For Week Ending August 13, 2016

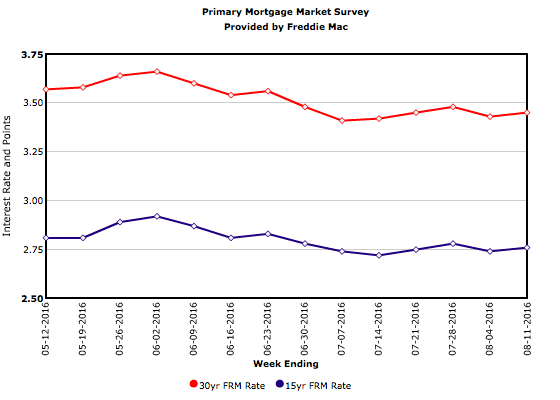

Residential construction, builder confidence and housing starts have all been up in recent months, creating a triple dose of good news as the country begins the inevitable home sales slowdown following the busy spring and summer seasons. The news creates hope that buyer traffic could maintain at a sufficient level over the last several months of the year.

In the Twin Cities region, for the week ending August 13:

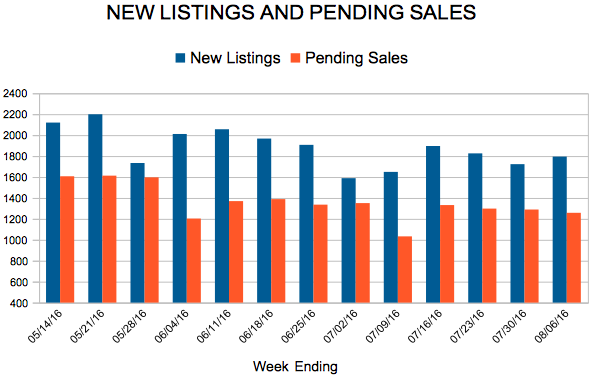

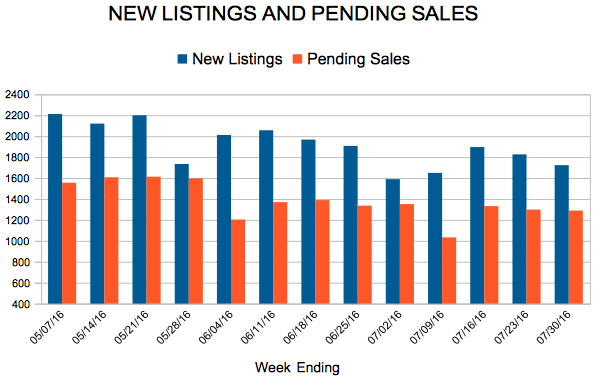

- New Listings decreased 5.5% to 1,651

- Pending Sales decreased 2.8% to 1,229

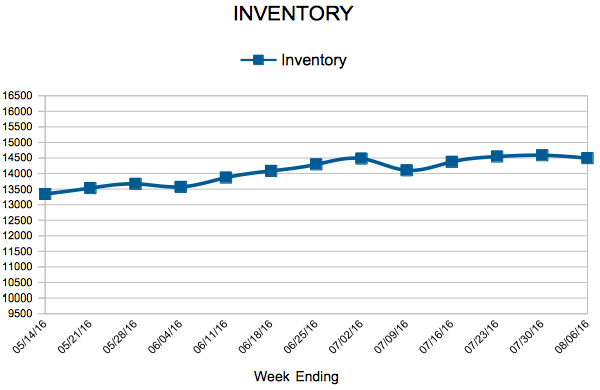

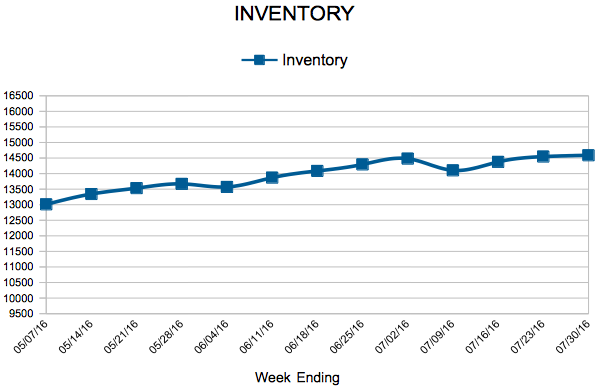

- Inventory decreased 17.3% to 14,521

For the month of July:

- Median Sales Price increased 6.6% to $239,900

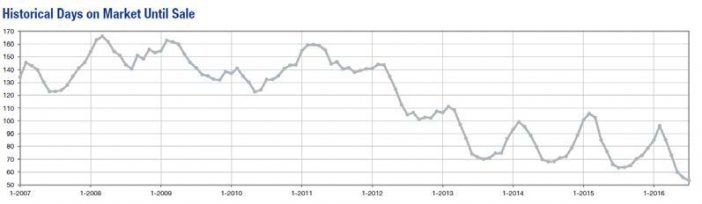

- Days on Market decreased 14.3% to 54

- Percent of Original List Price Received increased 0.8% to 98.4%

- Months Supply of Inventory decreased 21.1% to 3.0

All comparisons are to 2015

Click here for the full Weekly Market Activity Report. From The Skinny Blog.