- The median sales price increased 2.4% to $365,000

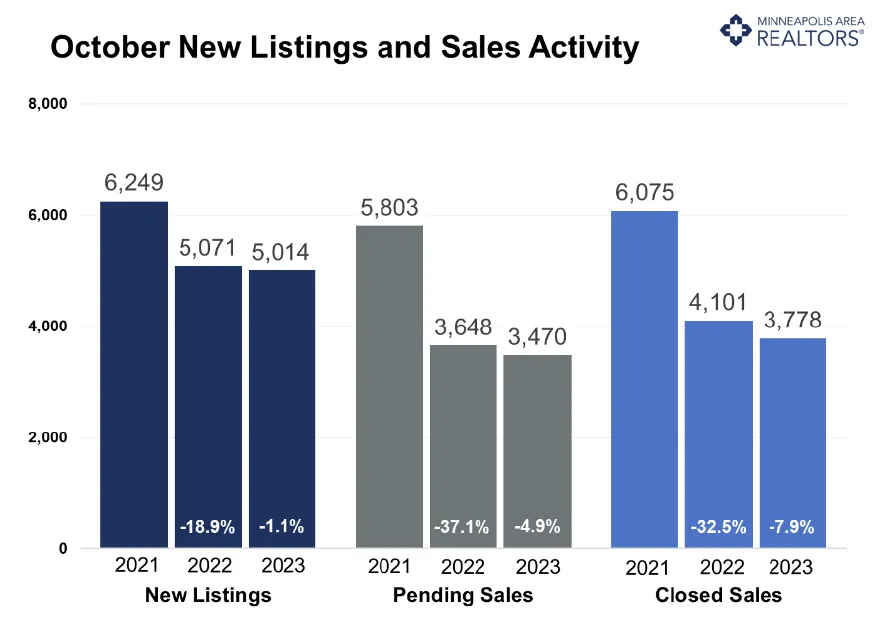

- Signed purchase agreements fell 4.9%; new listings down 1.1%

- Sellers still getting solid offers at 98.4% of list price in an average of 37 days

(Nov. 15, 2023) – According to new data from Minneapolis Area REALTORS® and the Saint Paul Area Association of REALTORS®, metro-wide home prices rose slightly in October. Sales activity slowed as mortgage rates weighed heavily on the marketplace even as listing activity could be flattening out.

Sellers, Buyers and Housing Supply

At around 8.0%, the fixed 30-year mortgage rate hit its highest level since 2000. Naturally, that weighed on home buyers who are already contending with tight inventory and rising prices. Pending sales were down 4.9% while closings were down 7.9%. It also weighed on would-be sellers and reinforces the “lock-in effect” where existing homeowners are unwilling to let go of their historically low mortgage rates. Sure enough, new listings declined 1.1%, which was the smallest decline since May of last year as the comparisons are more apples-to-apples. Townhomes and condos tend to be more affordable products. Townhome pending sales rose 6.5% while condo closed sales rose 8.4%. With existing homeowners clinging to their interest rate and low monthly payment, new home builders have captured a larger share of the market. New construction pending sales rose 31.6% in October compared to an 8.8% decline for existing homes. New home inventory rose 20.3% over the last 12 months compared to a 4.8% decline for previously owned properties.

Market-wide inventory levels fell 7.7% compared to last October. Millennials and Boomers alike are finding limited options and contending with affordability hurdles. More buyers are choosing to deploy cash instead of paying near 8.0% interest. Cash sales so far this year are at their highest level since 2014. To the surprise of many—and to varying degrees across the region, the market still feels “tight” with rising prices since both buyer and seller activity have declined. When housing supply levels rise but demand falls, that usually results in softening prices. Both supply and demand levels are lower, so the relative balance hasn’t changed as much as many expected. “Inventory is too low for prices to be falling much,” said Jerry Moscowitz, President of Minneapolis Area REALTORS®. “But rates are too high for prices to be rising much.”

Prices, Market Times and Negotiations

This combination of factors has also kept market times relatively brisk and negotiations still favoring sellers, but to a lesser degree than the last few years. Half the homes went under contract in under 20 days compared to 22 days last October, though the average market time rose slightly. Last month sellers accepted 98.4% of their original list price compared to 98.2% last year. Those two indicators reflect the surprisingly strong position in which many sellers still find themselves, assuming they’re willing to sell. This May was the only month of year-over-year price declines since February 2012. The year as a whole will likely show 1.0 to 2.0% price growth. For October, the median home price rose 2.4% to $365,000. “Buyers are feeling the triple punch of low inventory, rising prices and higher rates,” said Brianne Lawrence, President of the Saint Paul Area Association of REALTORS®. “That’s kept a good chunk of buyers sidelined and reflects a real shift from the last few years. That said, there has luckily been some easing in mortgage rates that may continue.”

Affordability, Rates and Payments

Even as the Federal Reserve paused their rate hikes, the impact of mortgage rates on monthly payments is significant. Mortgage rates hit a 23-year high recently. The Housing Affordability Index reached its lowest level since at least 2004. Given rates, incomes and prices at the time, affordability was better in 2006 than it is today. Using some assumptions around taxes and insurance, the monthly payment on the median priced home stands at $2,650 so far this year compared to $1,600 in 2020.

Location & Property Type

Market activity always varies by area, price point and property type. New home sales rose while existing home sales fell. Single family sales were down more than townhome and condo sales. Closings were down 13.9% in St. Paul but up 2.7% in Minneapolis. Cities such as St. Anthony, East Bethel, Somerset and Orono saw among the largest sales gains while New Hope, Robbinsdale and Mounds View all had notably lower demand than last year.

October 2023 Housing Takeaways (compared to a year ago)

- Sellers listed 5,014 properties on the market, a 1.1% decrease from last October

- Buyers signed 3,470 purchase agreements, down 4.9% (3,778 closed sales, down 7.9%)

- Inventory levels shrank 7.7% to 8,630 units

- Month’s Supply of Inventory rose 15.0% to 2.3 months (4-6 months is balanced)

- The Median Sales Price was up 2.4 percent to $365,000

- Days on Market rose 2.8% to 37 days, on average (median of 20 days, down 9.1%)

- Changes in Pending Sales activity varied by market segment

- Single family sales decreased 7.8%; condo sales were down 2.3%; townhouse sales rose 6.5%

- Traditional sales declined 5.1%; foreclosure sales rose 50.0% to 39; short sales fell 33.3% to 4

- Previously owned sales were down 8.8%; new construction sales increased 31.6%

- Sales under $500,000 decreased 6.4%; sales over $500,000 were up 2.7%