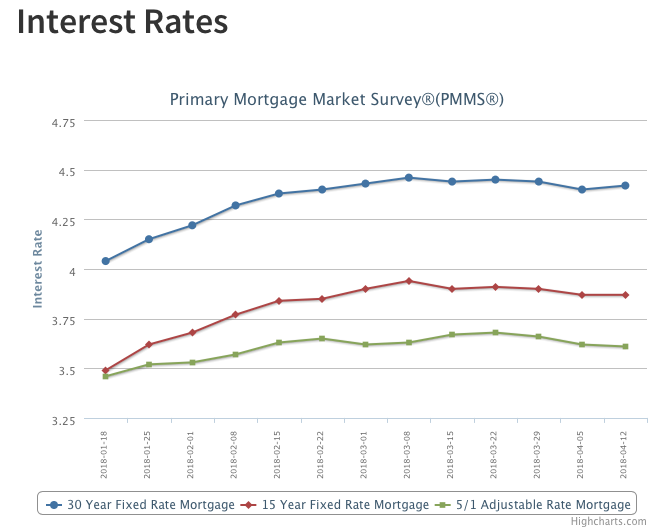

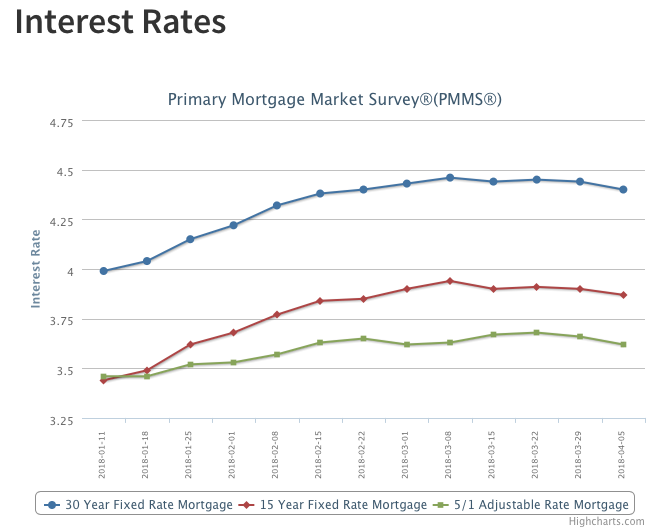

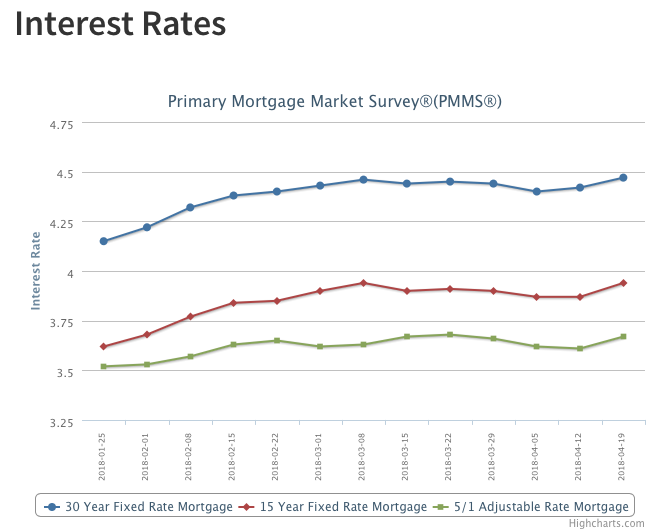

Treasury yields rose ahead of the release of the Fed’s Beige Book and speeches from New York Fed President William Dudley and Fed Governor Randal Quarles. Following Treasurys, mortgage rates soared. The U.S. weekly average 30-year fixed mortgage rate rose 5 basis points to 4.47 percent in this week’s survey, its highest level since January of 2014 and the largest weekly increase since February of this year.