For Week Ending February 10, 2018

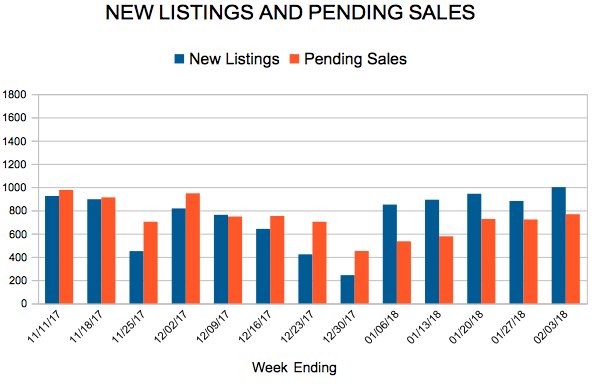

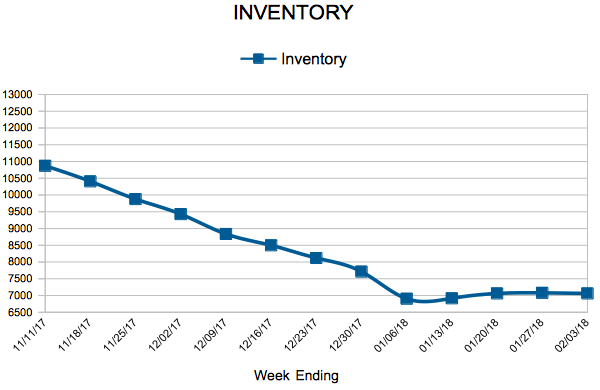

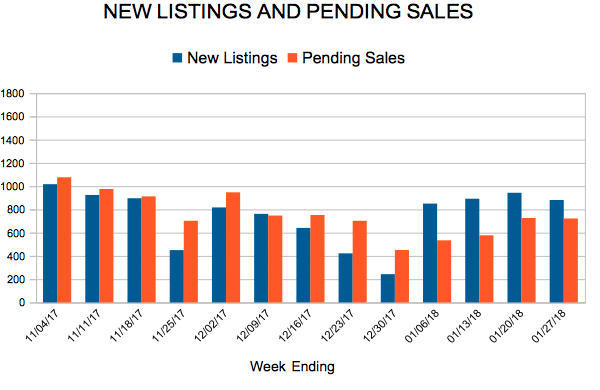

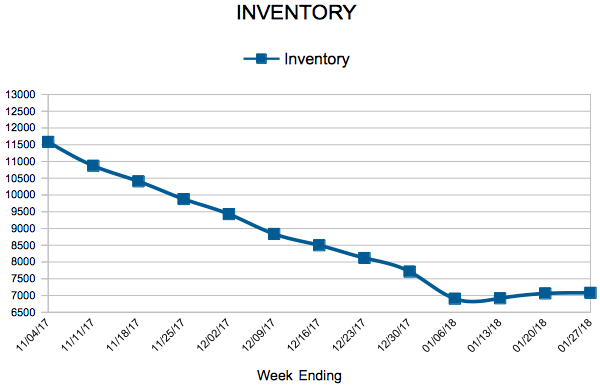

The market needs an increase in new listings in order to build inventory. It is something that has been needed for some time, and there has been positive movement in that regard in desirable submarkets. But it has not been consistent from week to week in year-over-year comparisons. Another way to boost inventory is to have fewer sales, but nobody wants to see that become an ongoing trend.

In the Twin Cities region, for the week ending February 10:

- New Listings increased 0.7% to 1,364

- Pending Sales decreased 6.9% to 853

- Inventory decreased 25.5% to 7,139

For the month of January:

- Median Sales Price increased 9.2% to $243,000

- Days on Market decreased 13.8% to 69

- Percent of Original List Price Received increased 1.0% to 96.9%

- Months Supply of Inventory decreased 22.2% to 1.4

All comparisons are to 2017

Click here for the full Weekly Market Activity Report. From The Skinny Blog.