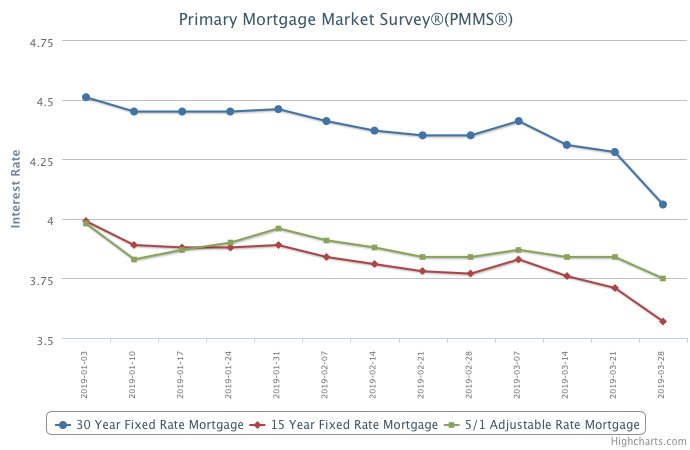

March 28, 2019

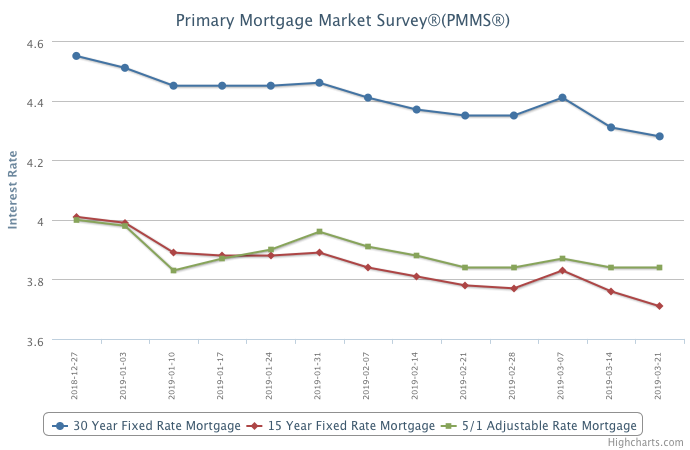

The Federal Reserve’s concern about the prospects for slowing economic growth caused investor jitters to drive down mortgage rates by the largest amount in over ten years. Despite negative outlooks by some, the economy continues to churn out jobs, which is great for housing demand. We have recently seen home sales start to recover and with this week’s rate drop we expect a continued rise in purchase demand.

Information provided by Freddie Mac.