Weekly Market Report

For Week Ending November 3, 2018

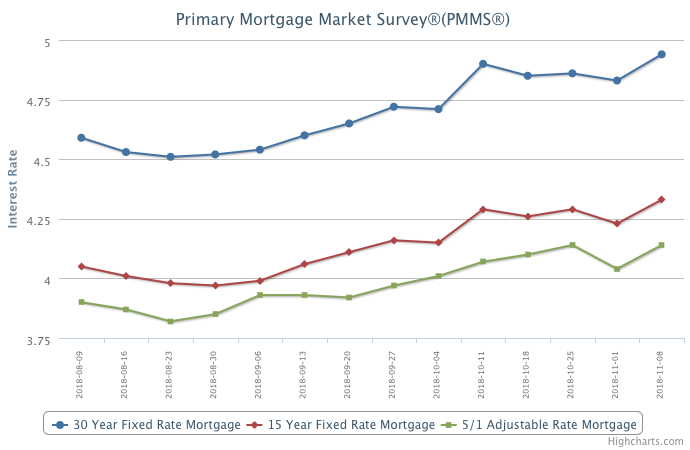

According to Freddie Mac, the 30-year fixed rate is at its highest average in seven years, reaching 4.94 percent. Last year at this time, the average rate was 3.90 percent. The higher rates are causing a slowdown in home price growth in some markets, but not all markets yet. Keeping a positive perspective, average rates were 5.97 percent ten years ago at this time, 6.78 percent 20 years ago and 10.39 percent 30 years ago. For maximum comparative impact, consider the 17.21 percent average rate of November 1981.

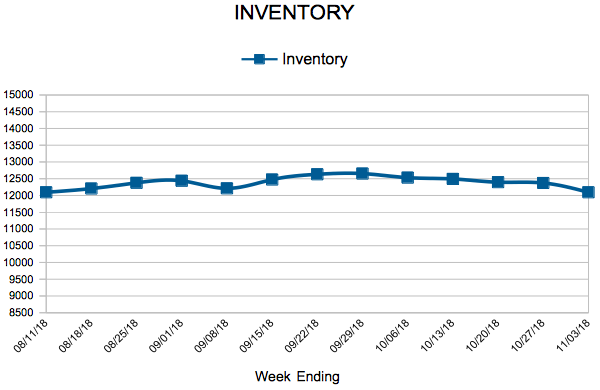

In the Twin Cities region, for the week ending November 3:

- New Listings increased 9.7% to 1,115

- Pending Sales decreased 16.5% to 943

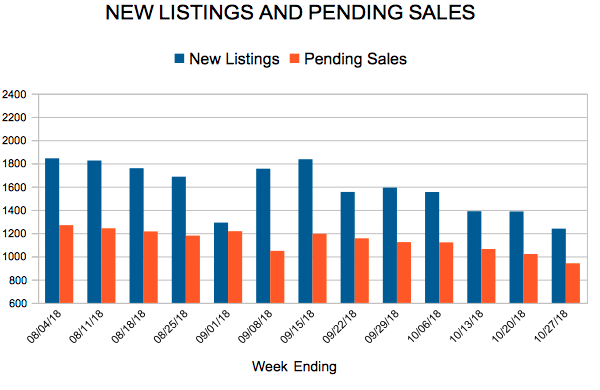

- Inventory decreased 1.1% to 12,095

For the month of September:

- Median Sales Price increased 6.1% to $262,000

- Days on Market decreased 16.0% to 42

- Percent of Original List Price Received increased 0.3% to 98.4%

- Months Supply of Inventory remained flat at 2.6

All comparisons are to 2017

Click here for the full Weekly Market Activity Report. From The Skinny Blog.

Mortgage Rates Hit Seven-Year High

November 8, 2018

The economy continued to show resilience as strong business activity and growth in employment drove the 30-year fixed mortgage rate to a seven year high of 4.94 percent – up 11 basis points from last week.

Higher mortgage rates have led to a slowdown in national home price growth, but the price deceleration has been primarily concentrated in affluent coastal markets such as California and the state of Washington. The more affordable interior markets – which have not yet experienced a slowdown home price growth – may see price growth start to moderate and affordability squeezed if mortgage rates continue to march higher.

Information provided by Freddie Mac.

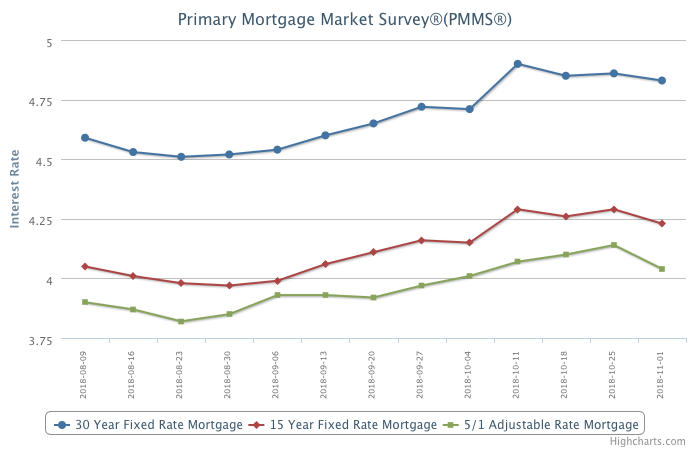

Mortgage Rates Fall Back

November 1, 2018

While higher mortgage rates have led to a decline in home sales this year, the weakness has been concentrated in expensive segments versus entry-level and first-time buyer which remains firm throughout most of the rest of the country. Despite higher mortgage rates, the monthly mortgage payment remains affordable. For many buyers the chronic lack of entry-level supply is a larger hurdle than higher mortgage rates because choices are limited and the inventory shortage has caused home prices to rise well above fundamentals.

Information provided by Freddie Mac.

New Listings and Pending Sales

Inventory

Weekly Market Report

For Week Ending October 27, 2018

Real estate professionals from around the globe recently gathered in Boston to network, teach, learn and share at the National Association of REALTORS® Conference and Expo. It is an annual tradition that has been going strong since 1908. An organized real estate industry is a healthy one that can have a positive effect on real estate transactions and beyond. The relative market balance being experienced across the nation can’t entirely be attributed to REALTOR® cooperation, but it certainly doesn’t hurt.

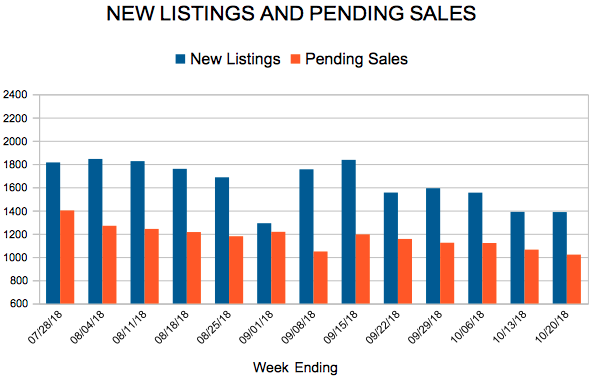

In the Twin Cities region, for the week ending October 27:

- New Listings increased 15.0% to 1,239

- Pending Sales decreased 9.1% to 941

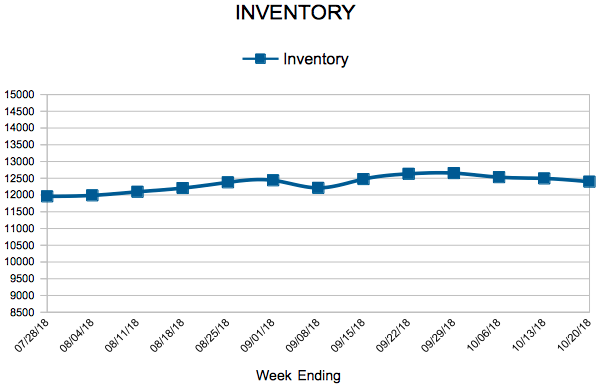

- Inventory decreased 1.4% to 12,374

For the month of September:

- Median Sales Price increased 6.1% to $262,000

- Days on Market decreased 16.0% to 42

- Percent of Original List Price Received increased 0.3% to 98.4%

- Months Supply of Inventory remained flat at 2.6

All comparisons are to 2017

Click here for the full Weekly Market Activity Report. From The Skinny Blog.

New Listings and Pending Sales

Inventory

Weekly Market Report

For Week Ending October 20, 2018

In general, the country is experiencing a balanced real estate market in one form or another, depending on geographic location. While it is true that median sales prices are relatively high in terms of housing affordability for the standard household wage, metrics such as new listings, pending sales and inventory are all fairly level with year-ago levels in much of the nation. At a time of stock market volatility, political uncertainty and rising interest rates, this is very welcome news.

In the Twin Cities region, for the week ending October 20:

- New Listings increased 4.3% to 1,387

- Pending Sales decreased 5.6% to 1,021

- Inventory decreased 2.3% to 12,397

For the month of September:

- Median Sales Price increased 6.1% to $262,000

- Days on Market decreased 16.0% to 42

- Percent of Original List Price Received increased 0.3% to 98.4%

- Months Supply of Inventory remained flat at 2.6

All comparisons are to 2017

Click here for the full Weekly Market Activity Report. From The Skinny Blog.

- « Previous Page

- 1

- …

- 77

- 78

- 79

- 80

- 81

- …

- 153

- Next Page »