For Week Ending December 1, 2018

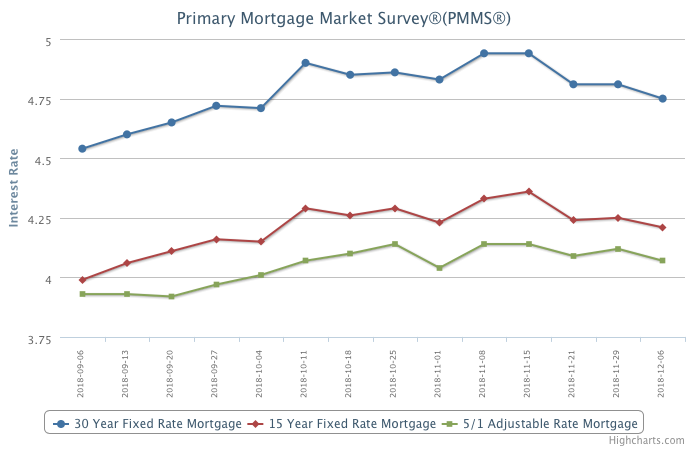

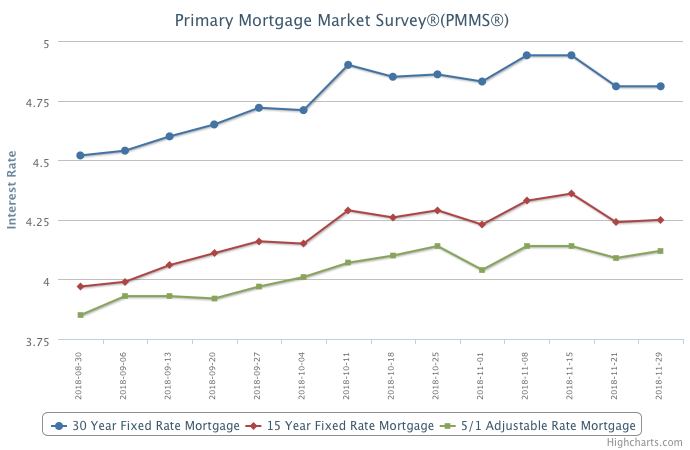

While recent stock market activity has displayed some heart-pounding drops and rallying rises, that volatility has not created the same tidal waves within residential real estate. Increasing home prices and mortgage rates have indeed created a sense of immediacy for some buyers and turned others away due to affordability concerns, but these decisions appear to be rooted in longer-term trends rather than the effects of a media headline or presidential tweet.

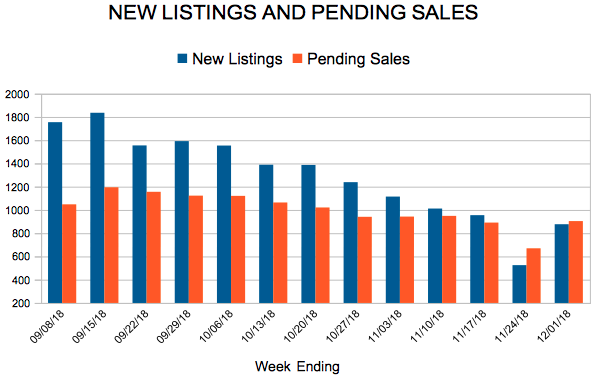

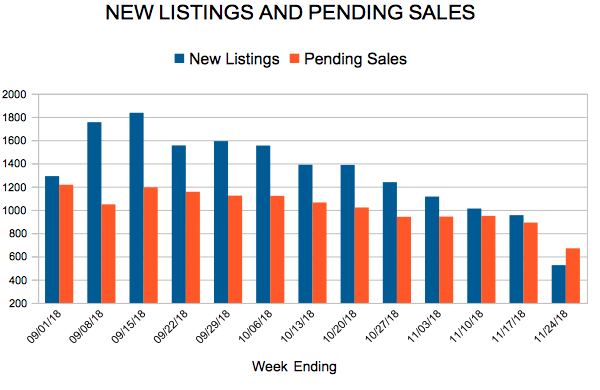

In the Twin Cities region, for the week ending December 1:

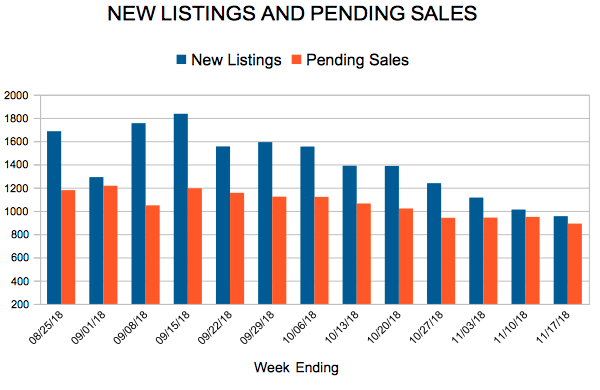

- New Listings increased 7.0% to 877

- Pending Sales decreased 9.0% to 904

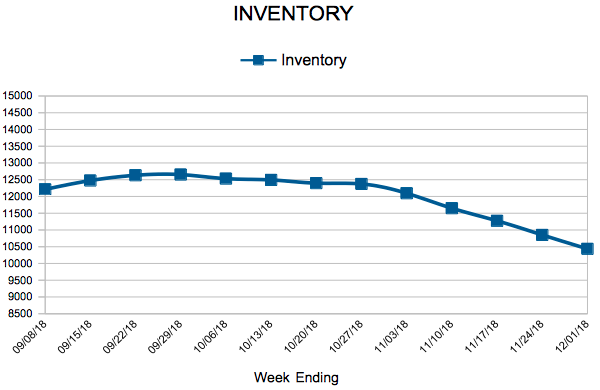

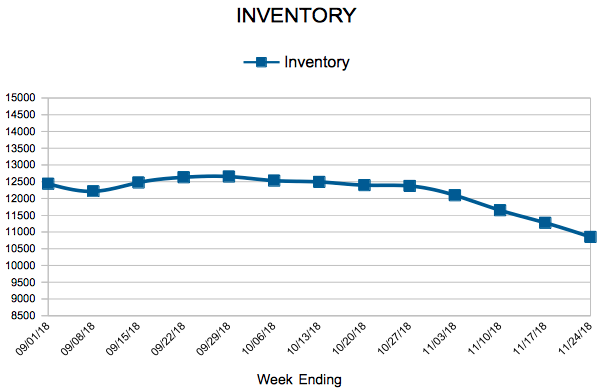

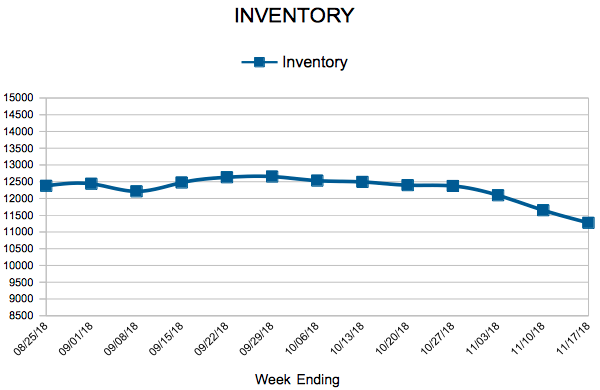

- Inventory increased 1.5% to 10,437

For the month of October:

- Median Sales Price increased 8.6% to $265,000

- Days on Market decreased 7.7% to 48

- Percent of Original List Price Received increased 0.2% to 97.9%

- Months Supply of Inventory remained flat at 2.4

All comparisons are to 2017

Click here for the full Weekly Market Activity Report. From The Skinny Blog.