Weekly Market Report

For Week Ending April 6, 2019

For Week Ending April 6, 2019

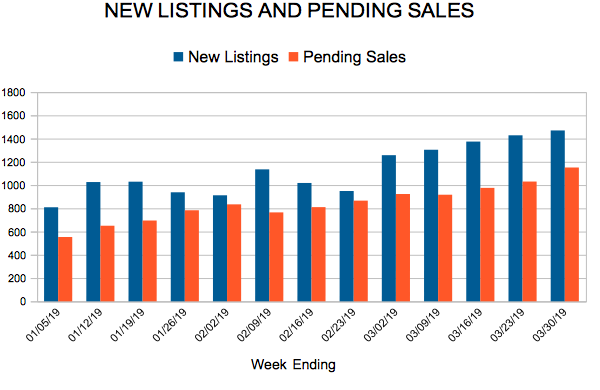

New listings finally started to perk up across the nation last week, effectively launching residential real estate into the springtime selling season. Much has been said and written about the slow launch of new homes for sale in what was anticipated to be a year of rising inventory. Mother Nature has had different plans so far in several markets, adding another burst of winter weather in April that may spoil an otherwise promising start to the second quarter of 2019.

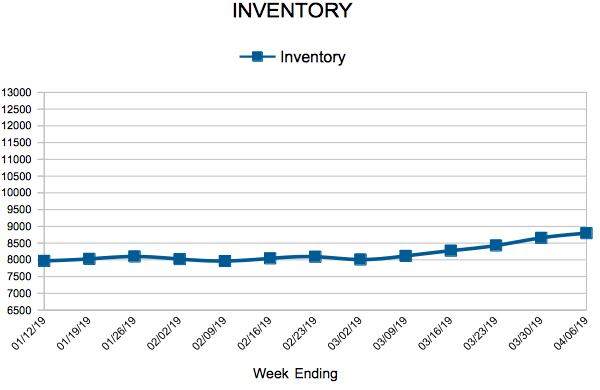

In the Twin Cities region, for the week ending April 6:

- New Listings decreased 3.4% to 1,883

- Pending Sales decreased 6.1% to 1,208

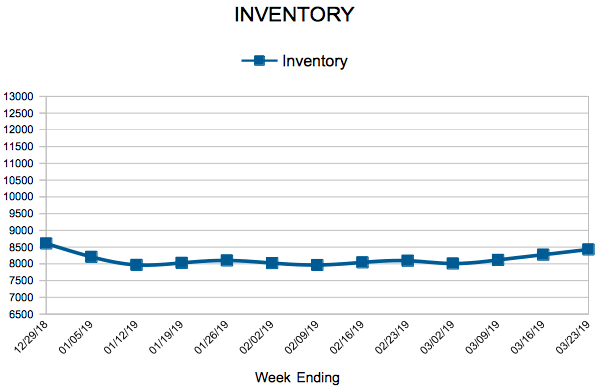

- Inventory decreased 2.2% to 8,797

For the month of March:

- Median Sales Price increased 6.5% to $275,000

- Days on Market increased 15.8% to 66

- Percent of Original List Price Received decreased 0.5% to 98.6%

- Months Supply of Homes For Sale remained flat at 1.8

All comparisons are to 2018

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

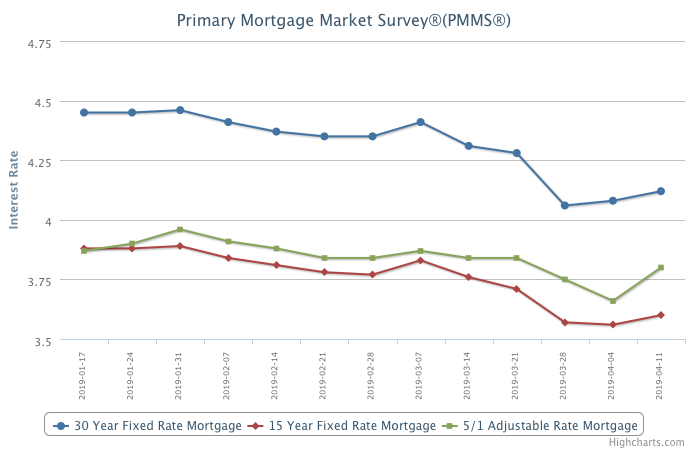

Mortgage Rates Inch Up

April 11, 2019

Rates moved up slightly this week while mortgage applications decreased following last week’s jump in rates – indicating borrower sensitivity to changing mortgage rates. Despite the recent rise, we expect mortgage rates to remain low, in line with the low 10-year treasury yields, boosting homebuyer demand in the next few months.

Information provided by Freddie Mac.

New Listings and Pending Sales

Inventory

Weekly Market Report

For Week Ending March 30, 2019

For Week Ending March 30, 2019

The national unemployment rate held firm at 3.8 percent for the second month in a row, which is good news for an economy that has shown signs of slowing down during the first three months of 2019. Hiring and wage gains have both been below expectations, retail sales dropped considerably to close 2018, and there have been fewer home sales across the nation. Maintaining a historically low unemployment rate is reassuring and may offer confidence to many wary and weary consumers.

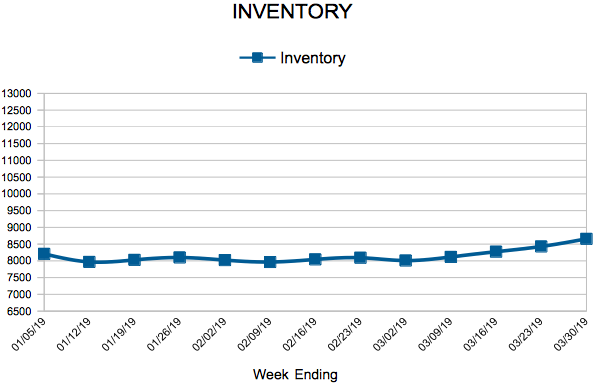

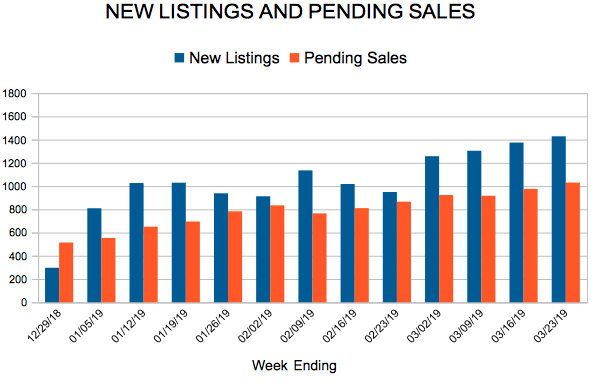

In the Twin Cities region, for the week ending March 30:

- New Listings increased 18.6% to 1,470

- Pending Sales decreased 3.1% to 1,151

- Inventory decreased 4.3% to 8,657

For the month of February:

- Median Sales Price increased 6.2% to $265,500

- Days on Market remained flat at 69

- Percent of Original List Price Received decreased 0.3% to 97.7%

- Months Supply of Homes For Sale remained flat at 1.7

All comparisons are to 2018

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

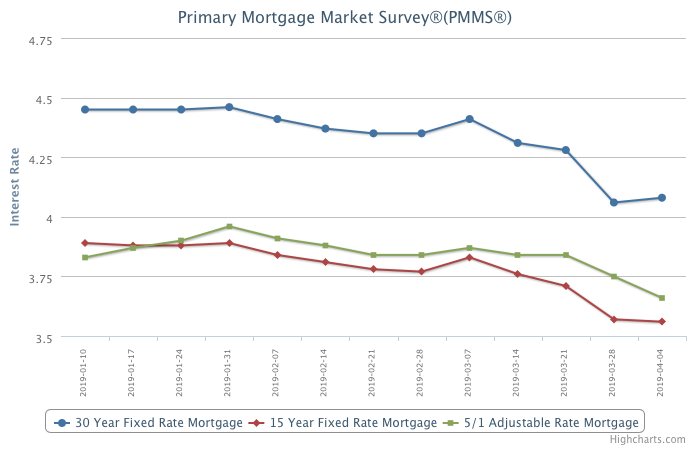

Mortgage Rates Remain Stable

April 4, 2019

Purchase mortgage application demand saw the second highest weekly increase over the last year and thanks to a spike in refinancing activity, overall mortgage demand rose to the highest level since the fall of 2016. While the housing market has faced many head winds the last few months, it sailed through the turbulence to calmer seas with demand buttressed by a strong labor market and low mortgage rates. The benefits of the decline in mortgage rates that we’ve seen this year will continue to unfold over the next few months due to the lag from changes in mortgage rates to market sentiment and ultimately home sales.

Information provided by Freddie Mac.

New Listings and Pending Sales

Inventory

Weekly Market Report

For Week Ending March 23, 2019

As new listings continue to fail to gain traction and inventory struggles to keep pace with the already low figures from last year, one begins to wonder if the U.S. is poised for a real estate slowdown. Some observers are seeing this as an inevitability, as investors price out more typical, family-driven home buyers. Housing starts and permits are also trending downward, and research indicates that the percentage of sales with price reductions are on the rise.

In the Twin Cities region, for the week ending March 23:

- New Listings decreased 10.4% to 1,428

- Pending Sales decreased 16.5% to 1,030

- Inventory decreased 5.6% to 8,429

For the month of February:

- Median Sales Price increased 6.2% to $265,500

- Days on Market remained flat at 69

- Percent of Original List Price Received decreased 0.3% to 97.7%

- Months Supply of Homes For Sale remained flat at 1.7

All comparisons are to 2018

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

- « Previous Page

- 1

- …

- 67

- 68

- 69

- 70

- 71

- …

- 153

- Next Page »