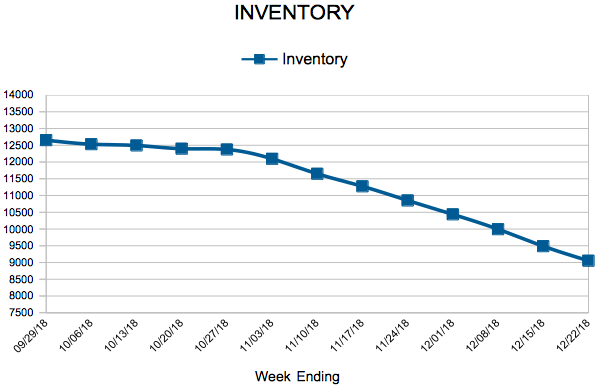

Inventory

Weekly Market Report

For Week Ending December 29, 2018

Although the 2018 U.S. stock market had its worst losses in a decade, employers added 2.64 million jobs in 2018 – the best year since 2015 – as well as 312,000 jobs during December. In addition, average hourly earnings increased 3.2 percent, matching the October 2018 percentage that marked a nearly ten-year high. The unemployment rate rose to 3.9 percent from 3.7 percent but is still historically low. These combined events give the impression of an economy that remains ultimately optimistic but is also recalibrating.

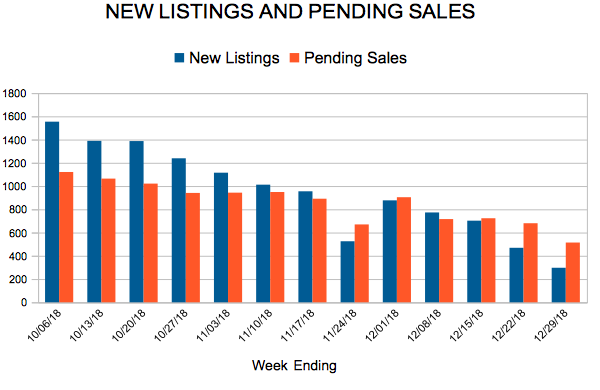

In the Twin Cities region, for the week ending December 29:

- New Listings increased 22.2% to 297

- Pending Sales increased 11.5% to 514

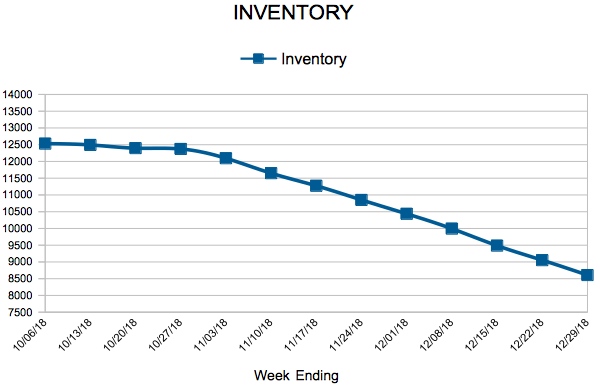

- Inventory increased 0.2% to 8,608

For the month of November:

- Median Sales Price increased 8.2% to $265,000

- Days on Market decreased 7.1% to 52

- Percent of Original List Price Received decreased 0.1% to 97.3%

- Months Supply of Inventory increased 10.5% to 2.1

All comparisons are to 2017

Click here for the full Weekly Market Activity Report. From The Skinny Blog.

New Listings and Pending Sales

Inventory

Weekly Market Report

For Week Ending December 22, 2018

The last few weeks of the year provide an opportunity for buyers, sellers and real estate practitioners alike to spend time with the family and friends that make owning a home that much more special. It also provides a time to plan for the potential for marginal increases in average household wages, median sales prices for homes, mortgage rates and total available homes for sale in 2019.

In the Twin Cities region, for the week ending December 22:

- New Listings increased 11.1% to 469

- Pending Sales decreased 7.4% to 680

- Inventory increased at 9,053

For the month of November:

- Median Sales Price increased 8.2% to $265,000

- Days on Market decreased 7.1% to 52

- Percent of Original List Price Received decreased 0.1% to 97.3%

- Months Supply of Inventory increased 10.5% to 2.1

All comparisons are to 2017

Click here for the full Weekly Market Activity Report. From The Skinny Blog.

November Monthly Skinny Video

“Housing is still relatively affordable.”

www.mplsrealtor.com

- « Previous Page

- 1

- …

- 73

- 74

- 75

- 76

- 77

- …

- 153

- Next Page »