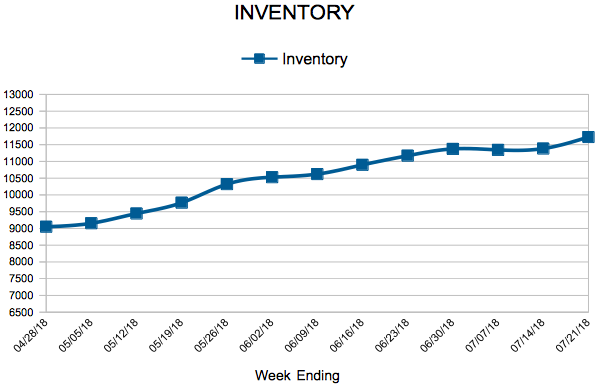

Inventory

Weekly Market Report

For Week Ending August 4, 2018

Competitive buyers vying for a somewhat limited number of homes for sale have helped prices continue to climb, frequently over the asking price. The latest recorded national unemployment rate of 3.9 percent is historically low and has served as a general indicator of a strong economy. To give a better idea of how good the unemployment situation is right now, we were looking at a historically low rate of 4.3 percent last year at this time.

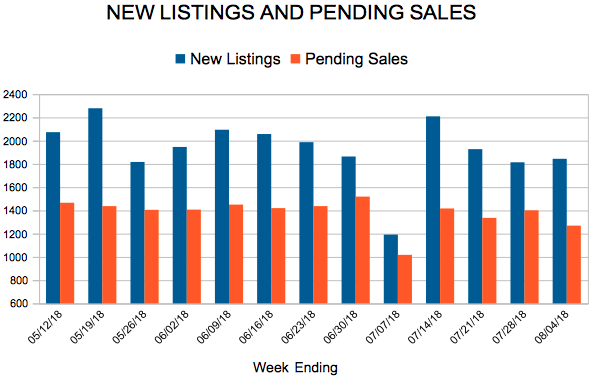

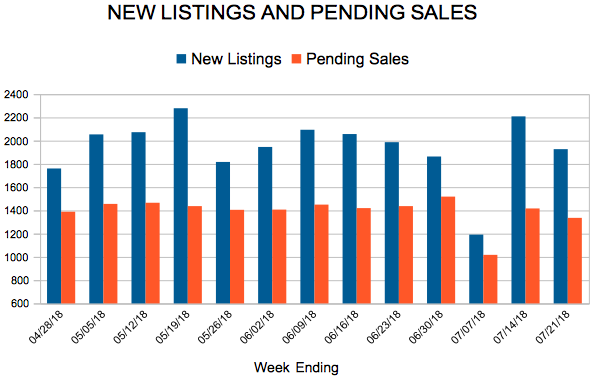

In the Twin Cities region, for the week ending August 4:

- New Listings increased 1.8% to 1,844

- Pending Sales decreased 10.7% to 1,269

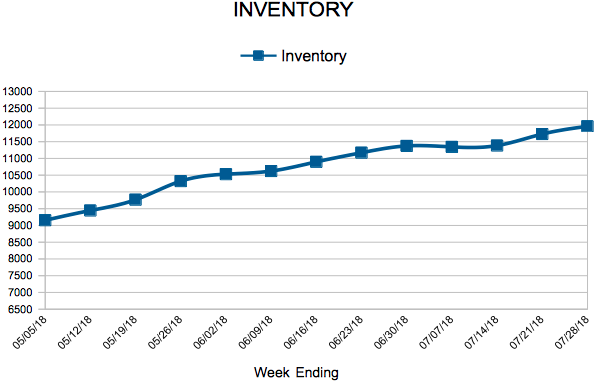

- Inventory decreased 11.4% to 11,989

For the month of June:

- Median Sales Price increased 5.3% to $271,000

- Days on Market decreased 16.7% to 40

- Percent of Original List Price Received increased 0.8% to 100.3%

- Months Supply of Inventory decreased 11.1% to 2.4

All comparisons are to 2017

Click here for the full Weekly Market Activity Report. From The Skinny Blog.

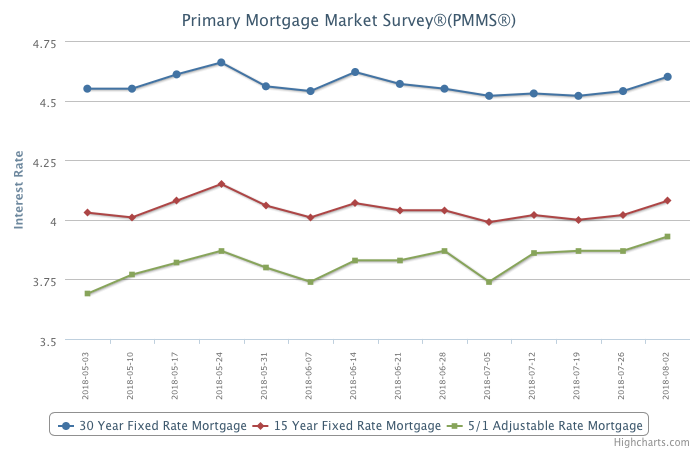

Mortgage Rates Inch Backward

Mortgage rates have mostly drifted sideways this summer. This stability is much needed for home sales, which have crested because of the multi-year run up in prices, tight affordable inventory and this year’s higher rates. Going forward, the strong economy will support the housing market, but with affordability pressures mounting, further spikes in mortgage rates will lead to continued softening in home price growth.

New Listings and Pending Sales

Inventory

Weekly Market Report

For Week Ending July 28, 2018

The U.S. Labor Department reported that the economy added 157,000 jobs in July, marking 93 months in a row of job additions. Beginning in October 2010, that is the longest streak of monthly employment growth on record. The unemployment rate dropped to a historically low 3.9 percent, and wage growth remained at an annual rate of 2.7 percent. Meanwhile, escalating tariff conflicts with U.S. trade partners have not yet impacted the day-to-day housing market, but builders have indicated that lumber tariffs are increasing prices for new homes.

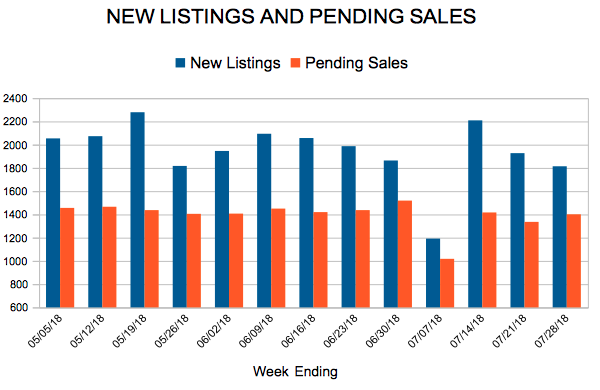

In the Twin Cities region, for the week ending July 28:

- New Listings increased 6.1% to 1,814

- Pending Sales increased 2.0% to 1,401

- Inventory decreased 12.5% to 11,959

For the month of June:

- Median Sales Price increased 5.3% to $271,000

- Days on Market decreased 16.7% to 40

- Percent of Original List Price Received increased 0.8% to 100.3%

- Months Supply of Inventory decreased 11.1% to 2.4

All comparisons are to 2017

Click here for the full Weekly Market Activity Report. From The Skinny Blog.

Mortgage Rates on the Upswing

The 30-year fixed-rate mortgage drifted up for the second consecutive week to 4.60 percent.

The higher rate environment, coupled with the ongoing lack of affordable inventory, has led to a drag on existing-home sales in the last few months. Yesterday, the Federal Reserve passed on raising short-term rates, but with the embers of a strong economy potentially stoking higher inflation, borrowing costs will likely modestly rise in coming months.

Even with home price growth easing slightly in some markets, mortgage rates hovering near a seven-year high will certainly create affordability challenges for some prospective buyers looking to close.

New Listings and Pending Sales

Inventory

- « Previous Page

- 1

- …

- 83

- 84

- 85

- 86

- 87

- …

- 153

- Next Page »