For Week Ending December 24, 2016

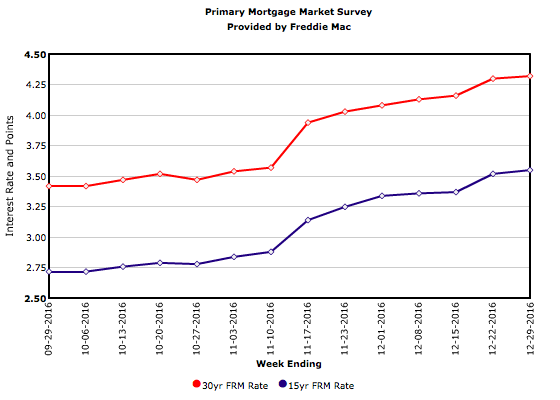

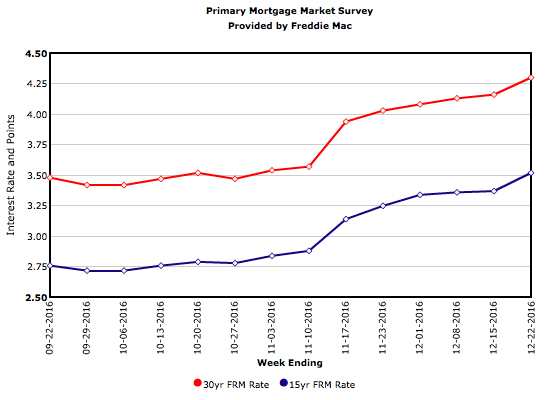

As we look toward 2017, the entirety of the U.S. housing market has never been worth as much as it is right now. Housing stock value grew to $29.6 trillion in 2016, regaining all of the value that was lost during the last recession. An upward trend in mortgage rates, mortgage credit and new construction are all common predictions for 2017.

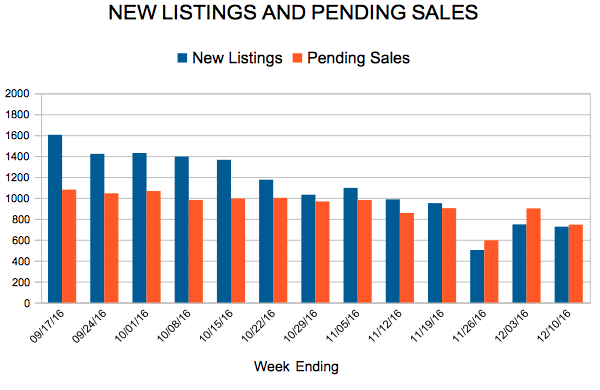

In the Twin Cities region, for the week ending December 24:

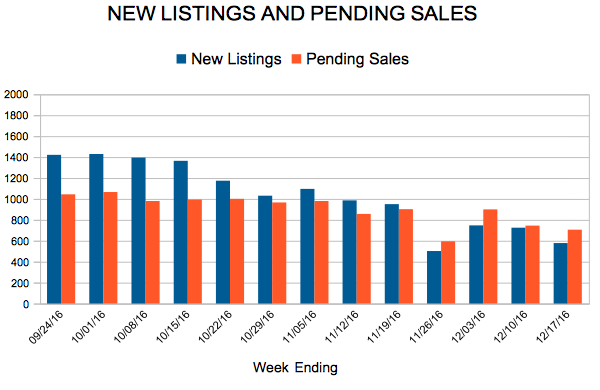

- New Listings increased 32.5% to 359

- Pending Sales increased 28.1% to 606

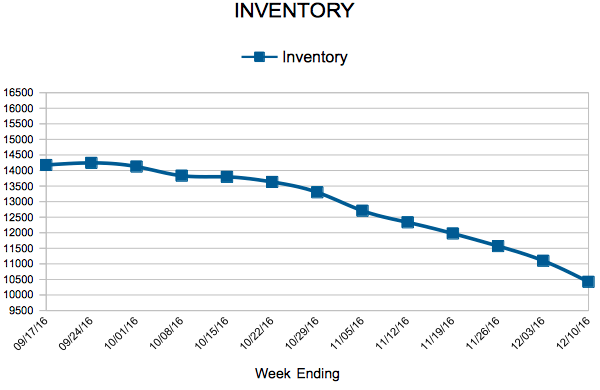

- Inventory decreased 23.9% to 9,469

For the month of November:

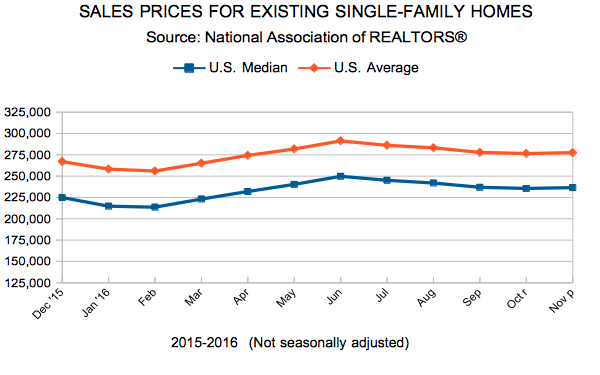

- Median Sales Price increased 5.5% to $231,400

- Days on Market decreased 15.1% to 62

- Percent of Original List Price Received increased 0.8% to 96.7%

- Months Supply of Inventory decreased 24.1% to 2.2

All comparisons are to 2015

Click here for the full Weekly Market Activity Report. From The Skinny Blog.