For Week Ending May 12, 2018

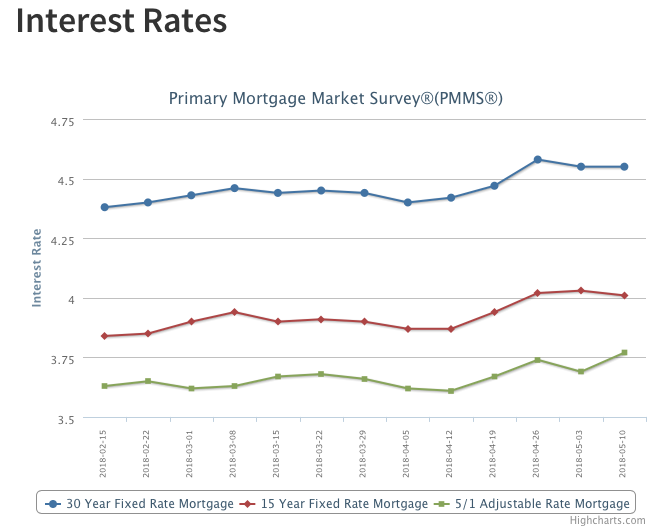

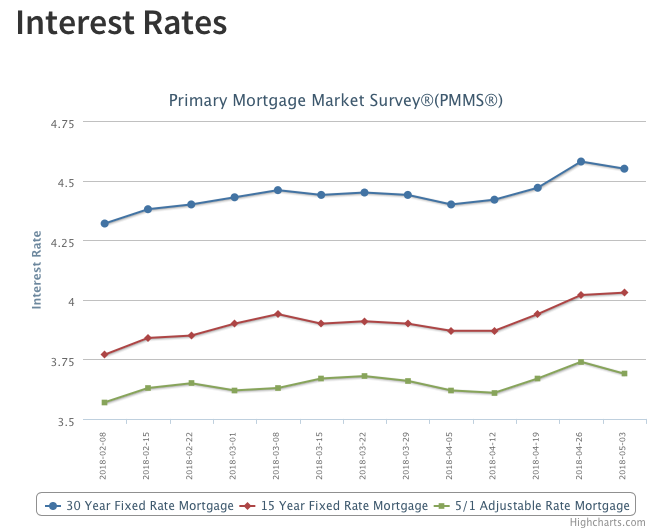

Inventory and days on market both continue to skim along at historic lows, while buyer demand is creating competitive purchase offer situations that are increasing the number of homes sold for more than the asking price. This practice is nothing new in more popular areas, but higher offers are becoming normal outside of the hottest cities and neighborhoods. Affordability is a challenge for some potential buyers, yet prices still rise in an environment of economic confidence.

In the Twin Cities region, for the week ending May 12:

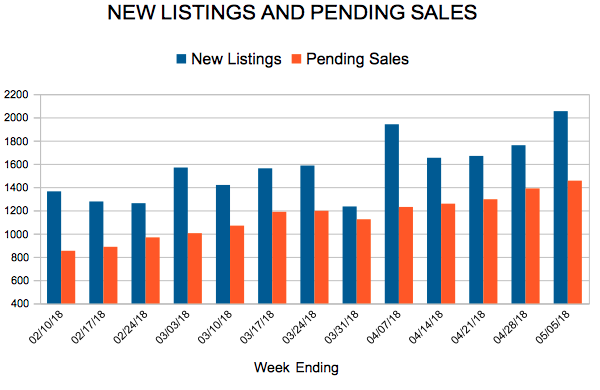

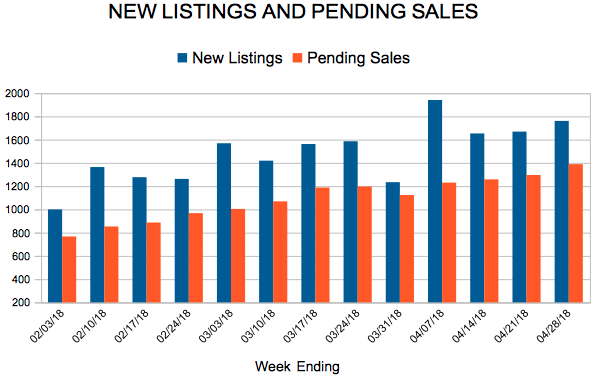

- New Listings decreased at 2,073

- Pending Sales decreased 5.5% to 1,466

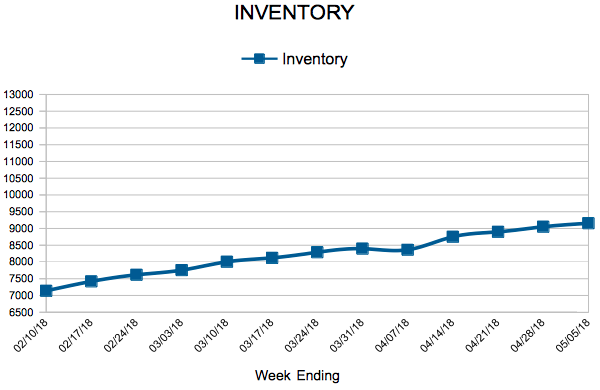

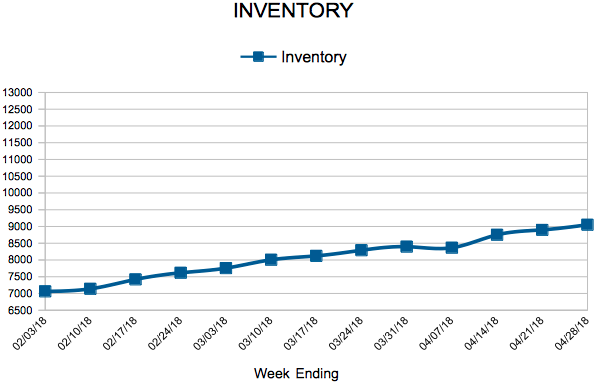

- Inventory decreased 23.9% to 9,446

For the month of April:

- Median Sales Price increased 8.9% to $266,750

- Days on Market decreased 10.2% to 53

- Percent of Original List Price Received increased 0.7% to 99.8%

- Months Supply of Inventory decreased 20.8% to 1.9

All comparisons are to 2017

Click here for the full Weekly Market Activity Report. From The Skinny Blog.