For Week Ending June 9, 2018

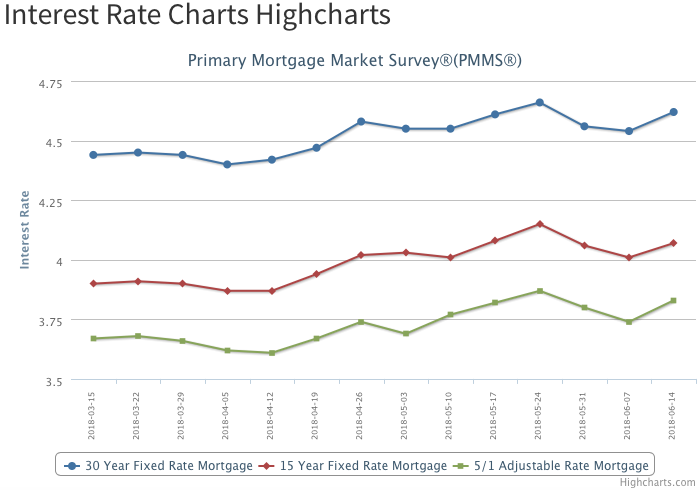

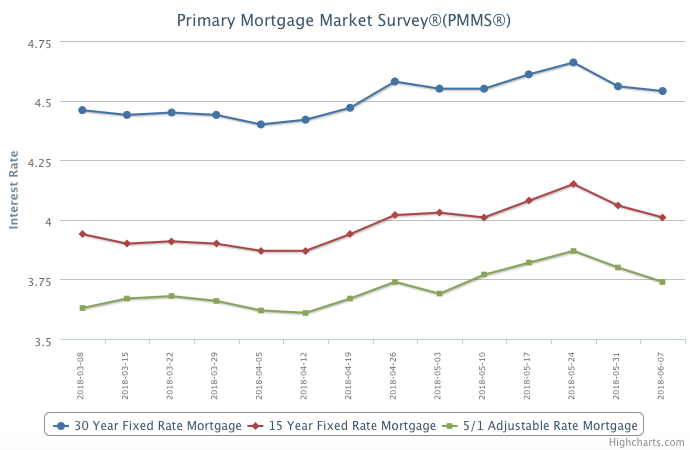

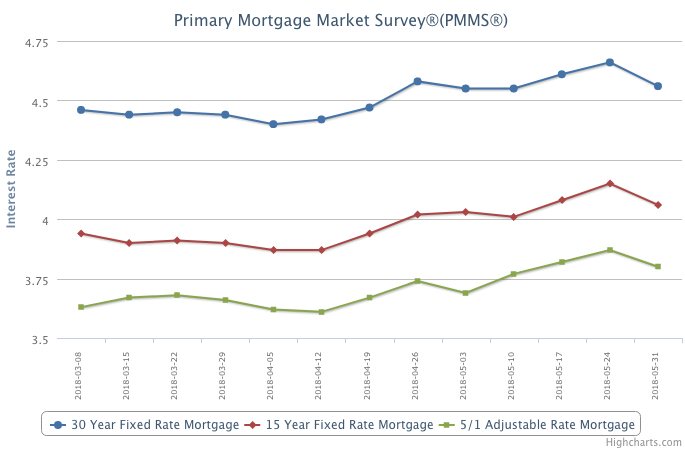

The Federal Reserve recently increased the federal funds rate by 0.25 percent, marking the second rate hike this year and seventh since late 2015. Two more 0.25 percent increases are expected by the end of the year. The 30-year mortgage rate did not increase, yet Fed action can have an indirect effect on the housing market. Buyers often react by trying to lock in at the current rate ahead of assumed future higher rates. Educating consumers that the Fed rate and mortgage rates are not the same can help curb panic buying.

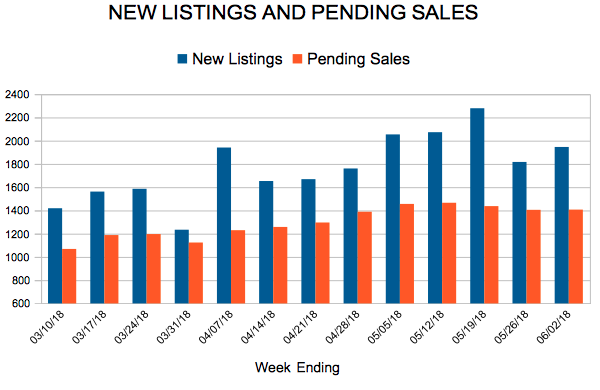

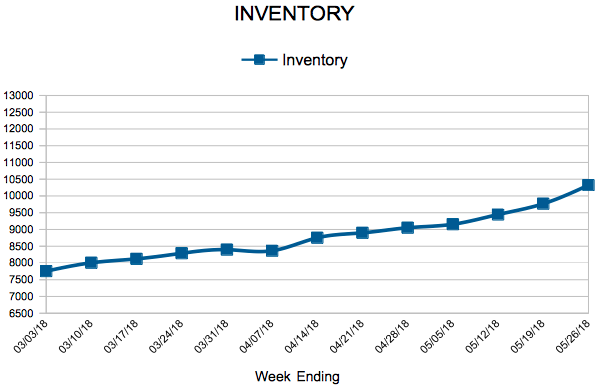

In the Twin Cities region, for the week ending June 9:

- New Listings decreased 2.7% to 2,094

- Pending Sales decreased 4.1% to 1,450

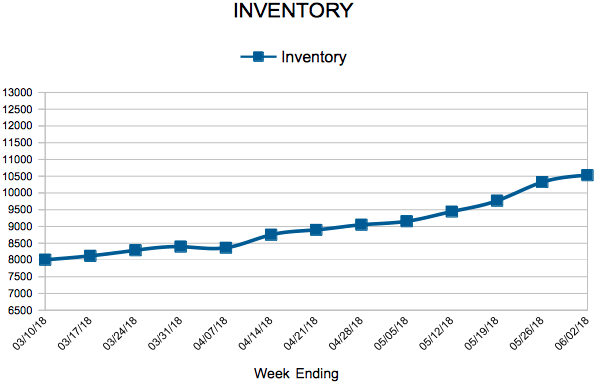

- Inventory decreased 18.5% to 10,623

For the month of May:

- Median Sales Price increased 8.4% to $271,000

- Days on Market decreased 9.6% to 47

- Percent of Original List Price Received increased 0.7% to 100.2%

- Months Supply of Inventory decreased 12.0% to 2.2

All comparisons are to 2017

Click here for the full Weekly Market Activity Report. From The Skinny Blog.