For Week Ending May 26, 2018

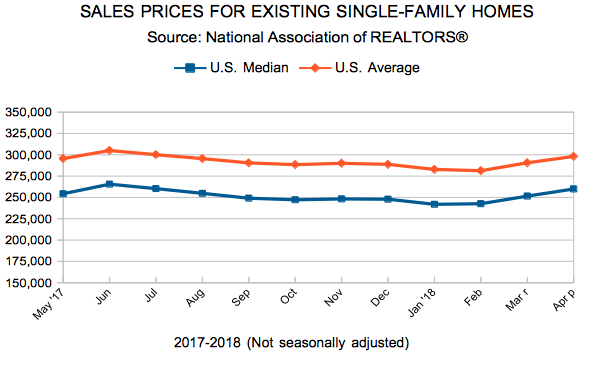

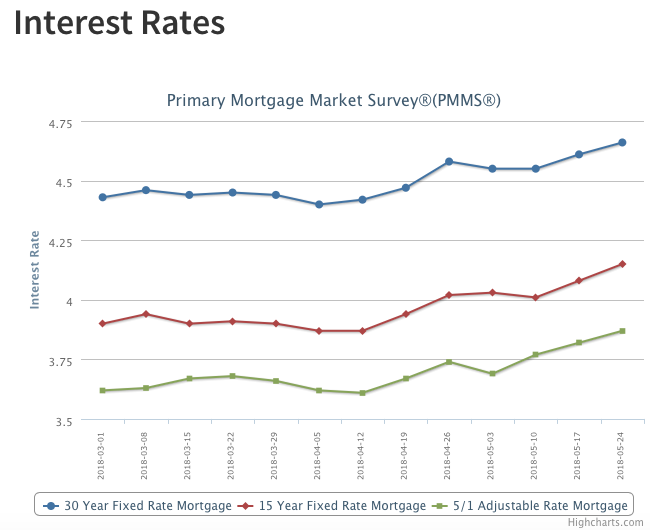

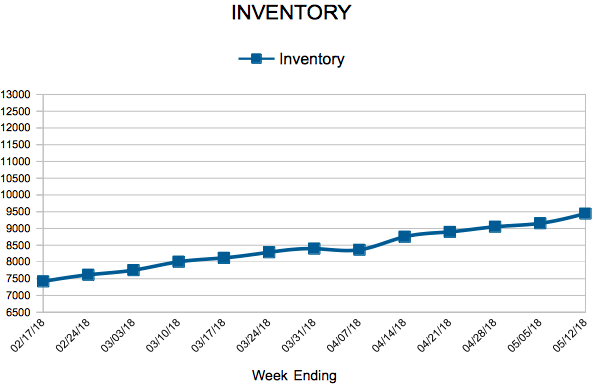

Residential real estate activity is in full swing across America. Some trends are persisting as they have week after week, month after month and now year after year. But some metrics are teasing a deviation from the norm. There may not be as many homes for sale as there were last year at this time, and home price increases are still more likely than not, but there is a chance that we could see more positive changes in either sales or new listings as the summer months progress.

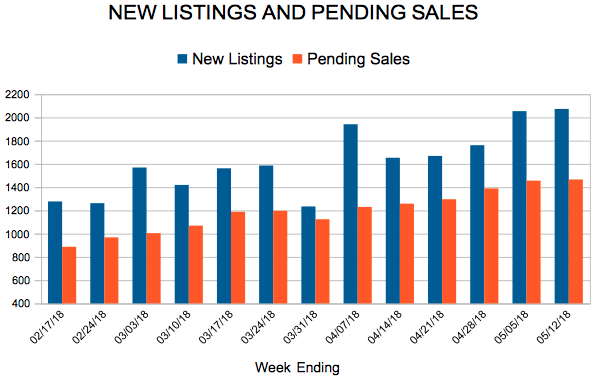

In the Twin Cities region, for the week ending May 26:

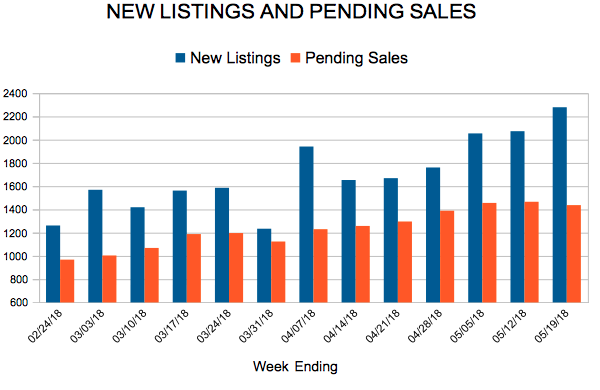

- New Listings increased 5.5% to 1,817

- Pending Sales decreased 9.9% to 1,405

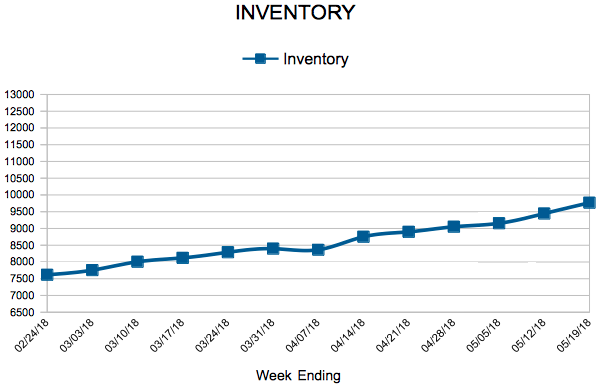

- Inventory decreased 19.4% to 10,322

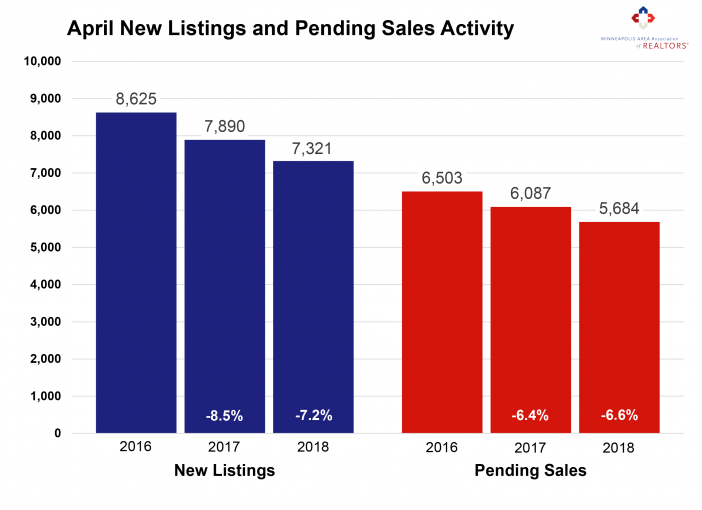

For the month of April:

- Median Sales Price increased 8.8% to $266,500

- Days on Market decreased 10.2% to 53

- Percent of Original List Price Received increased 0.8% to 99.9%

- Months Supply of Inventory decreased 20.8% to 1.9

All comparisons are to 2017

Click here for the full Weekly Market Activity Report. From The Skinny Blog.