Inventory

Weekly Market Report

For Week Ending February 16, 2019

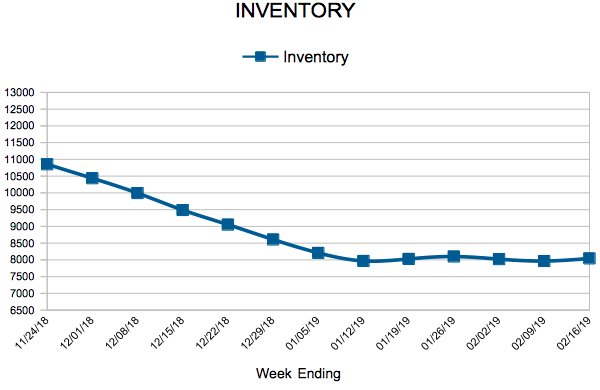

The National Association of REALTORS® has reported in the last month that national existing-home sales and pending sales are both down in year-over-year comparisons, but that has not necessarily been a constant from market to market. While weather-related events have hampered some of the necessary machinations of making home sales, buyers have shown determination toward achieving their homeownership goals. This week has shown some sales strain in many markets, but spring is just around the corner.

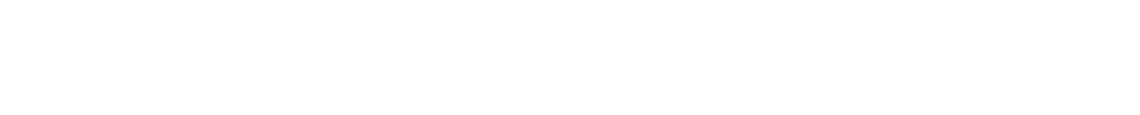

In the Twin Cities region, for the week ending February 16:

- New Listings decreased 20.5% to 1,018

- Pending Sales decreased 10.5% to 810

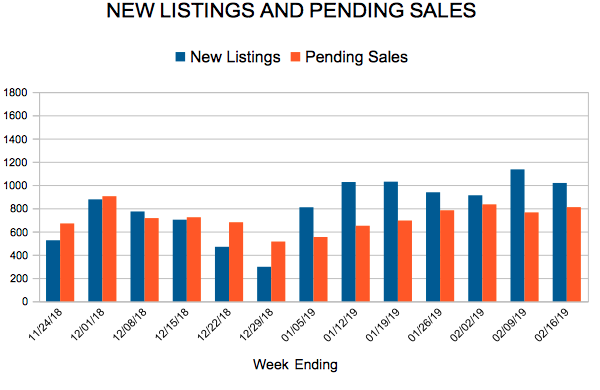

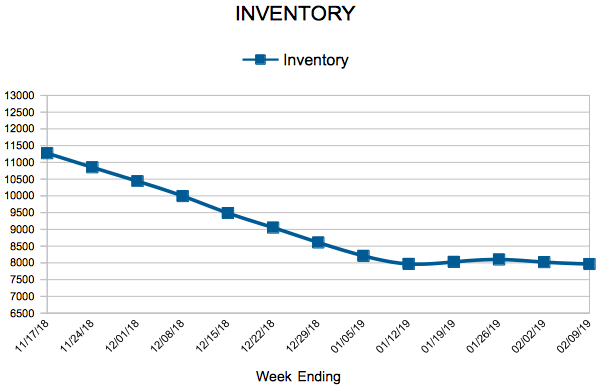

- Inventory decreased 2.5% to 8,043

For the month of January:

- Median Sales Price increased 6.1% to $259,000

- Days on Market decreased 5.8% to 65

- Percent of Original List Price Received increased 0.1% to 97.0%

- Months Supply of Homes For Sale increased 13.3% to 1.7

All comparisons are to 2018

Click here for the full Weekly Market Activity Report. From The Skinny Blog.

A mostly strong start to the year

The latest numbers show that 2019 was off to a good start for TwinCities residential real estate. Sellers produced another increase in listing activity, while buyers entered into more contracts than last January even while closed sales fell. Market times continued to shrink as the median sold home price rose compared to last year. After two months of declines, the ratio of sold to list price rose slightly in January. There are some early indications the market is improving for buyers, even though sellers still have strong negotiating leverage and quick market times.

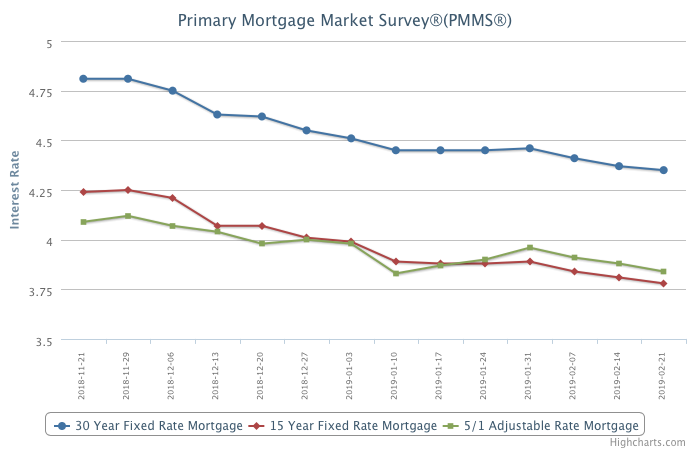

The number of active listings for sale has increased compared to the prior year. Buyers have seen inventory gains for four consecutive months. Months supply also ticked up to 1.6 months, suggesting the market is still tight but rebalancing and normalizing. After increasing to 5.0 percent in November, mortgage rates have settled back down around 4.5 percent. The lack of supply is especially noticeable at the entry-level prices, where multiple offers and homes selling for over list price are commonplace. The move-up and upper-bracket segments are less competitive and better supplied. Inventory could rise substantially, and we’d still have a balanced market.

January 2019 by the Numbers

(compared to a year ago)

– Sellers listed 4,359 properties on the market, a 7.8 percent increase from last January

– Buyers closed on 2,681 homes, a 4.6 percent decrease

– Inventory levels for January rose 1.1 percent compared to 2018 to 7,828 units

– Months Supply of Inventory increased 6.7 percent to 1.6 months

– The Median Sales Price rose 6.1 percent to $258,900, a record high for January

– Cumulative Days on Market declined 5.8 percent to 65 days, on average (median of 44)

– Changes in Sales activity varied by market segment:

– Single family sales fell 5.2 percent; condo sales rose 5.3 percent; townhome sales declined 2.9 percent

– Traditional sales decreased 1.4 percent; foreclosure sales sank 50.3 percent; short sales were flat

– Previously-owned sales were down 5.5 percent; new construction sales ramped up by 12.8 percent

Quotables

“We’re still very much undersupplied locally and nationally,” said Todd Urbanski, President of Minneapolis Area REALTORS®. “We’re expecting 2019 to be a good year for both buyers and sellers.”

“Our data shows slightly more inventory, and rates are down from where they were at the end of last year,” said Linda Rogers, President-Elect of Minneapolis Area REALTORS®. “Buyers should know that they’re going to find more options out there this spring and summer.”

All information is according to the Minneapolis Area REALTORS® based on data from NorthstarMLS. Minneapolis Area REALTORS® is the leading regional advocate and provider of information services and research on the real estate industry for brokers, real estate professionals and the public. We serve the Twin Cities 16-county metro area and western Wisconsin.

From The Skinny Blog.

Mortgage Rates Head Even Lower

February 21, 2019

Mortgage rates fell for the third consecutive week, continuing the general downward trend that began late last year. Wages are growing on par with home prices for the first time in years, and with more inventory available, spring home sales should help the market begin to recover from the malaise of the last few months.

Information provided by Freddie Mac.

January Monthly Skinny Video

“Despite a strong U.S. economy, historically low unemployment and steady wage growth, home sales began to slow across the nation in late last year.”

Existing Home Sales

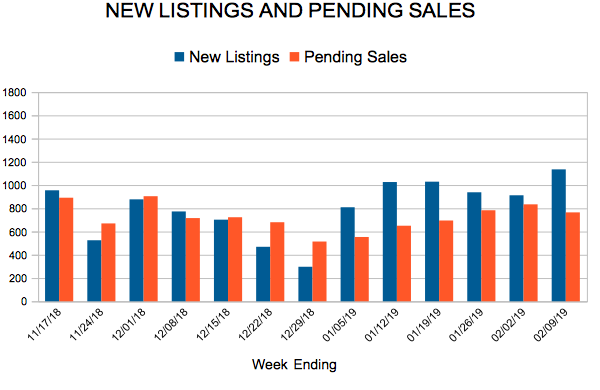

New Listings and Pending Sales

Inventory

Weekly Market Report

For Week Ending February 9, 2019

For the third of four weeks, it is worthwhile to mention the weather when discussing residential real estate in large portions of the U.S. After a relatively quiet December and January, February has turned in some impressively cold and snowy days that have stalled some buying and selling actions. That said, housing markets are proving to be resilient in the face of predictions of a tougher year for the industry. It’s early, but economic fundamentals remain positive.

In the Twin Cities region, for the week ending February 9:

- New Listings decreased 17.4% to 1,135

- Pending Sales decreased 13.9% to 765

- Inventory increased 1.2% to 7,966

For the month of January:

- Median Sales Price increased 6.1% to $259,000

- Days on Market decreased 5.8% to 65

- Percent of Original List Price Received increased 0.1% to 97.0%

- Months Supply of Inventory increased 6.7% to 1.6

All comparisons are to 2018

Click here for the full Weekly Market Activity Report. From The Skinny Blog.

- « Previous Page

- 1

- …

- 70

- 71

- 72

- 73

- 74

- …

- 153

- Next Page »