For Week Ending January 13, 2018

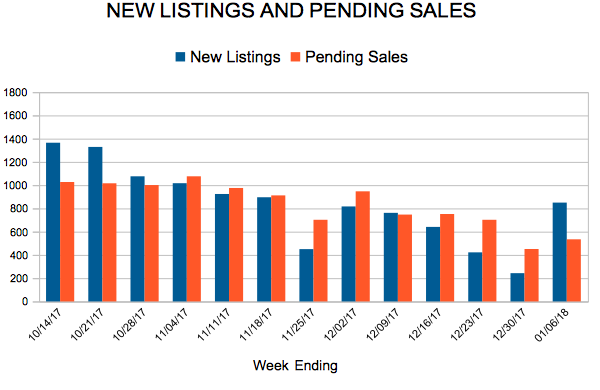

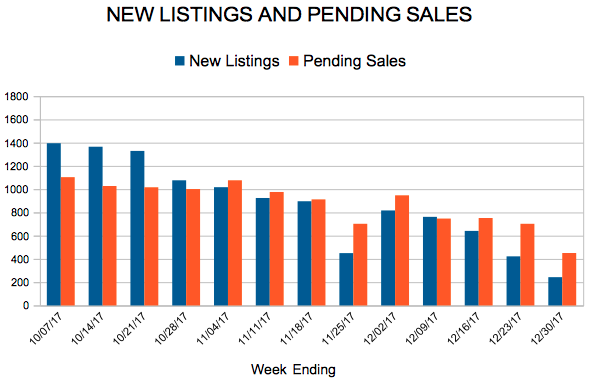

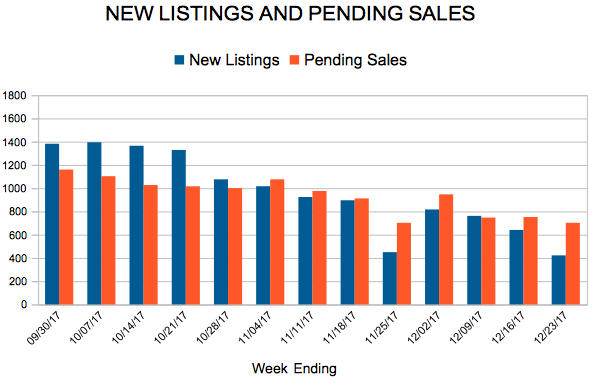

At the beginning of a calendar year, it is often common for home buyers and sellers to become immediately more active. Call it the result of a resolution or the promise of something new, but it is a noted phenomenon across the country. It’s really too early to say if the trend will continue in 2018, but the first weeks of the year have not necessarily shown a huge jolt in activity so much as the last weeks of 2017 were quieter than usual.

In the Twin Cities region, for the week ending January 13:

- New Listings decreased 5.4% to 892

- Pending Sales decreased 13.0% to 577

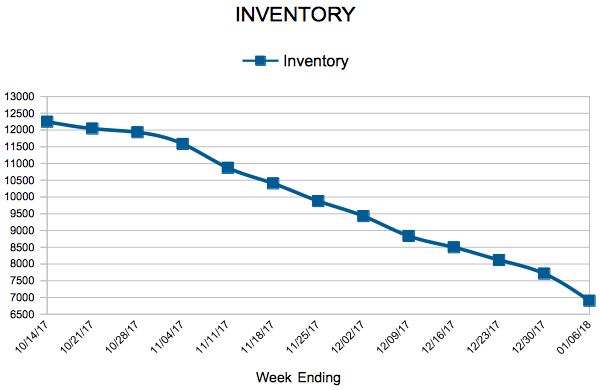

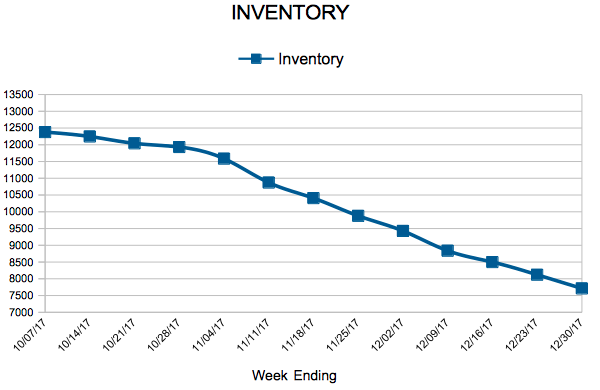

- Inventory decreased 26.9% to 6,918

For the month of December:

- Median Sales Price increased 9.7% to $248,000

- Days on Market decreased 15.3% to 61

- Percent of Original List Price Received increased 1.3% to 97.1%

- Months Supply of Inventory decreased 26.3% to 1.4

All comparisons are to 2017

Click here for the full Weekly Market Activity Report. From The Skinny Blog.