Inventory

Weekly Market Report

For Week Ending January 7, 2017

If predictions hold true – a continuing inventory crunch, moderate price gains, higher mortgage rates – 2017 will likely be in favor of the seller. On the other end of the spectrum, deals may be harder to come by if the largest potential group of buyers, the millennials, do not start wading into the buying pool with more fervor.

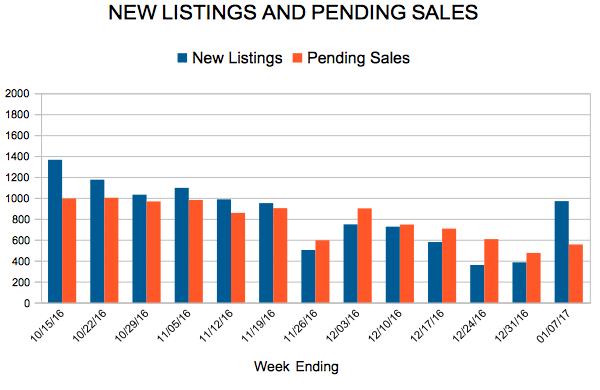

In the Twin Cities region, for the week ending January 7:

- New Listings decreased 15.1% to 969

- Pending Sales decreased 21.1% to 555

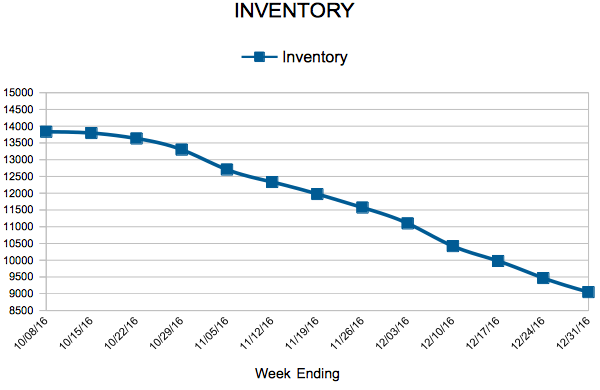

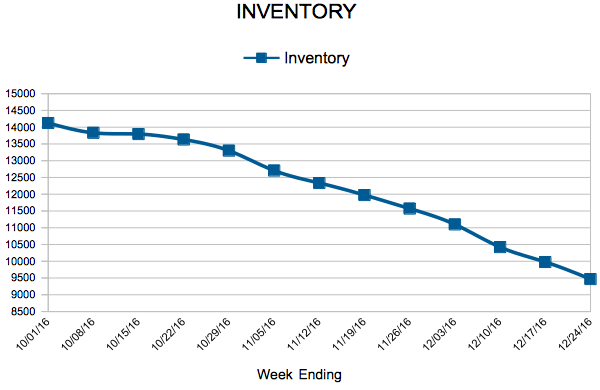

- Inventory decreased 25.5% to 8,298

For the month of December:

- Median Sales Price increased 4.1% to $228,500

- Days on Market decreased 10.1% to 71

- Percent of Original List Price Received increased 0.6% to 96.0%

- Months Supply of Inventory decreased 26.1% to 1.7

All comparisons are to 2016

Click here for the full Weekly Market Activity Report. From The Skinny Blog.

Mortgage Rates Lower Again

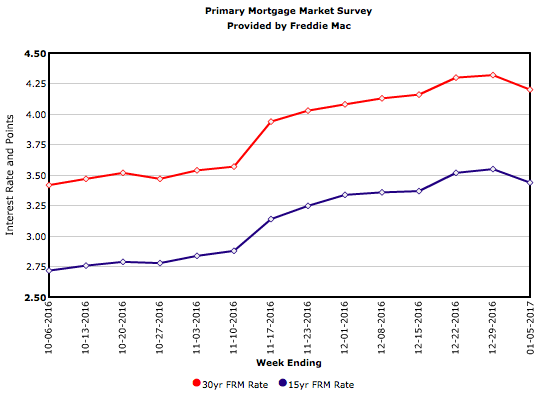

After absorbing a mixed December jobs report, the 10-year Treasury yield fell 8 basis points. The 30-year mortgage rate moved in tandem with Treasury yields falling 8 basis points to 4.12 percent, the second decline since the presidential election.

New Listings and Pending Sales

Inventory

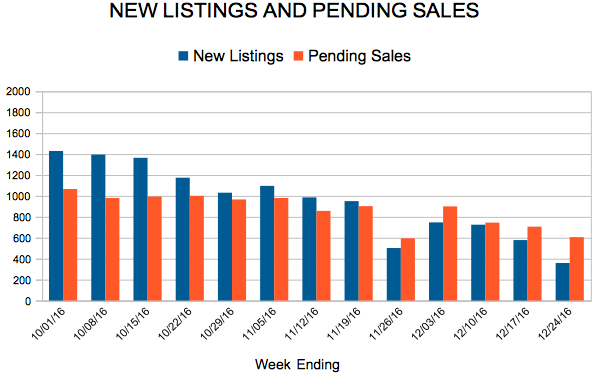

Weekly Market Report

For Week Ending December 31, 2016

At the outset of 2017, we are watching for upward movement in some of the same areas that we were watching in 2016. Inventory remains a key metric, as continued decreases may push out potential buyers, especially if mortgage rates continue to increase. However, buying a home is still considered more affordable than renting in two-thirds of the country according to the 2017 Rental Affordability Report by ATTOM Data Solutions.

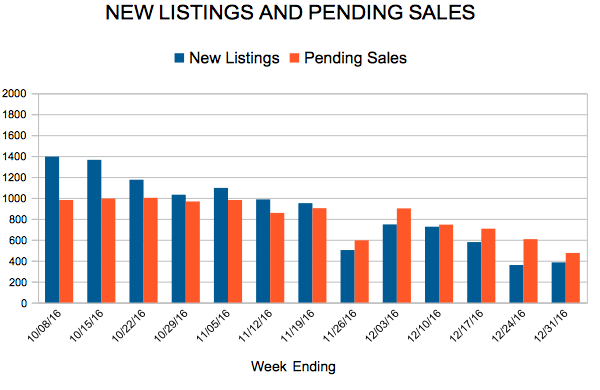

In the Twin Cities region, for the week ending December 31:

- New Listings decreased 7.5% to 384

- Pending Sales decreased 14.9% to 474

- Inventory decreased 24.9% to 9,049

For the month of December:

- Median Sales Price increased 4.1% to $228,500

- Days on Market decreased 10.1% to 71

- Percent of Original List Price Received increased 0.6% to 96.0%

- Months Supply of Inventory decreased 30.4% to 1.6

All comparisons are to 2015

Click here for the full Weekly Market Activity Report. From The Skinny Blog.

Mortgage Rates Start the Year Lower

The 30-year mortgage rate fell this week for the first time since the presidential election, dropping 12 basis points to 4.20 percent. This marks the first time since 2014 that mortgage rates opened the year above 4 percent. Despite this week’s breather, the 66-basis point increase in the mortgage rate since November 3, is taking its toll–the MBA’s refinance index plunged 22 percent this week.

New Listings and Pending Sales

Inventory

- « Previous Page

- 1

- …

- 122

- 123

- 124

- 125

- 126

- …

- 153

- Next Page »