For Week Ending March 9, 2019

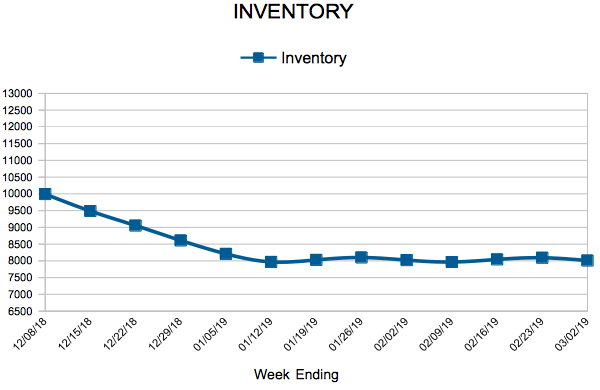

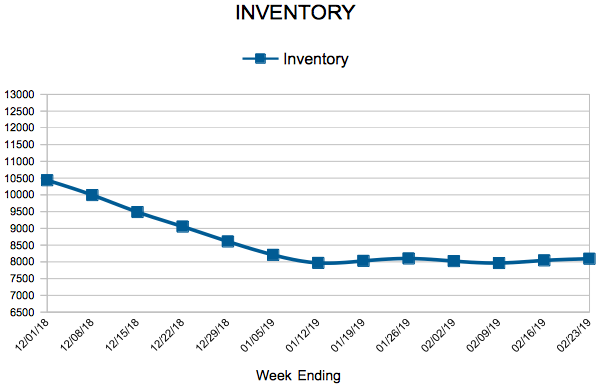

New listings and overall housing inventory are still proceeding slower than last year in many markets across the U.S., and they are mostly trailing activity for last year, which was already rather low. Sales have also been slower than last year at this time in areas with lingering winter weather, but the thaw is on. That may present a new set of difficulties for communities that have experienced an abundance of rain and snow over the last few months.

In the Twin Cities region, for the week ending March 9:

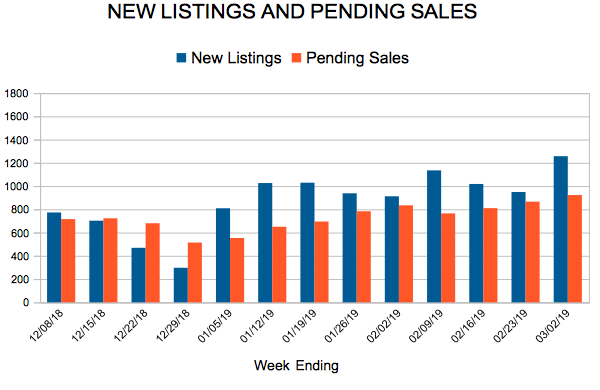

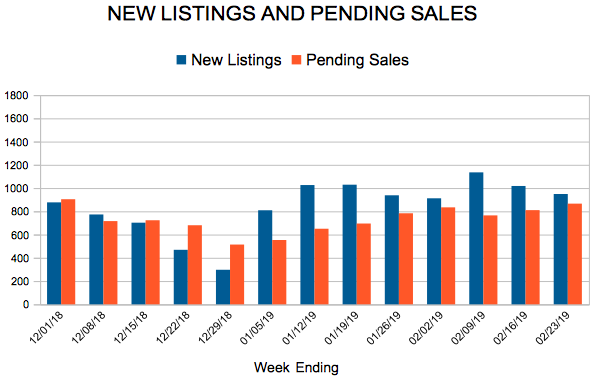

- New Listings decreased 8.6% to 1,304

- Pending Sales decreased 16.2% to 917

- Inventory decreased 6.2% to 8,117

For the month of February:

- Median Sales Price increased 6.2% to $265,500

- Days on Market remained flat at 69

- Percent of Original List Price Received decreased 0.3% to 97.7%

- Months Supply of Homes For Sale remained flat at 1.7

All comparisons are to 2018

Click here for the full Weekly Market Activity Report. From The Skinny Blog.