Weekly Market Report

For Week Ending October 12, 2024

For Week Ending October 12, 2024

According to the Mortgage Bankers Association, the median mortgage application payment was $2,057 in August, down from $2,140 in July, marking the fourth consecutive month affordability conditions improved. Mortgage rates are down significantly from their peak of 7.79% last October, which should help bring additional buyers to the market in the months ahead.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING OCTOBER 12:

- New Listings increased 12.5% to 1,368

- Pending Sales increased 7.3% to 865

- Inventory increased 10.8% to 10,244

FOR THE MONTH OF SEPTEMBER:

- Median Sales Price increased 2.4% to $379,950

- Days on Market increased 14.7% to 39

- Percent of Original List Price Received decreased 0.8% to 98.5%

- Months Supply of Homes For Sale increased 12.0% to 2.8

All comparisons are to 2023

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

September Housing Market Update

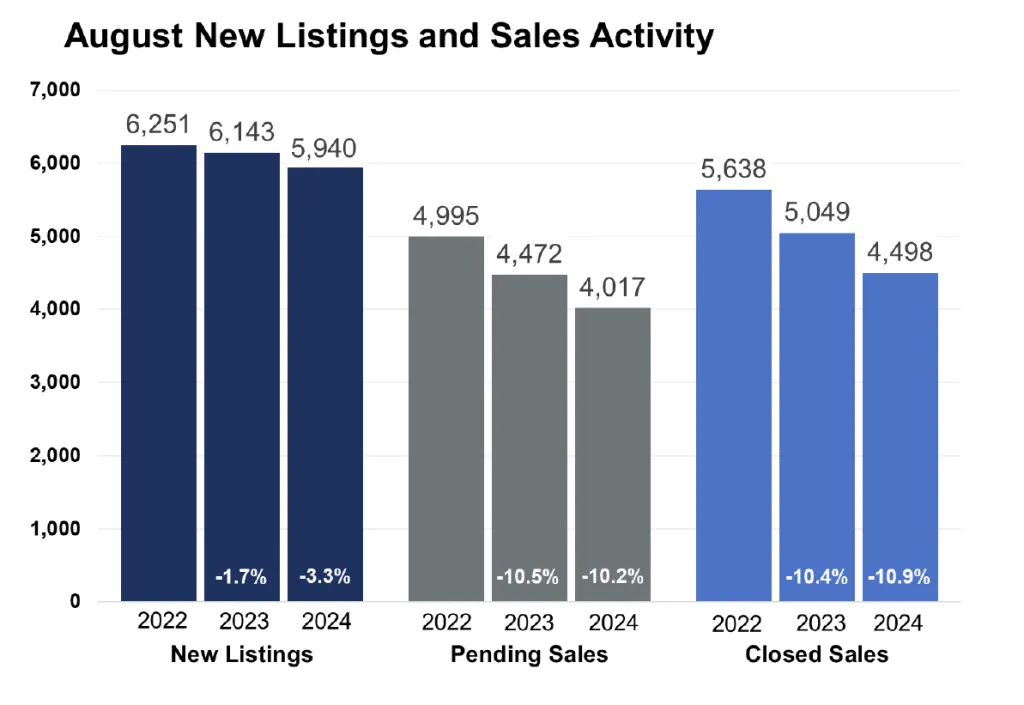

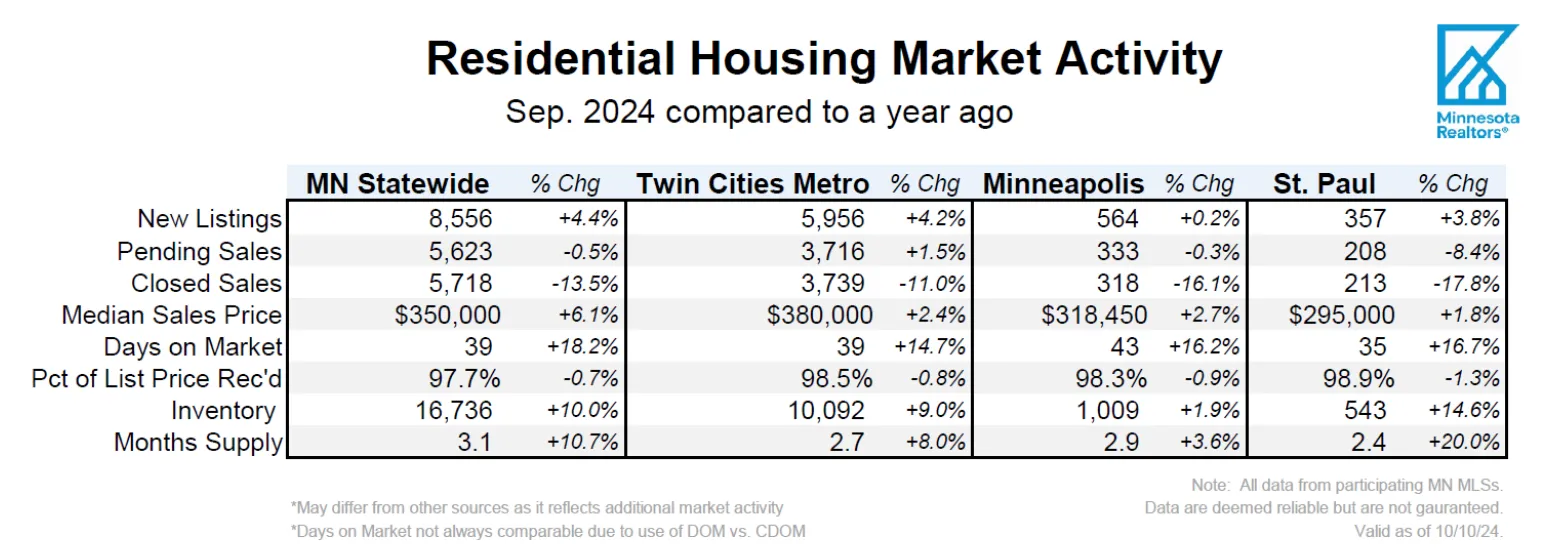

- Statewide, signed purchase agreements were down 0.5% and new listings were up 4.4%

- The median sales price increased 6.1% to $350,000

- Market times rose 18.2% to 39 days and inventory was up 10.0% to 16,736

(Oct. 15, 2024) – According to new data from the Minnesota state and Twin Cities metro REALTOR® Associations, listings rose compared to last year while sales were flat. Inventory and prices are both up.

Sellers, Buyers and Housing Supply

It’s no secret that buyers have been facing a triple punch lately: higher prices, higher mortgage rates and tight inventory. That’s shown up in slower sales activity, lower affordability and slim pickings when it comes to the number of homes for sale on the market. In fact, statewide, sales hit their lowest level since 2011, but now signed purchase agreements are rising. Sellers are caught in between—either they stay put in a home they might have outgrown or trade up to a higher price, higher mortgage rate and higher monthly payment. But there’s evidence that’s changing.

For example, the state and metro saw 4.4% and 4.2% more new listings, respectively, when compared to September 2023. For sales, statewide activity was relatively flat (down 0.5%) while metro-area activity rose a modest 1.5%. The fact that listing activity has been stronger than sales means inventory levels are up—most recently rising an even 10%. But we’re still in a sellers’ market. Lower inflation, stronger-than-expected hiring and the Federal Reserve’s mid-September rate cut are all reassuring signs for home buyers. That’s not to say there are no concerns about housing or the economy. For now, however, this marginally better confidence is helping to stabilize home sales and slightly improve affordability.

When it comes to mortgage rates, be careful what you wish for. Rates back below 5% could mean recession. The fact that so many homeowners enjoy rates below 4% creates the “lock-in effect” where would-be sellers choose to stay put instead of trading up to a higher price and higher rate. “There is still plenty of pent-up activity both buyers and sellers—who are being patient,” according to Geri Theis, President of Minnesota Realtors®. “That sounds like a good idea until you realize everyone else is waiting for the same thing. And as rates come down, some may find themselves in another competitive environment where listings are selling for over asking price,” she added.

Prices, Market Times and Negotiations

All situations and transactions are unique. First-time buyers without equity have an uphill battle while move-up buyers with equity from their first home are able to roll that into the next property. The more affordable price points have seen the largest declines in demand as those buyers are more rate sensitive. Luxury market activity continues to outperform as those buyers are less rate sensitive. Sales at or above $1M have risen 16.8% over the last 12 months, more than any other price point. Those relocating here with equity from higher-priced coastal markets should face fewer headwinds. And each market segment is unique as well. Some listings are still getting multiple offers and selling for over list price. Overall, however, sellers accepted offers at 97.7% of list price statewide and 98.5% in the metro. Both figures were down from last year. And those offers came in after an average of 39 days on market both statewide and in the metro—both figures up from a year ago. “There are significant differences from price point to price point and area to area,” said Jamar Hardy, President of Minneapolis Area REALTORS®. “Buyers were excited as rates hit the low sixes even though they’ve trickled higher since, and I believe we’ll see a real boost if and when we go below 6%.”

The state’s median home price was up 6.1% to $350,000; the metro median price was up 2.4% to $380,000. Since 2021, the typical mortgage payment on the median-priced Twin Cities home has risen from around $1,750 to $2,750 per month. Most economists agree that the path for rates should be lower, but it will be bumpy on the way down. What’s also true is that incomes are and have been rising faster than home prices. That should give households a chance for earnings to catch up to home prices. In the meantime, more supply will mean less competition and more choices, which should translate into better affordability and more manageable price growth. “I have buyers who are pleased to see more options to choose from,” said Amy Peterson, President of the Saint Paul Area Association of REALTORS®. “But for the most part sellers still hold the reigns even with the extra inventory we’ve seen.”

Location Differences | Minnesota Statewide

Market activity always varies by area, price point and property type. Regions such as Hibbing/Virginia and Bemidji saw the largest gains in new listings. Bemidji also saw the largest gain in pending sales and now has 6.2 months of supply—the most of any region. St. Cloud and Grand Rapids also had notable increases in sales. Homes sold the fastest in the Duluth/North Shore region along with St. Cloud and the core Twin Cities. Prices were highest in the metro followed by Detroit Lakes, Alexandria and Brainerd. The most affordable regions of the state are Hibbing/Virginia, Bemidji and Willmar.

Location Differences | Twin Cities Metro

For cities with at least five sales, Deephaven, Maple Plain and Mayer had the largest sales gains. The highest priced areas were Deephaven, Wayzata, Orono and Medina while the most affordable areas were Hutchinson, Norwood Young America and Robbinsdale. But the areas with the largest increases in sales price were Deephaven, Orono and Little Canada. The most oversupplied markets were Centerville, Hanover and Wayzata while the most undersupplied markets were Circle Pines, Crystal and New Hope. Homes took the longest to sell in Bayport, Annandale and Orono and sold the fastest in Corcoran, Arden Hills and Circle Pines.

From The Skinny Blog.

Weekly Market Report

For Week Ending October 5, 2024

For Week Ending October 5, 2024

According to the National Association of REALTORS® 2023 Profile of Home Buyers and Sellers, buyers moved a median distance of 20 miles to their new home last year, down from 50 miles the year before, and closer to the previous norm of 15 miles. Among those buyers surveyed, 60% said the quality of the neighborhood was the most important factor in deciding where to move, while proximity to friends and family and housing affordability came in at 45% and 39%, respectively.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING OCTOBER 5:

- New Listings increased 14.9% to 1,447

- Pending Sales increased 19.5% to 1,007

- Inventory increased 12.0% to 10,267

FOR THE MONTH OF AUGUST:

- Median Sales Price increased 2.2% to $388,500

- Days on Market increased 21.2% to 40

- Percent of Original List Price Received decreased 1.3% to 98.7%

- Months Supply of Homes For Sale increased 17.4% to 2.7

All comparisons are to 2023

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Weekly Market Report

For Week Ending September 28, 2024

For Week Ending September 28, 2024

The average rate on a 30-year fixed mortgage dropped to 6.08% the week ending September 26, 2024, the lowest level in two years, according to Freddie Mac. Rates have fallen one and a half percentage points over the past 12 months, and buying power has increased significantly as a result, with Realtor.com reporting the typical homebuyer could afford a home priced $74,000 higher than the October 2023 median sales price for the same monthly payment.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING SEPTEMBER 28:

- New Listings increased 11.5% to 1,337

- Pending Sales increased 4.4% to 935

- Inventory increased 12.3% to 10,293

FOR THE MONTH OF AUGUST:

- Median Sales Price increased 2.2% to $388,500

- Days on Market increased 21.2% to 40

- Percent of Original List Price Received decreased 1.3% to 98.7%

- Months Supply of Homes For Sale increased 17.4% to 2.7

All comparisons are to 2023

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Weekly Market Report

For Week Ending September 21, 2024

For Week Ending September 21, 2024

Nationally, inventory was up 35.8% year-over-year in August, according to Realtor.com’s latest Monthly Housing Market Trends Report, with active listings now at the highest level since May 2020. As the number of homes for sale continues to grow in many areas, some agents are reporting that list prices are softening, homes are spending more time on market, and price reductions are becoming more common compared to the same period last year.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING SEPTEMBER 21:

- New Listings increased 11.9% to 1,435

- Pending Sales decreased 1.5% to 879

- Inventory increased 11.4% to 10,180

FOR THE MONTH OF AUGUST:

- Median Sales Price increased 2.1% to $388,000

- Days on Market increased 21.2% to 40

- Percent of Original List Price Received decreased 1.3% to 98.7%

- Months Supply of Homes For Sale increased 17.4% to 2.7

All comparisons are to 2023

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

August Monthly Skinny Video

Weekly Market Report

For Week Ending September 14, 2024

For Week Ending September 14, 2024

Mortgage activity surged the week ending September 13, 2024, as falling interest rates boost borrower demand nationwide. The Mortgage Bankers Association reports mortgage loan application volume increased 14.2% on a seasonally adjusted basis from the previous week, with purchase applications up 5%, while refinance applications jumped 24% from one week earlier.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING SEPTEMBER 14:

- New Listings decreased 0.6% to 1,433

- Pending Sales decreased 5.1% to 856

- Inventory increased 11.4% to 10,002

FOR THE MONTH OF AUGUST:

- Median Sales Price increased 2.2% to $388,500

- Days on Market increased 21.2% to 40

- Percent of Original List Price Received decreased 1.3% to 98.7%

- Months Supply of Homes For Sale increased 17.4% to 2.7

All comparisons are to 2023

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

August Housing Market Update

Buyer and seller activity down from last August, but lower rates on the way

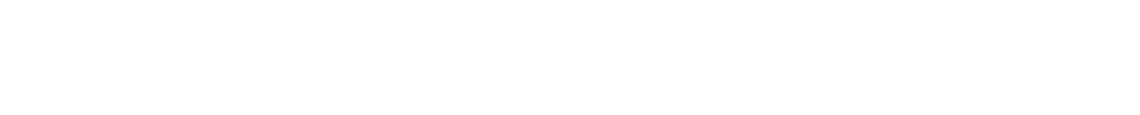

- Pending sales fell 10.2%; new listings down 3.3%

- The median sales price increased 2.6% to $389,700

- Market times rose 21.2% to 40 days; inventory up 11.7% to 9,712

(Sep. 17, 2024) – According to new data from Minneapolis Area REALTORS® and the Saint Paul Area Association of REALTORS®, seller activity softened along with buyer activity. Inventory and prices were higher.

Sellers, Buyers and Housing Supply

$2,820. That’s what a homeowner would save per year if they purchased or refinanced the median-priced home in August compared to if they purchased it when rates were at their peak in late 2023. Assuming 20.0% down, the monthly payment on a $389,700 home decreased from $2,790 to $2,555 per month when comparing August interest rates to when they were at their peak. At today’s mid-September rate of 6.1%, that payment drops even further to $2,474. That includes principal, interest, taxes and insurance. It’s a good representation of real monthly costs outside of maintenance and repairs. And that $2,820 in annual savings amounts to about 2.3% of the median family income in the metro.

Those lower rates need some time to course through the system before impacting demand. For August, pending sales were down 10.2% but are only down 0.7% for the year. Seller activity was also lower; new listings fell 3.3% but are actually up 8.5% for the year. Homes took more time to sell. At an average of 40 days, market times were up 21.2% for the month but are only 7.3% higher compared to 2023 year-to-date. Buyers thirsty for more inventory will benefit from an 11.7% increase in the number of homes for sale. That figure has now risen for ten straight months. Unfortunately, that inventory isn’t necessarily at the price points or in the locations today’s home buyers want or need.

Prognosticators are already discussing Spring market 2025. The rate environment should continue to improve, but a significant backlog of pent-up demand could overwhelm even the inventory growth we’ve seen. Unleashing that demand could also mean buyers once again find themselves in multiple-offer situations writing contracts for over list price. “The biggest hurdle is affordability; the other big hurdle has been supply,” said Jamar Hardy, President of Minneapolis Area REALTORS®. “The trend in mortgage rates is promising, but it will take time to fix our long-term housing shortage.”

Prices, Market Times and Negotiations

Prices are still rising but at a more subdued pace. The market-wide median sales price rose to $389,700, but the existing single-family median price is $410,000 and new single-family homes fetched $535,000. Overall, sellers accepted offers at 98.7% of their list price on average. Single-family sellers got 99.0% while condos were closer to 96.0%. Despite a metro-wide average of 40 days, single-family homes spent 37 days on market while condos spent 74. ““There’s more variation across different areas and price points than most would expect,” said Amy Peterson, President of the Saint Paul Area Association of REALTORS®. “Lower interest rates could result in quicker market times and stronger offers, so a drop in rates could cancel out any inventory gains.”

Location & Property Type

Market activity always varies by location and segment. Despite the new home market being better supplied, new home sales underperformed existing home sales. And despite better affordability, condo sales fell nearly twice as much as single family. Sales over $500,000 performed better than sales under $500,000 as higher-end buyers are less rate-sensitive. Cities such as Centerville, Dellwood, St. Bonifacius and Minnetrista had among the largest sales gains while Stacy, Ham Lake and Elko New Market all had notably weaker demand. For cities with at least three sales, the highest priced areas were Afton, Woodland, Excelsior, Wayzata and Orono while the most affordable areas were Rush City, Elko New Market, Osseo and Oakdale.

August 2024 Housing Takeaways (compared to a year ago)

- Sellers listed 5,940 properties on the market, a 3.3% decrease from last August

- Buyers signed 4,017 purchase agreements, down 10.2% (4,498 closed sales, up 13.8%)

- Inventory levels increased 11.7% to 9,712 units

- Month’s Supply of Inventory rose 13.0% to 2.6 months (4-6 months is balanced)

- The Median Sales Price was up 2.6% to $389,700

- Days on Market rose 21.2% to 40 days, on average (median of 20 days, up 33.3%)

- Changes in Pending Sales activity varied by market segment and price point

- Single family sales fell 7.9%; condo sales were down 14.0%; townhouse sales decreased 16.3%

- Traditional sales were down 9.7%; foreclosure sales declined 23.4% to 36; short sales rose 28.6% to 9

- Previously owned sales decreased 8.8%; new construction sales were down 16.6%

- Sales under $500,000 declined 11.4%; sales over $500,000 fell 4.0%

Weekly Market Report

For Week Ending September 7, 2024

For Week Ending September 7, 2024

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index hit a new all time high in June, rising 5.4% year-over-year, a slight decline from a 5.9% annual gain the previous month. The 20-City Composite was up 6.5% from the same time last year, with New York reporting the largest annual increase at 9%, followed by San Diego and Las Vegas, at 8.7% and 8.5%, respectively.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING SEPTEMBER 7:

- New Listings decreased 0.4% to 1,422

- Pending Sales increased 10.1% to 765

- Inventory increased 12.6% to 9,748

FOR THE MONTH OF AUGUST:

- Median Sales Price increased 2.4% to $389,000

- Days on Market increased 21.2% to 40

- Percent of Original List Price Received decreased 1.3% to 98.7%

- Months Supply of Homes For Sale increased 17.4% to 2.7

All comparisons are to 2023

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

- « Previous Page

- 1

- …

- 7

- 8

- 9

- 10

- 11

- …

- 153

- Next Page »