Weekly Market Report

For Week Ending July 7, 2018

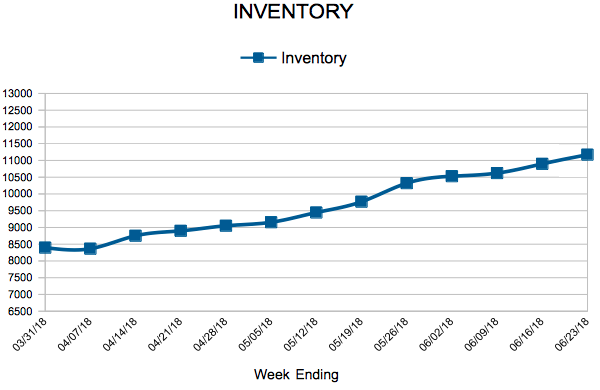

As prices persistently rise and months of supply decrease in year-over-year comparisons, it continues to be an ideal time for more sellers to enter the market. Across the U.S., inventory levels are still lagging behind last year, but new listings have perked up nicely so far this year. This has been coupled with many announced new home-building projects across the nation and a more positive tone from the building community.

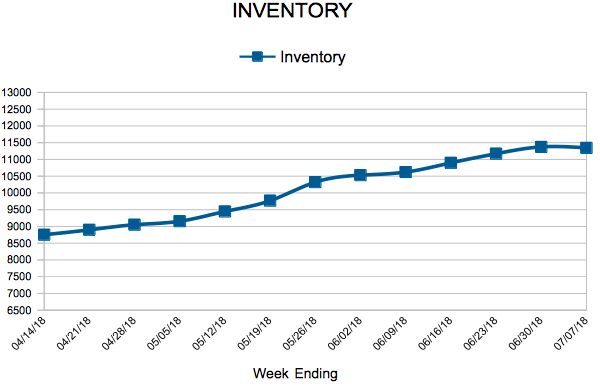

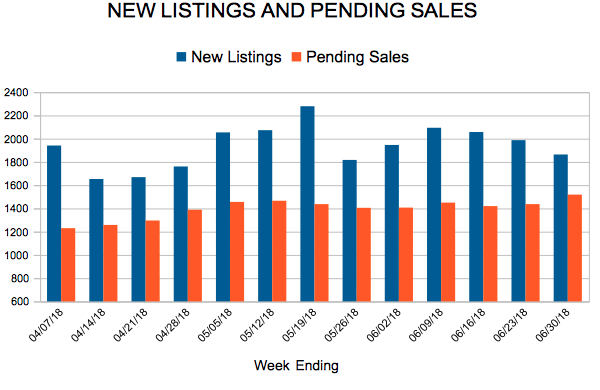

In the Twin Cities region, for the week ending July 7:

- New Listings decreased 14.6% to 1,192

- Pending Sales decreased 10.6% to 1,018

- Inventory decreased 14.6% to 11,344

For the month of June:

- Median Sales Price increased 5.3% to $271,000

- Days on Market decreased 16.7% to 40

- Percent of Original List Price Received increased 0.8% to 100.3%

- Months Supply of Inventory decreased 14.8% to 2.3

All comparisons are to 2017

Click here for the full Weekly Market Activity Report. From The Skinny Blog.

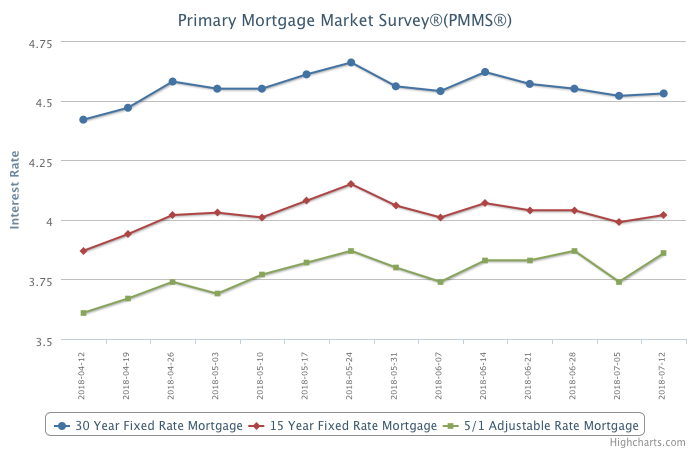

Mortgage Rates Inch Higher

Mortgage rates were mostly unchanged, but did tick up for the first time since early June.

The 10-year Treasury yield continues to hover along the same narrow range, as increased global trade tensions are causing investors to take a cautious approach. This in turn has kept borrowing costs at bay, which is certainly welcoming news for those looking to buy a home before the summer ends.

New Listings and Pending Sales

Inventory

Weekly Market Report

For Week Ending June 30, 2018

The unemployment rate rose to 4.0 percent in June 2018, marking the first increase in nearly a year. Economic forecasters are calling this a healthy increase indicative of more people being counted as entering the work force in an exceptional job market that added more than 213,000 paying jobs in June. Strong demand for workers combined with low supply creates upward pressure on wages. Employed people with higher wages are generally good for residential real estate.

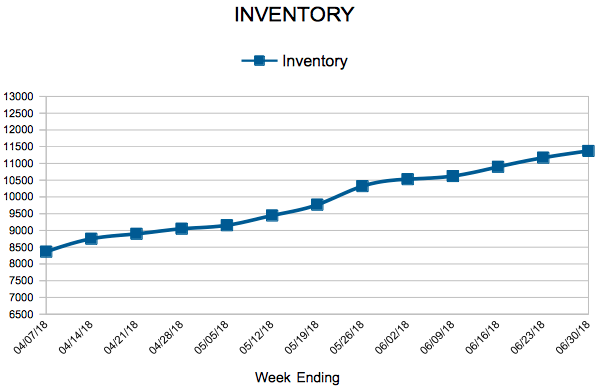

In the Twin Cities region, for the week ending June 30:

- New Listings increased 15.1% to 1,864

- Pending Sales increased 1.1% to 1,519

- Inventory decreased 16.5% to 11,374

For the month of May:

- Median Sales Price increased 8.3% to $270,750

- Days on Market decreased 9.6% to 47

- Percent of Original List Price Received increased 0.7% to 100.2%

- Months Supply of Inventory decreased 12.0% to 2.2

All comparisons are to 2017

Click here for the full Weekly Market Activity Report. From The Skinny Blog.

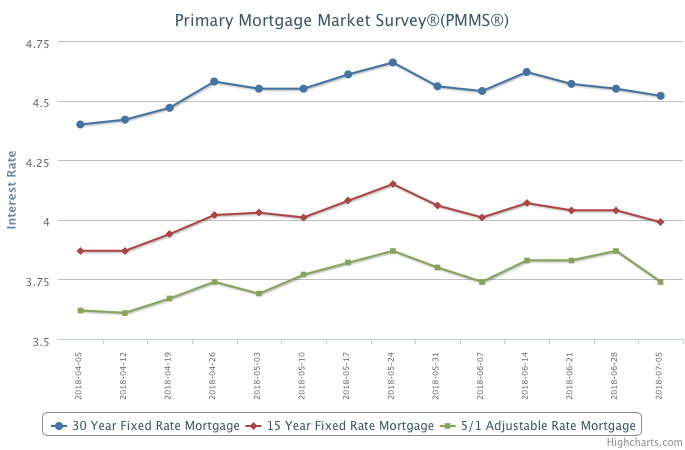

Mortgage Rates Continue Recent Decline

After a rapid increase throughout most of the spring, mortgage rates have now declined in five of the past six weeks.

The run-up in mortgage rates earlier this year represented not just a rise in risk-free borrowing costs, but for investors, the mortgage spread also rose back to more normal levels by about 20 basis points. What that means for buyers is good news. Mortgage rates may have a little more room to decline over the very short term.

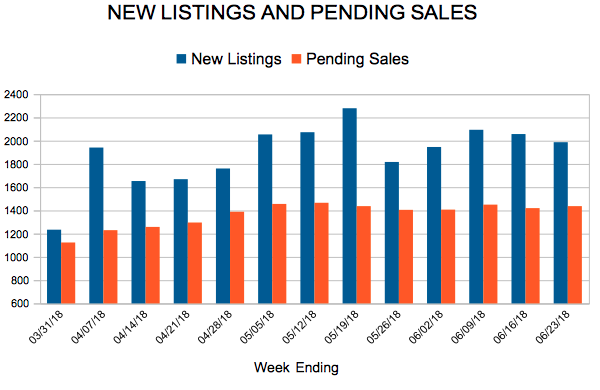

New Listings and Pending Sales

Inventory

Weekly Market Report

For Week Ending June 23, 2018

The first half of the year in residential real estate fared as expected, with the most obvious markers continuing to be low inventory and higher prices. We are also seeing decreased affordability in many markets coupled with more urgency (lower days on market) and increased purchase offers (higher pending sales) ahead of perceived future rate increases that have not yet materialized in the wake of the 0.25 percent increase in the federal funds rate. All of this makes for a busy summer. Let’s examine the local market.

In the Twin Cities region, for the week ending June 23:

- New Listings increased 1.3% to 1,987

- Pending Sales decreased 3.7% to 1,437

- Inventory decreased 16.8% to 11,171

For the month of May:

- Median Sales Price increased 8.4% to $271,000

- Days on Market decreased 9.6% to 47

- Percent of Original List Price Received increased 0.7% to 100.2%

- Months Supply of Inventory decreased 12.0% to 2.2

All comparisons are to 2017

Click here for the full Weekly Market Activity Report. From The Skinny Blog.

- « Previous Page

- 1

- …

- 85

- 86

- 87

- 88

- 89

- …

- 153

- Next Page »